Stocks fell on Tuesday, and 10-year Treasury bond yields jumped to their highest level since 2018 ahead of the money influx that should strengthen the aggressive Federal Reserve policy tightening.

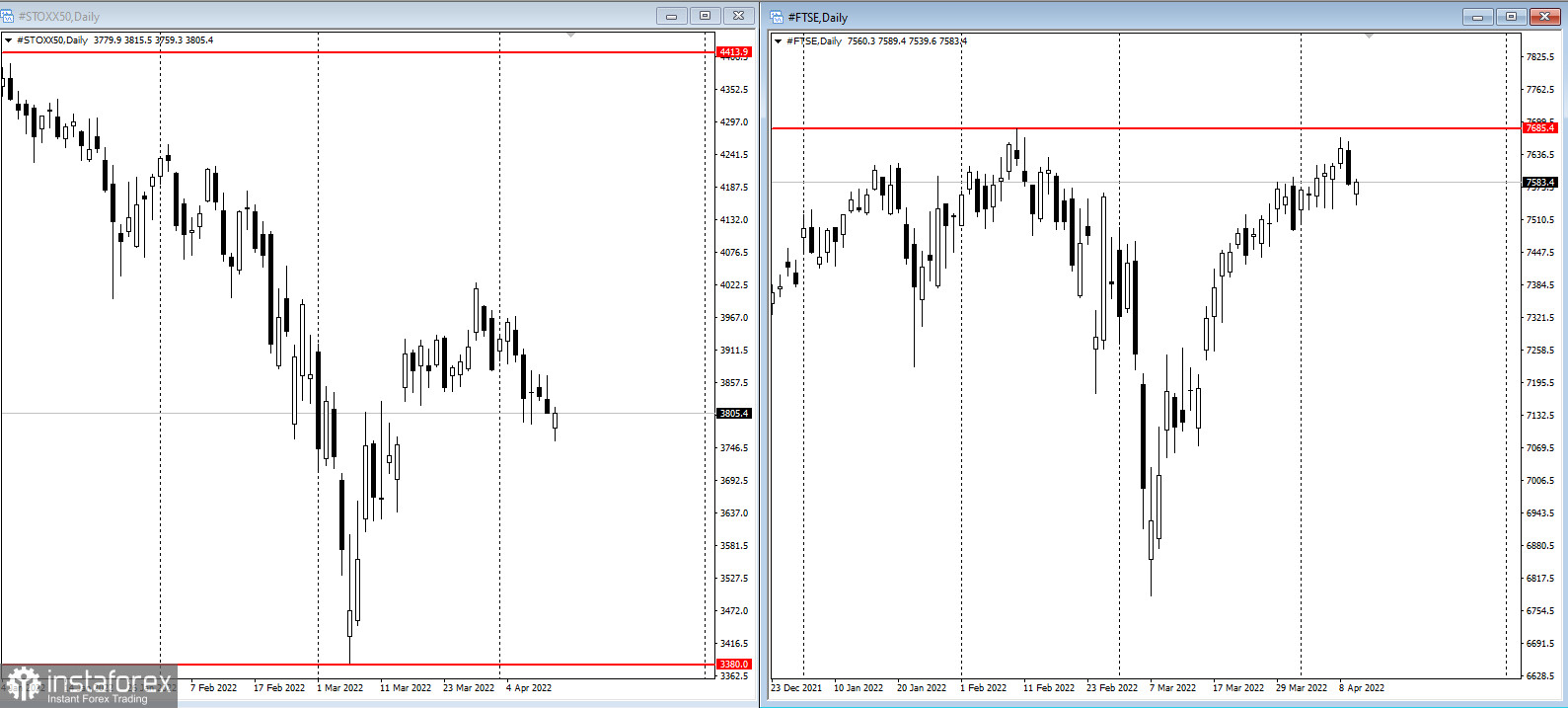

The European STOXX 50 index lost about 1.2%, while US stock futures showed smaller declines. The Asia-Pacific MSCI Inc. index has dropped for the second day in a row. China eased some of the gloom, recovering on speculation that officials may take steps to bolster economic growth amid Covid lockdowns.

