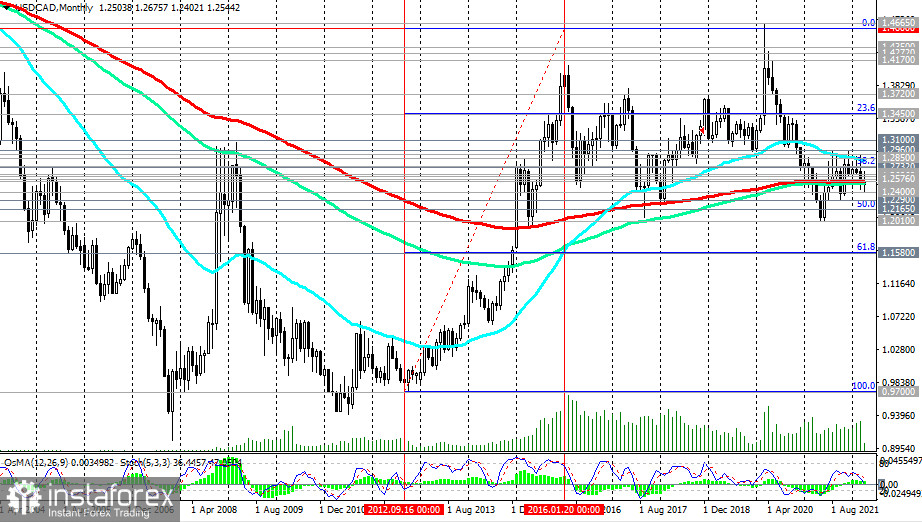

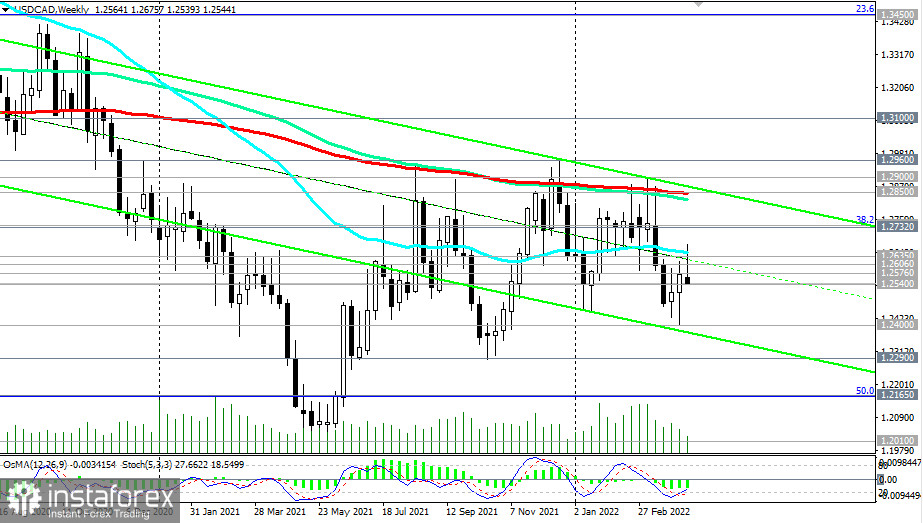

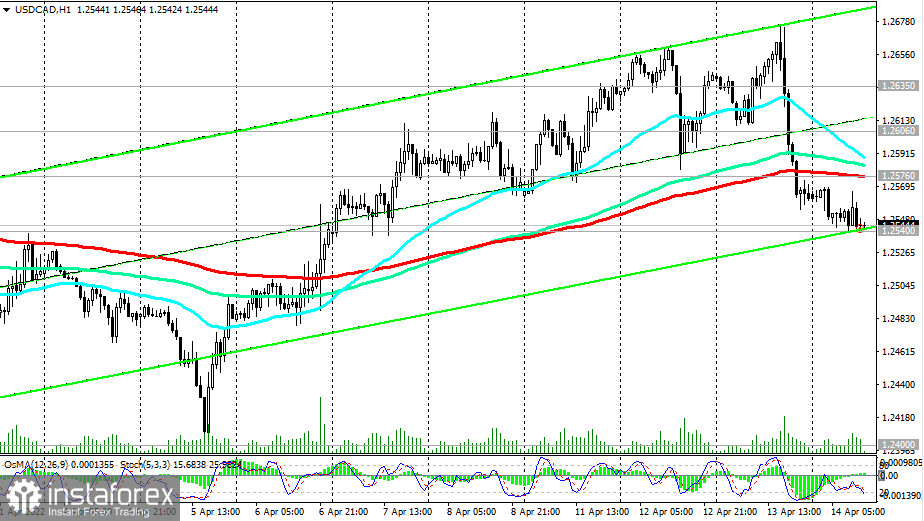

As we have mentioned in our Fundamental Analysis, starting from January 2021, the USD/CAD pair has been trading in a range between 1.2960 and 1.2010. The 200-day moving average serves as a median line on the monthly chart, coinciding with the level of 1.2540. A breakout of this level will send USD/CAD towards the lower boundary of the channel but first to 1.2010. This, in turn, will mark a final break into the bear market zone.

