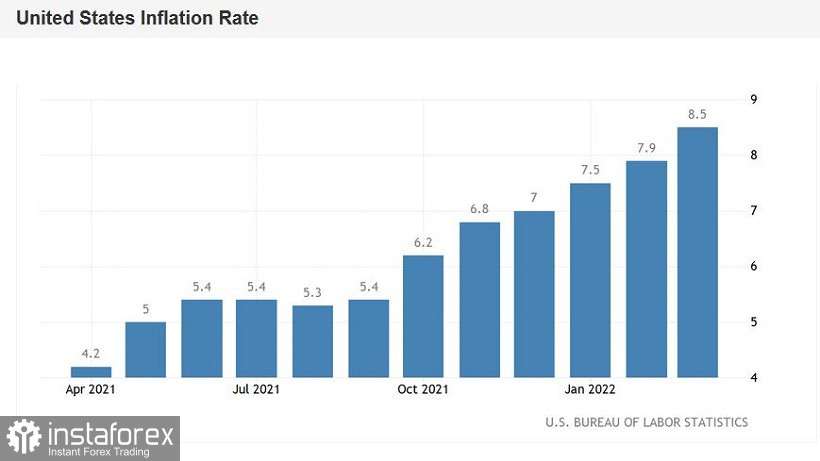

American inflation in annual terms exceeded the 8 percent mark - for the first time in the last 40 years. The last time the consumer price index was at this height was back in 1981. In March 2022, the indicator was again at the level of 8.5% (y/y). The core index, excluding food and energy prices, also showed record growth, reaching 6.5% year-on-year. Compared to February, prices in March increased by 1.2% (in monthly terms) – this is the strongest growth rate since September 2005. Annual inflation in the United States has been rising for the sixth consecutive month. The sharpest increase in prices for the year was recorded for naval fuel oil (a jump of 70.1% at once), followed by gasoline (+48%). The cost of food (for home and out) increased by almost 9% year-on-year.

This dynamic is due to several reasons. Among the main ones are geopolitical instability in Eastern Europe, a sharp rise in the price of black gold, an outbreak of coronavirus and a partial lockdown in China, systemic failures in supply chains, an increase in consumer demand against a background of limited supply. All these reasons are somehow related to each other, so the result was a so-called perfect storm. Even at the end of last year, many Federal Reserve members were confident that inflation in 2022 would slow down, especially in the second half of the year. The central bank was in no hurry to tighten the parameters of monetary policy, pointing, in particular, to the effect of a low base and the temporary nature of inflationary growth. Today the situation is radically different.

Now most members of the Fed are in favor of a more aggressive pace of interest rate hikes this year relative to the intentions that were announced in January. Back at the March meeting, many representatives of the Federal Open Market Committee allowed the option of a 50-point rate hike "at one or more meetings." This is evidenced by the minutes of this meeting. In general, the so-called "hawk wing" of the Fed has expanded significantly this year. The traditional and consistent hawks (such as Bullard) were joined by ex-centrists and even some doves. Waller, Daly, Barkin, Mester, Brainard, in particular, started talking about a more aggressive rate hike. Fed Chairman Jerome Powell also quite unequivocally announced the implementation of a tougher scenario so that the high level of inflation does not take root.

One can argue for a long time about how timely the central bank reacted to the inflation boom, but the fact remains that the Fed is ready to raise the interest rate by 50 points at once at the May meeting. More than 80% of experts surveyed by Reuters expressed their confidence in this. Moreover, almost 60% of them said that the Fed will increase the rate by the same amount following the results of the June meeting. And one more important nuance: recently, the head of the San Francisco Fed, Mary Daly, confirmed that the Fed could start reducing the balance sheet as early as next month. Returning to the minutes of the March meeting, it should be recalled that the Fed is ready to implement a "faster" pace of reducing the size of the balance sheet than in the period 2017-2019. The minutes states that the central bank will begin to reduce assets on the central bank's balance sheet in increments of $95 billion per month ($35 billion in mortgage-backed securities and $60 billion in US government bonds). For comparison, it can be noted that in 2017-2019, the scale was $50 billion per month, and it took the Fed about a year to bring the target to this.

In other words, today's release served as another argument for strengthening the positions of dollar bulls throughout the market. The external fundamental background also contributes to the strengthening of the greenback. Today there were quite alarming signals regarding the prospects of negotiations between Russia and Ukraine. According to Russian President Vladimir Putin, the Ukrainian side has moved away from its agreements in Istanbul, and now the negotiating parties "have again returned to a deadlock for themselves and for everyone." It is worth noting that similar signals have already been received before – both from Russian Foreign Minister Sergei Lavrov and from the representative of the Turkish president. They said in one form or another that the negotiating groups are still far from final agreements. Today's statement by the Russian president was a confirmation that the negotiation process has clearly stalled.

Such a fundamental background contributes to the further decline of the EUR/USD pair. Bears are now besieging the most important support level of 1.0850, which corresponds to the lower line of the Bollinger Bands indicator on the D1 timeframe. Therefore, at the moment short positions are risky, despite the priority of the southern scenario. It is necessary to wait for a price breakthrough. Overcoming the target of 1.0850 will open the way to the support level of 1.0805 (annual low) and potentially into the area of the 7th figure.