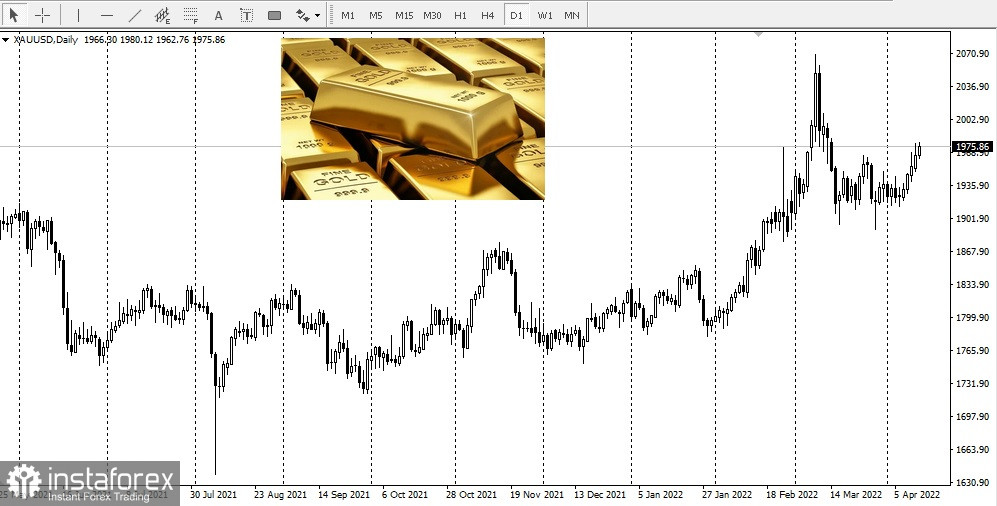

This year's Fed rate hike will have minimal impact on gold and bitcoin.

The Federal Reserve is expected to raise interest rates between five and seven times this year. Last month, the Fed already increased rates by 25 basis points.

According to Frank Holmes, Executive Chairman of HIVE Blockchain Technologies, higher interest rates will not crash the gold and cryptocurrency market as real interest rates will not become positive. The cryptocurrency market is on its own trajectory.

Holmes discussed the impact rising interest rates will have on Bitcoin and gold prices at the Bitcoin 2022 conference in Miami. HIVE Blockchain Technologies is the first publicly traded cryptocurrency miner listed on the Toronto Venture Exchange.

"Rising interest rates is a very sensitive issue now. The Fed must be very careful in slowing down the economy in an election year. The 10- and 2-year bonds are now inverted. But I think when push comes to shove, there will be a quick economic slowdown". Moreover, Holmes said it was highly possible that the US and the EU would be in recession by the end of this year or in 2023.

Many experts expected that cryptocurrency to act as a safe haven asset like gold during the Russian invasion of Ukraine. However, cryptocurrencies did not rise like gold in the early days of this geopolitical crisis. However, Holmes disagrees. He added that Ethereum went down to $2,400, but it immediately soared to $3,500.

However, cryptocurrencies did not rise like gold in the early days of this geopolitical crisis. However, Holmes disagrees. He added that Ethereum went down to $2,400, but it immediately soared to $3,500.

Moreover, Ethereum and Bitcoin have both risen from the lows of February 24.

Holmes spoke about some of the challenges for cryptocurrencies. "The big headwind is regulations, the EU versus. the US in regulations. There is a big push by politicians in the US, and I hope Canada gets its act together to understand that regulators and politicians have to embrace young taxpayers. Holmes advises investors to stay bullish.

Holmes spoke about some of the challenges for cryptocurrencies. "The big headwind is regulations, the EU versus. the US in regulations. There is a big push by politicians in the US, and I hope Canada gets its act together to understand that regulators and politicians have to embrace young taxpayers. Holmes advises investors to stay bullish.