The US consumer inflation data published on Tuesday turned out to be ambiguous, which probably caused the positive dynamics of US stock indices before sliding into negative territory.

Today, the focus of the market will be on the publication of producer inflation figures in the US, which is expected to grow to 10.6% from 10.0% in annual terms. Its monthly value in March should rise to 1.1% from February's 0.8%. Despite the importance of these data, we do not expect the market to react sharply, as is traditionally the case with the publication of consumer inflation figures.

Earlier today, figures on consumer inflation in Britain were released, which are breaking records. The consumer price index showed an annual increase to 7.0%, which was last recorded in 1992. Monthly growth in March was 1.1%, which is higher than the forecast of 0.7% and the February value of 0.8%. The data presented again indicate that the Bank of England will probably have to continue the cycle of raising interest rates and, perhaps, as vigorously as expected from the Fed.

Today, investors will also focus on the outcome of the Bank of Canada's monetary policy meeting. According to the consensus forecast, the bank will have to raise the key interest rate to 1.00% from the current level of 0.50%. After this event, the central bank will hold a press conference.

How will the Canadian dollar react to the decision to raise interest rates?

It may lead to a local decrease in the USDCAD pair, but nothing more, since the factor of the expected more aggressive rate hike from the Fed on a kind of virtual scale significantly outweighs the "strength" of the decision of the central bank of Canada.

Based on the general mood in the markets, we believe that it will be possible to observe a local pullback towards positive sentiment today, which may cause limited demand in the stock markets. The main topic in the markets is still the high inflation in economically developed countries. Investors are wondering whether the Fed will take active action on the issue of raising rates. We expect that the May meeting of the regulator may become a milestone if rates are raised immediately by 0.5% to 1%. Maintaining such a pace of raising the cost of borrowing will lead the US economy into recession, followed by the global economy. This whole picture is further aggravated by the growing tension between Washington and Moscow amid the Ukraine crisis, which may lead to extremely unpleasant consequences in the near future.

Forecast:

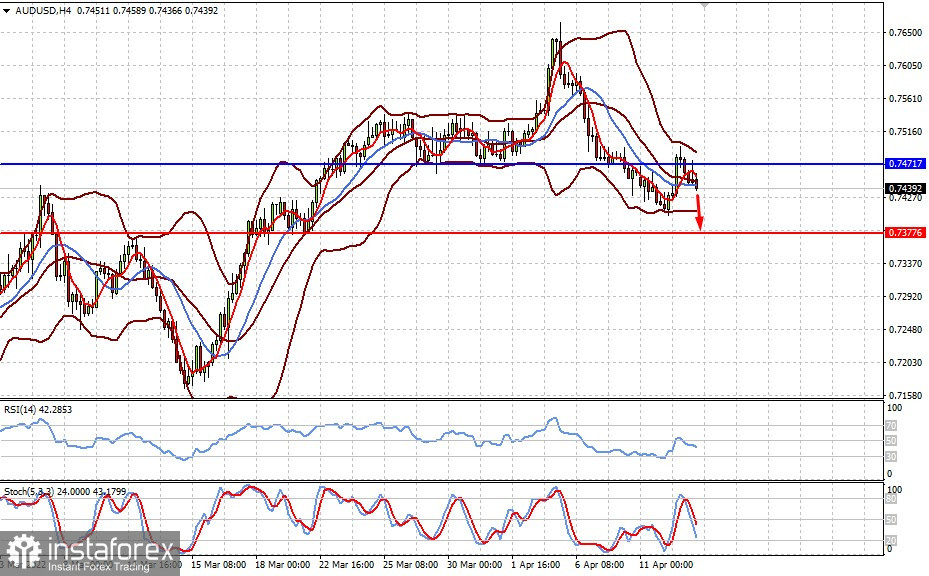

The AUDUSD pair failed to consolidate above the level of 0.7470, which may become the basis for its continued fall to 0.7377.

The XAUUSD pair is holding above the strong level of 1966.70. Consolidation above may lead to its growth to 2002.00.