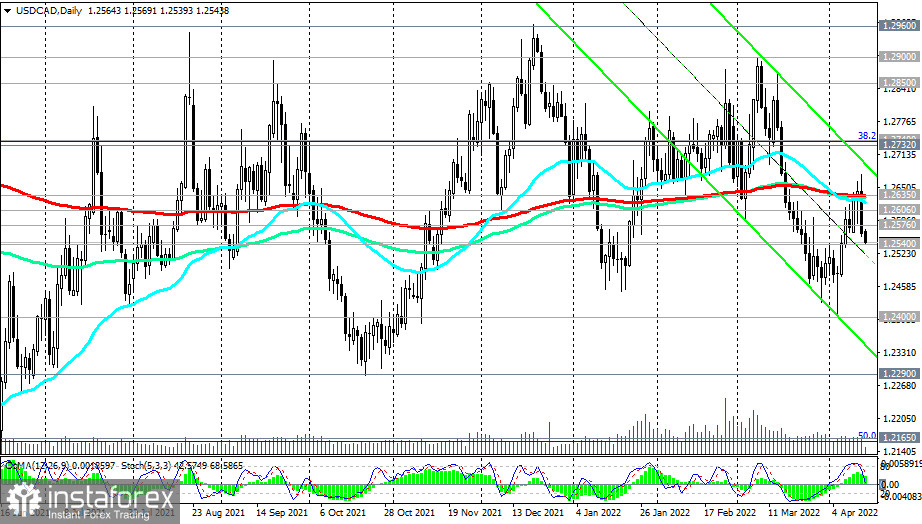

USD/CAD is also trading below the key resistance levels of 1.2635 (EMA 200, EMA 144 on the daily chart) and 0.2850 (EMA 200 on the weekly chart). The prevailing downward movement makes short positions preferable. A breakout of the support at 1.2540 will serve as a signal for adding more sell positions.

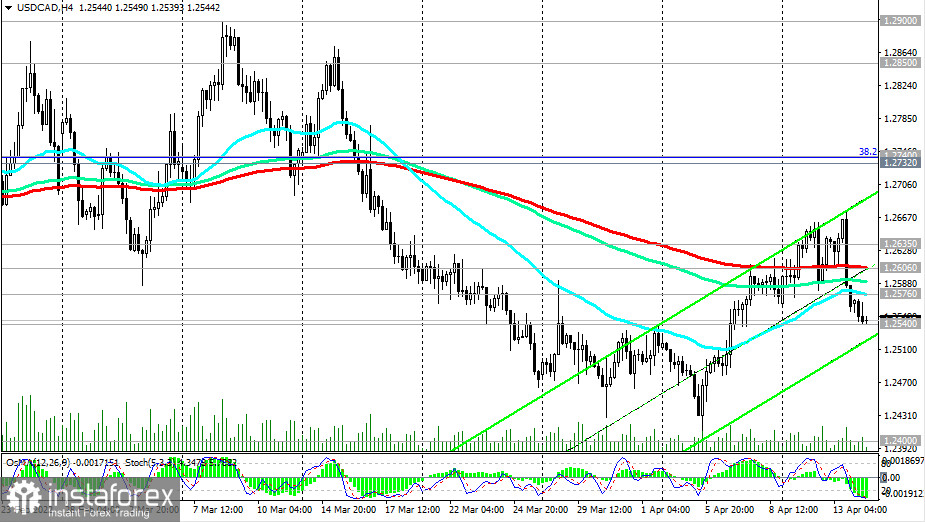

In an alternative scenario, a breakout of the resistance level of 1.2576 (EMA 200 on the 1-hour chart) will become the first signal for resuming long trades. In this case, the target in the upward correction will be the resistance levels of 1.2606 (EMA 200 on the 4-hour chart) and 1.2635 (EMA 200 on the daily chart).

A breakout of the local resistance level of 1.2675 (monthly high) may provoke further growth towards the resistance levels of 1.2850 (EMA 200 and the upper boundary of the descending channel on the weekly chart) and 1.2960. A breakout of these levels will mean the return of USD/CAD to the zone of a long-term bull market.

Support levels: 1.2540, 1.2450, 1.2400, 1.2290, 1.2165, 1.2050

Resistance levels: 1.2576, 1.2606, 1.2635, 1.2675, 1.2700, 1.2730, 1.2800, 1.2850, 1.2900

Trading scenarios:

Sell Stop 1.2530. Stop Loss 1.2585. Take Profit 1.2500, 1.2450, 1.2400, 1.2290, 1.2165, 1.2050

Buy Stop 1.2585. Stop Loss 1.2530. Take Profit 1.2600, 1.2635, 1.2675, 1.2700, 1.2730, 1.2800, 1.2850, 1.2900