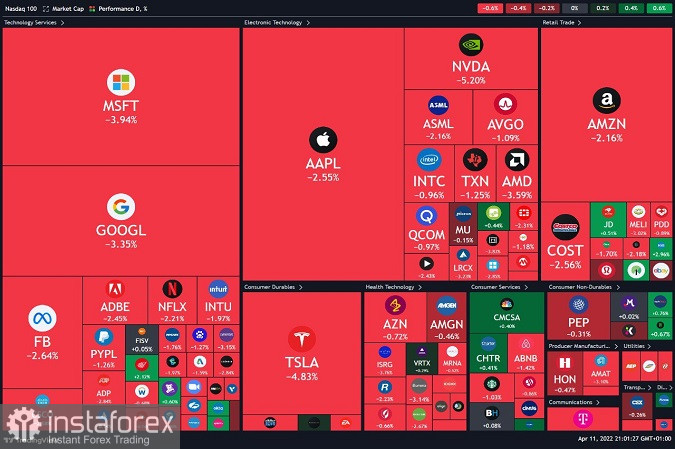

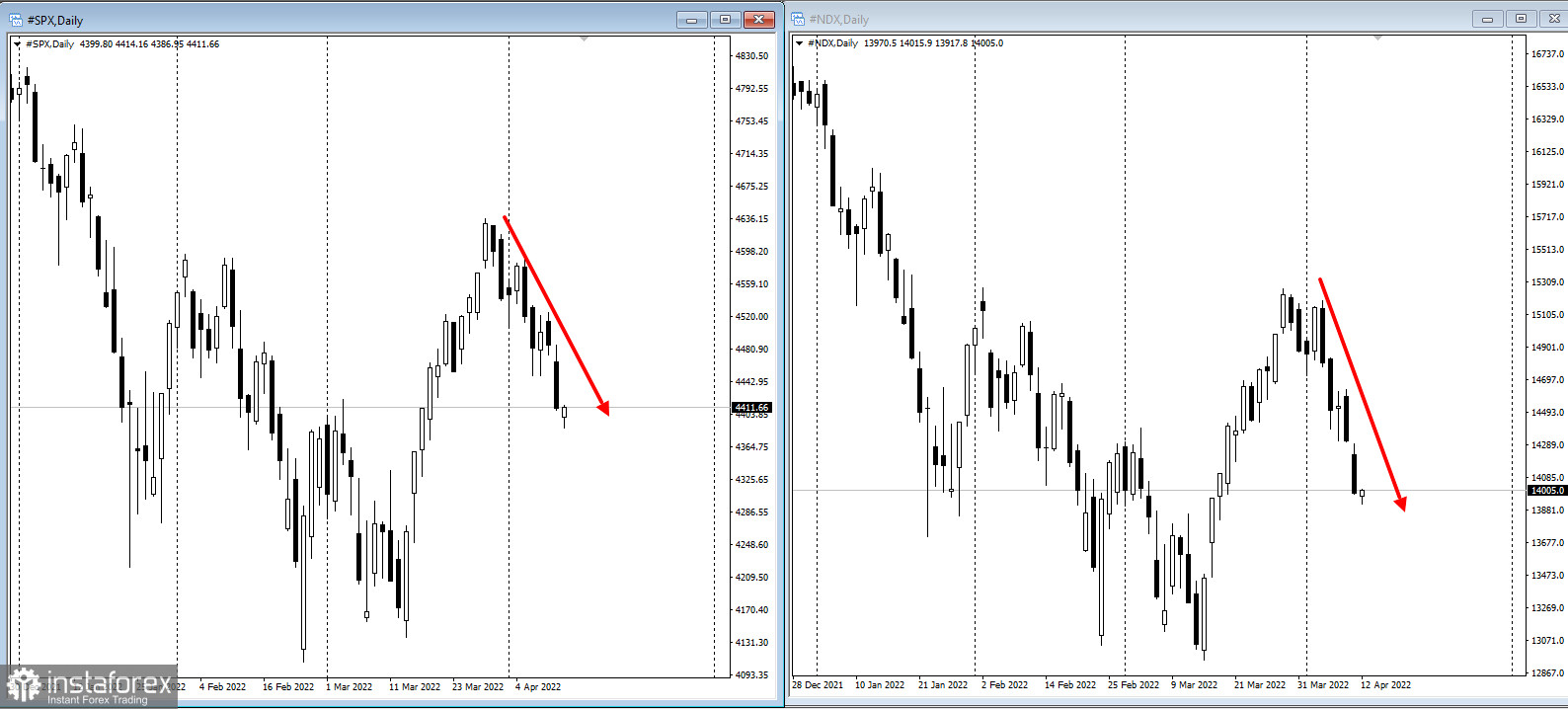

The US stock market is falling for the sixth day in a row.

US Treasuries declined, sending the 10-year yield above 2.80%. The US dollar index halted its longest gaining streak since 2020. Both readings reflect that the Fed is going to implement its fastest monetary tightening since 1994.

Banking and retail stocks showed the fastest decline in Europe. Deutsche Bank AG and Commerzbank AG plummeted the most after a major investor sold its stake in two of Germany's largest public banks. Dubai Electricity & Water Authority jumped after raising $6.1 billion in the world's second-largest IPO this year.

In the UK, welfare fell at the fastest pace in more than eight years in February as the average earnings lagged the inflation level.

The next big test for the markets looms later on Tuesday when the US is expected to release inflation for March that may exceed 8%. While this could mean, however, there are concerns that price pressures will remain elevated. The military actions in Ukraine are disrupting the supply chains of key commodities, and China's lockdowns are straining supply chains, too.

"What we are facing this year is stagflation," Kathryn Rooney Vera, head of global macro research at Bulltick LLC. "It's a very difficult environment the Fed has found itself in and the market is potentially pricing in 50 basis points of hikes at each of the next two policy meetings," she added.

According to the Bank of America global fund manager's April survey, the "fast and furious" Fed has sent global growth optimism to a record low and keeps Wall Street stability risks high.

Meanwhile, Sri Lanka warned creditors of a possible default and suspended payments on some foreign debt, an extraordinary move taken to preserve dwindling US dollar reserves for basic food and fuel imports.

The Moscow Stock Exchange Index is slowly falling for the sixth day in a row in anticipation of a technical default on the sovereign debt.

Events to watch this week:

- Earnings season kicks off, including reports from Citigroup, JPMorgan Chase, Goldman Sachs, Morgan Stanley, Taiwan Semiconductor Manufacturing, Wells Fargo

- US CPI, Tuesday

- OPEC Monthly Oil Market Report, Tuesday

- Fed Governor Lael Brainard and Richmond Fed President Thomas Barkin will give a speech, Tuesday

- Bank of Canada rate decision, Wednesday

- EIA Crude Oil Inventory Report, Wednesday

- Reserve Bank of New Zealand interest rate decision, Wednesday

- China trade, medium-term credit lines, Wednesday

- ECB rate decision, Thursday

- Bank of Korea policy decision, Thursday

- US Retail Sales, Initial Jobless Claims, Business Inventories, University of Michigan Consumer Sentiment, Thursday

- Cleveland Fed President Loretta Mester, Philadelphia Fed President Patrick Harker will speak Thursday

- US stock and bond markets are among those closed for Good Friday