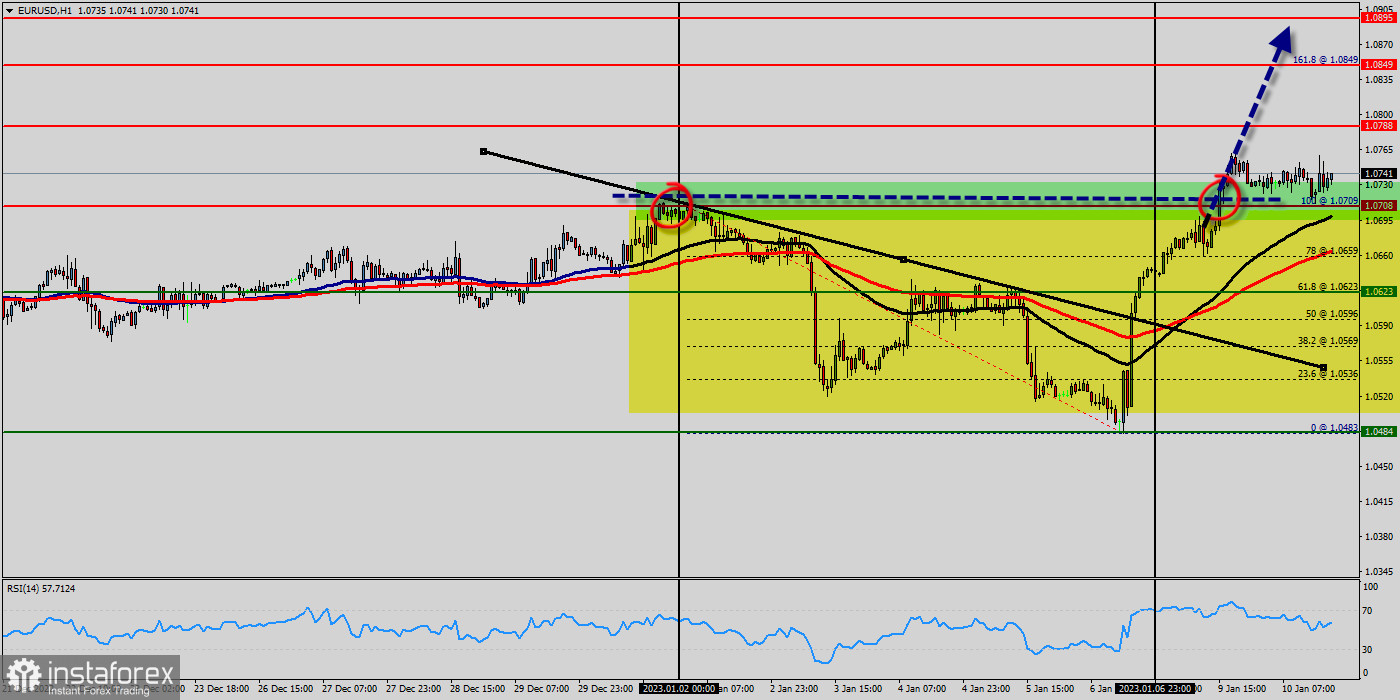

The EUR/USD pair broke resistance at 1.0623 which turned into strong support yesterday. This level coincides with 61.8% of Fibonacci retracement which is expected to act as major support today. Equally important, the RSI is still signaling that the trend is upward, while the moving average (100) is headed to the upside.

On the one-hour chart, immediate support is seen at 1.0659, which coincides with a ratio of 78% Fibonacci retracement. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100) and (50),

Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (1.0623) in the coming hours. The EUR/USD pair will demonstrate strength following a breakout of the high at 0.9958. Consequently, the market is likely to show signs of a bullish trend.

In other words, buy orders are recommended above 1.0708 with the first target at 1.0788. Then, the pair is likely to begin an ascending movement to 1.0788 mark and further to 1.0849 levels.

The level of 1.0849 will act as strong resistance, and the double top is already set at 1.0788.

On the other hand, the daily strong support is seen at 1.0623. If the GBP/USD pair is able to break out the level of 1.0623 , the market will decline further to 1.0503 (daily support 2).