Inflation in the UK accelerated from 6.2% to 7.0%, which did not affect the market at all as the data came completely in line with the forecast. So, in the European session, the market was simply trading flat.

Inflation (UK)

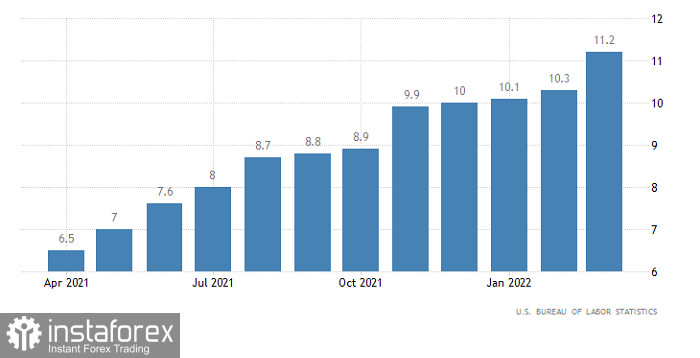

Some movement happened during the US trading hours although the market moved in the opposite direction. The cause of this was not the data on the US producer price index although the indicator accelerated from 10.3% to 11.2%, with the forecast of 11.0%. A day earlier, a stronger rise in the inflation rate provoked a rather noticeable decline in the British pound because a faster-than-expected pace of inflation almost inevitably leads to a faster rate hike by the US Federal Reserve. The producer price index is considered a leading indicator which now shows that inflation is set to rise further. In fact, this should have supported the US dollar but that did not happen. Instead, the pound strengthened, which also helped the single European currency to rise.

Producer Price Index (United States)

At its previous meeting, the Bank of England published a forecast suggesting that inflation will reach its peak in April, accelerating to 7.2%. However, during the North American trading session, a number of banks released their forecasts predicting that the UK inflation rate will rise to 9.0% as soon as April. This is in stark contrast to the BoE's forecast. Given that current inflation is running at 7.0%, it is unlikely to stop at the rate of 7.2% and will most probably continue to accelerate further. Therefore, the Bank of England will have to cope with this somehow, probably by raising the interest rate once again. This reason could have pushed the pound higher.

Today, the data on retail sales in the United States is out. The indicator is expected to fall to 11.0% from 17.6%. However, this news will most likely stay unnoticed as it coincides with the start of the press conference with Christine Lagarde. Apparently, the board meeting of the European Central Bank is in the center of attention. Most probably, interest rates will remain unchanged as well as all other aspects of the monetary policy pursued by the regulator. What interests the market is the statement made by Christine Lagarde afterwards. If, as usual, she does not mention anything about a rate hike, the US dollar will resume its growth. But if the head of the ECB makes a hint at a possible monetary tightening before the end of this year, the euro will advance rapidly, helping the pound to rise as well.

Retail Sales (United States)

EUR/USD managed to rebound from the pivot point of 1.0800 and started a correction afterwards. Given the upcoming event, high speculative interest still prevails in the market. Therefore, rapid changes in the price movement are possible. The level of 1.0940 serves as resistance for buyers. At this point, traders may reduce the volume of long positions. In case the price holds firmly above 1.0950, the path towards 1.1000 will be opened.

After a long break near the psychological level of 1.3000, GBP/USD finally showed good trading activity. As a result of a rebound, the quote reversed by more than 130 pips. Speculative activity is still high in the market and it may push the price higher to the resistance level of 1.3180. At this point, the volume of long positions may decline.