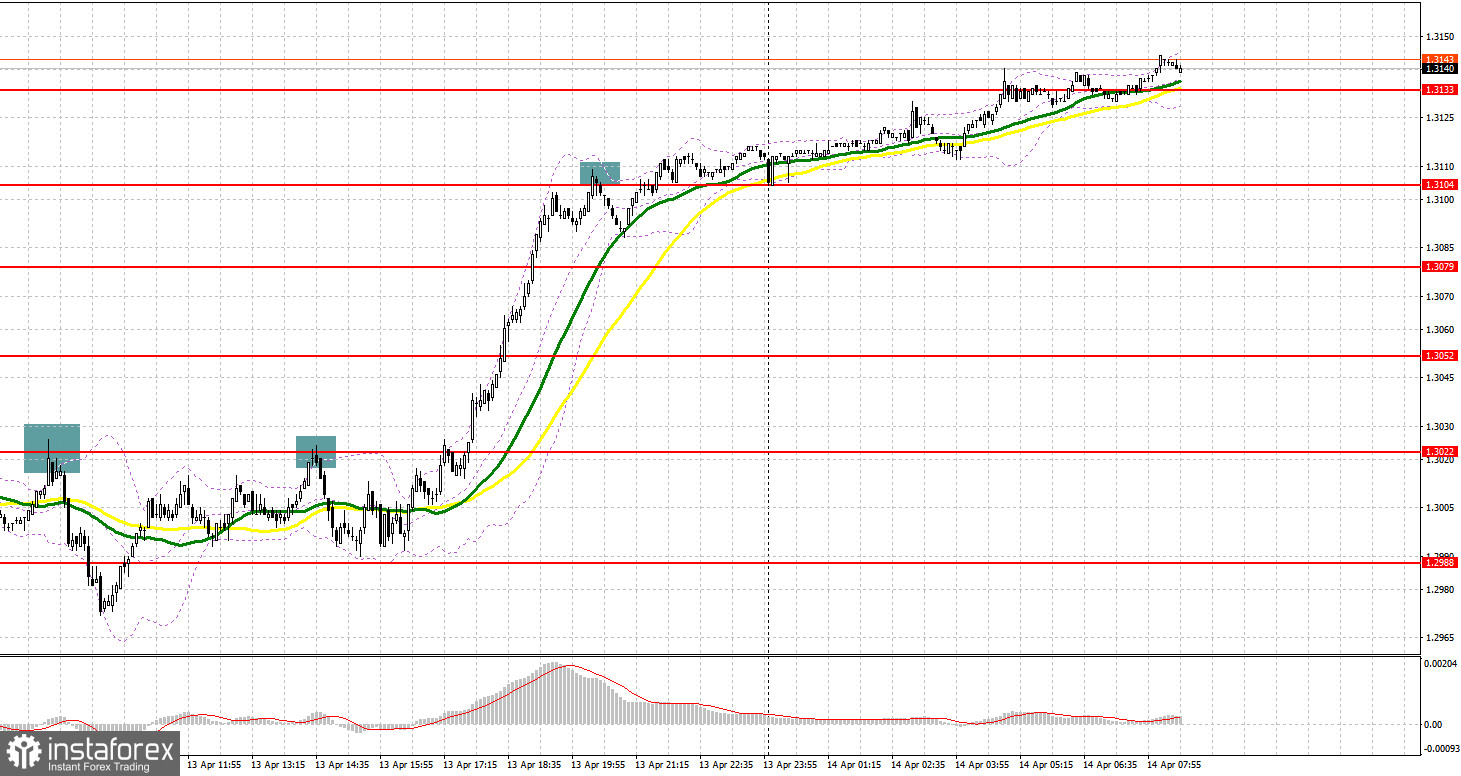

Yesterday, there were several excellent entry points that helped traders make a profit. Now let's look at the 5-minute chart and try to figure out what actually happened. In the morning article, I highlighted the level of 1.3022 and recommended taking decisions with this level in focus. Inflation in the UK surged as widely expected. The pound/dollar pair also spiked amid this news. Importantly, the pair rose yesterday following the release of the CPI report. However, shortly after, the pound sterling faced strong bearish pressure. A false breakout of 1.3022 generated a good entry point into short positions. As a result, the downward movement totaled more than 50 pips. The breakout of 1.2988 occurred without an upward test. For this reason, I did not open new short positions. Closer to the middle of the day, the bulls again made an unsuccessful attempt to push the pair above 1.3022, which gave a sell signal. It dropped by another 40 pips. Only during the US session, bulls managed to push the quotes above 1.3022. However, it happened without a downward test. Thus, I missed entry points into long positions. The bull run halted only at 1.3104. After a false breakout, it was possible to sell the pound sterling, keeping in mind a slight downward correction of 15 pips at the end of the day.

What is needed to open long positions on GBP/USD

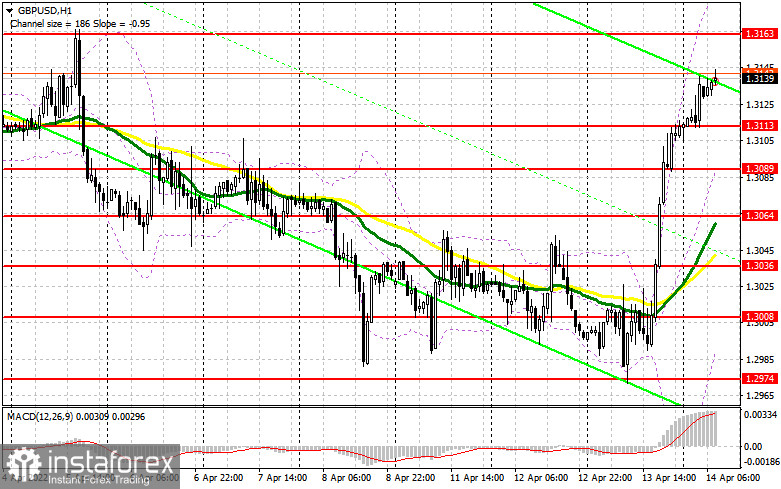

