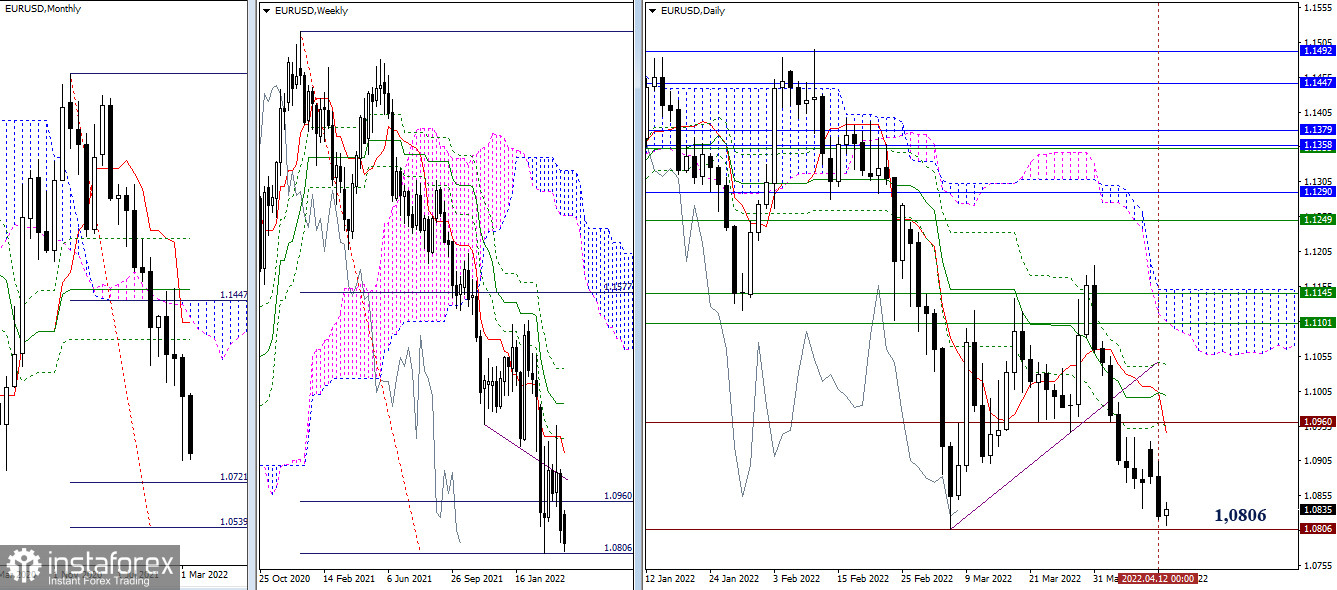

EUR/USD

Higher timeframes

Bearish activity dominated yesterday. At the moment, they are close to testing the major milestone at 1.0806 (minimum extremum + 100% weekly target level). A breakdown and a reliable resumption of the downward trend will open the way to the monthly target for the breakdown of the cloud (1.0721 – 1.0539). The nearest resistance in the current situation can be noted in the area of 1.0944–60 (daily short-term trend + the first target of the week).

