After US inflation reached a new four-decade high in March, accelerating to 8.5% from a year earlier, gold also hit yesterday's high.

The US consumer price index of 8.5% was even higher than market expectations, which were preparing for an increase in price pressure to 8.4%. The most recent data follows February's 7.9% annual increase.

Core inflation, excluding energy and food price volatility, accelerated to 6.5% YoY. This surprised economists. And monthly growth was also below market expectations, up 0.3%.

The most significant price increases were registered for housing, food, and gasoline. In March, the Gasoline Index rose by 18.3 percent and amounted to more than half of the monthly increase.

Gold, reacting to this data, rose by more than $25 and reached new daily highs.

Despite higher-than-expected inflation in March, some economists believe that the first month of spring will be the peak of price pressure.

CIBC Capital Markets economist Katherine Judge said that March is likely to be the peak of inflation, because starting from April, the indices will catch up with some of the highs of last year, and gasoline prices have recently declined.

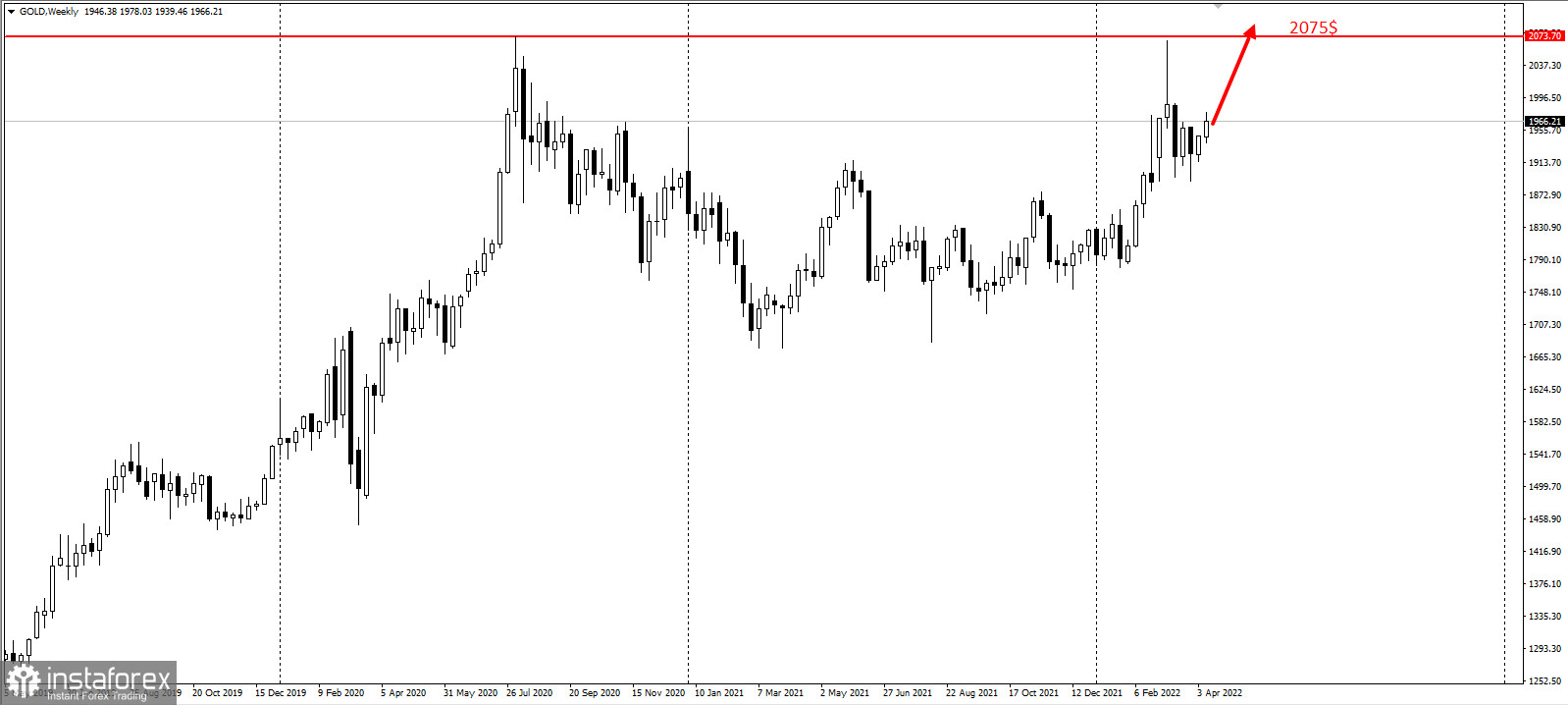

At the same time, the March figures confirm the intention of the Federal Reserve to aggressively tighten policy at its May meeting. To reach the inflation target in 2023, the Fed is going to raise rates by 50 basis points at the next meeting. Thereafter, there will be a series of increases of 25 basis points before pausing in the fourth quarter. At this rate, gold could easily rewrite its all-time high of $2,075:

The day before the release of the data on Tuesday, the Biden administration announced its assumption that the March inflation report would be grossly inflated, citing a surge in oil and gas prices, blaming Russia for it. This was announced on Monday by White House Press Secretary Jen Psaki.