A sharp jump in the pound sterling might signal the end of the bear market that originated in March. A fresh inflation report once again showed that consumer prices approached new highs. This is why the Bank of England needs to take measures to cap soaring inflation. Traders expect the regulator to hike the key rate against the backdrop of slowing economic growth. If the BoE sticks to its way-and-see approach, it could worsen economic problems. Apparently, big market players returned to the market amid rate hike expectations. Besides, now, the pound sterling is trading at a favorable price. The bulls need to protect the nearest support level of 1.3113. This level was formed following the results of yesterday's trade. Of course, it is better not to open long positions on this level. I would advise doing so only after a false breakout. There are no crucial economic reports for the UK today. As for the Credit Conditions Survey, it is of less importance to speculators. To cement further rise, bulls should receive new drivers. The pair needs to break above the nearest strong resistance level of 1.3163. The breakout and a downward rest of 1.3163 will generate an additional entry point into long positions. It could also strengthen the bull market and open the way to 1.3192. A more distant target level will be a high of 1.3219 where I recommend profit-taking. If the pair declines and bulls show no activity at 1.3113, there is no need to worry. It is better to postpone purchases until the next support level of 1.3089. It is recommended to enter the market only if there is a false breakout. The optimal scenario is to buy GBP/USD immediately on a rebound from 1.3064 or even a lower low of 1.3036, keeping in mind an intraday correction of 30-35 pips.