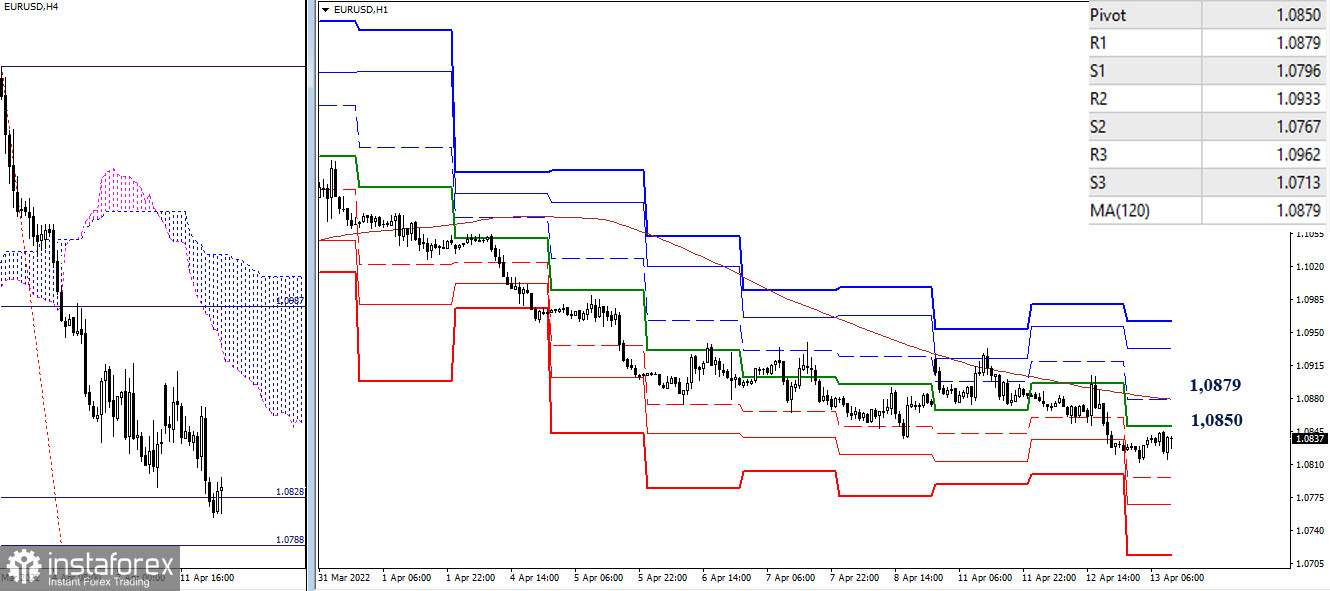

H4 - H1

In the lower timeframes, the main advantage is on the side of the bears. Now the first target for the breakdown of the H4 cloud (1.0828) is being tested. Further, during the intraday decline, attention will be directed to the support of the classic pivot points (1.0796 – 1.0767 – 1.0713) and 100% completion of the H4 target (1.0788). In the case of the development of the emerging correction, the first to test its strength will be the key levels of the lower timeframes, which are currently the resistance and are located at 1.0850 (central pivot point) and 1.0879 (the weekly long-term trend). Consolidation above and reversal of the moving average can change the current balance of power.

