After the release of the latest data on the dynamics of consumer inflation in the euro area and especially in Germany, the question of the likelihood that the European Central Bank will have to start raising interest rates began to be actively discussed in the market

This topic has come to the fore and has a strong impact on the European stock market, which at the end of Wednesday's trading could not even fully support the optimistic mood that prevailed in America after the release of the first corporate reports, which turned out to be better than expected. Earlier, the ECB did everything to delay this unpleasant issue for the region, trying not to plunge the local economy into recession against the background of the conflict in Ukraine. But now it will be extremely difficult to do this. The strengthening of inflationary pressure can hardly be ignored by the bank, which means there is a high probability that the outcome of the meeting will be an increase in interest rates.

The important question remains with what pace the central bank will do this. While the key interest rate is at zero. The deposit rate is -0.50%, margin lending at 0.25%. If a historic decision is actually made to start raising rates, which were lowered to their current values in March 2016, then this could be a fateful decision.

Therefore, the market is wondering: if the ECB decides to raise rates, how much at once and at what pace it will do it in the near foreseeable future?

We believe that there is a high probability that rates may be increased by 0.25% today. The regulator may try to test the reaction of the economy to these measures, and then take more concrete actions. If this is really the case, then already at today's press conference, Lagarde will speak on this burning topic.

What will be the reaction of the European stock market and the euro currency?

We believe that perhaps the ECB's decision to raise rates by a quarter of a percentage point will not have a negative impact on the local stock market, which is now under the impression of the start of corporate reporting. But the euro exchange rate may continue to grow steadily against the dollar, on the one hand, supported by demand for company shares, and on the other, by the fact that there would be an increase in ECB interest rates, which will shift the balance of power in its favor for a while.

In general, I consider the situation in the markets. We believe that there is a possibility of a local rally in the stock markets, accompanied by a decline in government bond yields and a weakening of the dollar on the whole front.

Forecast of the day:

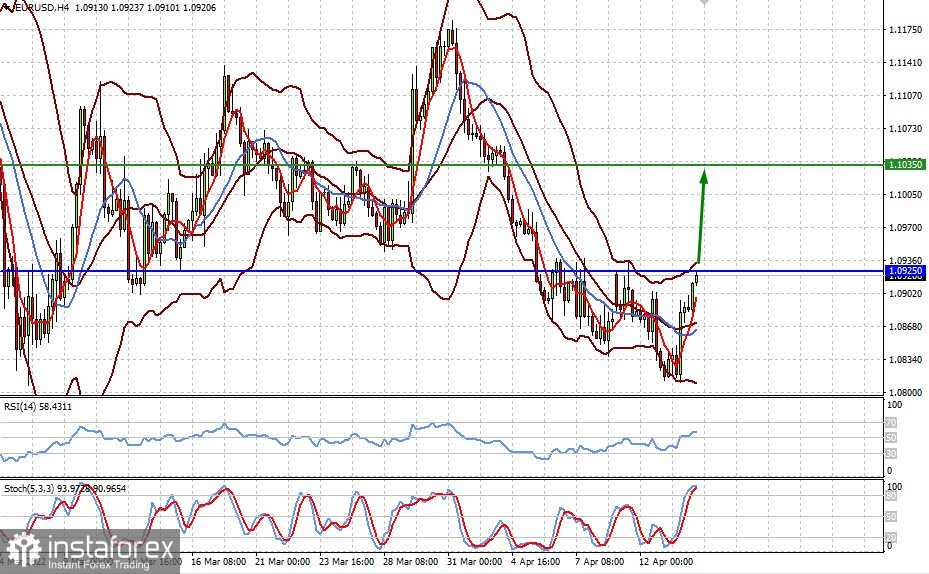

The EURUSD pair is trading below the 1.0925 level. The ECB's decision to raise interest rates may lead to a sharp increase in the pair with its movement to the area of 1.1035 or even higher.

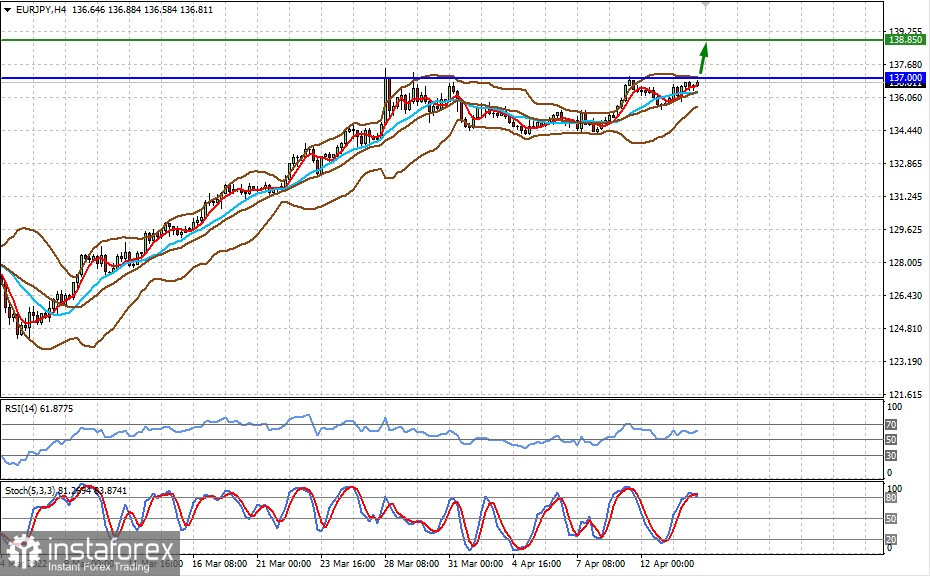

The EURJPY pair is staying below the strong resistance level of 137.00. The news about the rise in the cost of borrowing by the ECB may provoke the pair to rise to 138.85.