What is needed to open short positions on GBP/USD

A sudden upward reversal of the pound sterling caught the bears off guard. Now, the situation has become more complicated for sellers. The downtrend is broken. It is still unclear how major market players will behave in the current conditions. It is better to refrain from opening short positions today. It is necessary to wait for growth and a false breakout around the nearest resistance level of 1.3163. You may also focus on 1.3192. However, I would advise you to open short positions only when a false breakout has occurred. If the pressure on the pound sterling returns, the bears will try very hard to show energy at around 1.3113. I do not suppose that the bulls will fight for this level. So, a breakout and consolidation below this range with an upward test may give a sell signal. As a result, the pound sterling may decline to the lows of 1.3089 and 1.3064. The moving averages are passing in the positive territory there. So, I recommend profit-taking. If GBP/USD rises and bears shoe no energy a t1.3192, I advise you to postpone short positions to a larger resistance level of 1.3219. The optimal scenario is to open short positions there only in case of a false breakout. It is possible to sell GBP/USD immediately on a rebound from a high of 1.3253, keeping in mind an intraday correction of 30-35 pips.

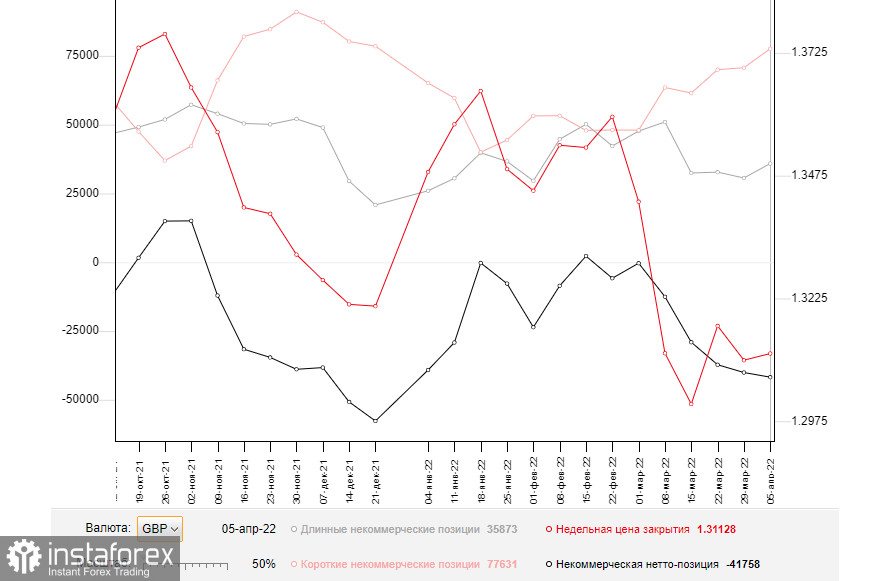

COT report

The COT report (Commitment of Traders) for April 5 logged a rise in both short and long positions. However, the number of short positions exceeded the number of long ones. It once again increased in the negative delta. Concerns about the state of the UK economy and the risks of high inflation, which is sure to worsen the ongoing crisis of British households, have intensified after the recent reports. GDP data indicated a very sharp slowdown in economic expansion. Analysts note that the situation will only get worse as now, it is quite difficult to assess inflationary risks. Undoubtedly, the consumer price index will soar in the coming months. At the same time, the dovish rhetoric of the BoE governor will only push consumer prices up. The only thing that may boost the bull market is the positive results of the negotiations between Russia and Ukraine. The parties should make progress towards a peace treaty. Apart from that, one should keep in mind the Fed's aggressive policy. It is becoming more hawkish every day. Unlike the UK, the US has no such problems. This is why it is easier for the Fed to raise the interest rate at a faster pace. The regulator is expected to hike the key rate at the May meeting. If so, it will be another signal to sell the pound sterling. The COT report for April 5 revealed that the number of long non-profit positions rose to 35,873 from 30,624, while the number of short non-profit positions jumped to 77,631 from 70,694. This led to an increase in the negative value of the non-commercial net position to -41,758 from -40,070. The weekly closing price lifted higher to 1.3112 against 1.3099.

Signals of technical indicators

Moving averages

GBP/USD is trading above 30- and 50-period moving averages. It means that there is a possibility of an upward correction.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If the pair rises, the upper limit of the range around 1.3192 will act as resistance. In case of a decrease, the lower limit of the range around 1.3090 will act as support.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.