***

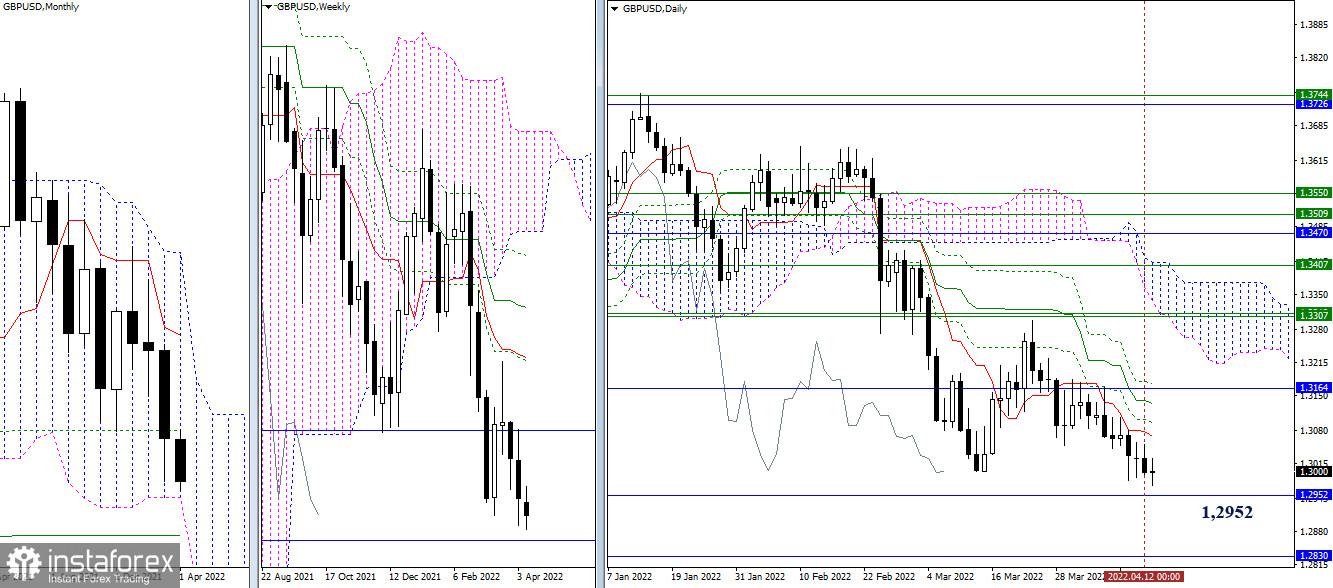

GBP/USD

Higher timeframes

The situation of recent days is in no hurry to develop. The pair has updated the March minimum (1.3000) and continues to remain in the zone of attraction and influence of the support of the lower border of the monthly cloud (1.2952). This is the most important level for the bears in this area. The next support is the monthly medium-term trend (1.2830). The nearest resistances in this area are the levels of the daily Ichimoku cross (1.3069 – 1.3097 – 1.3135 – 1.3173), reinforced by monthly Fibo Kijun (1.3164).

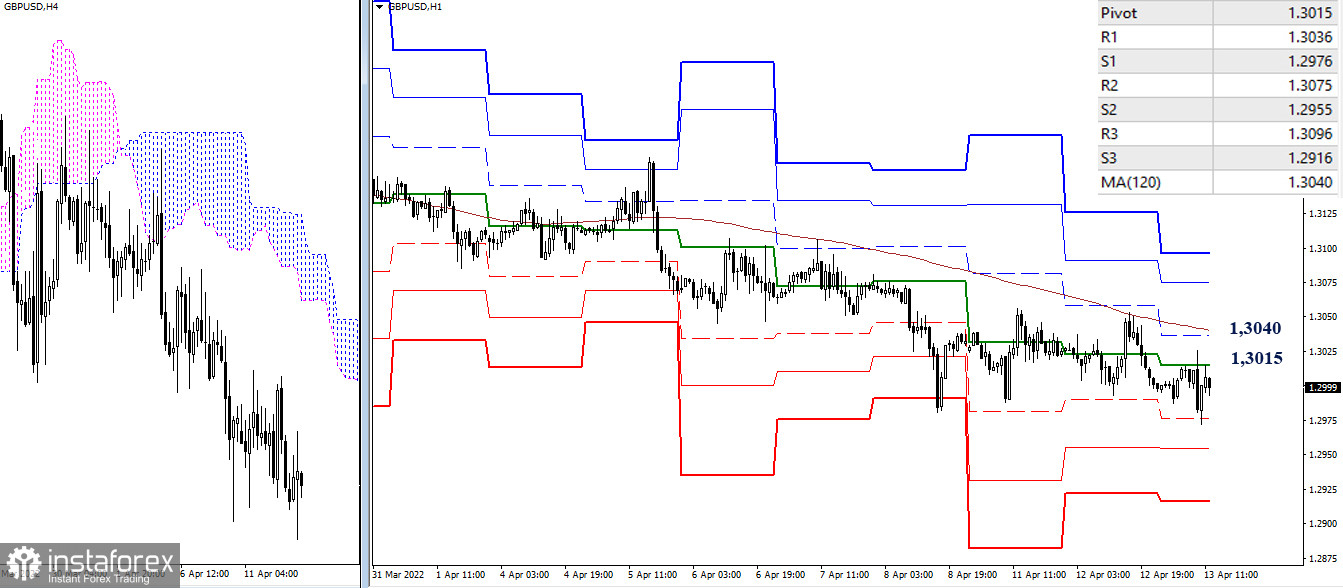

H4 - H1

In the lower timeframes, the advantage is currently on the side of the bears. The key levels of 1.3015 (central pivot point of the day) and 1.3040 (weekly long-term trend) are now on the way to the development of a corrective rise. Consolidation above and reversal of the moving average will change the current balance of power.

Meanwhile, the attention of the bulls is directed to testing the final resistances of the classic pivot points of the current day (1.3075 – 1.3096). Working under key levels (1.3015–40) will keep the prospects of strengthening bearish sentiment. The support of the classic pivot points, which serve as the main reference points within the day, can be noted at 1.2976 – 1.2955 – 1.2916.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)