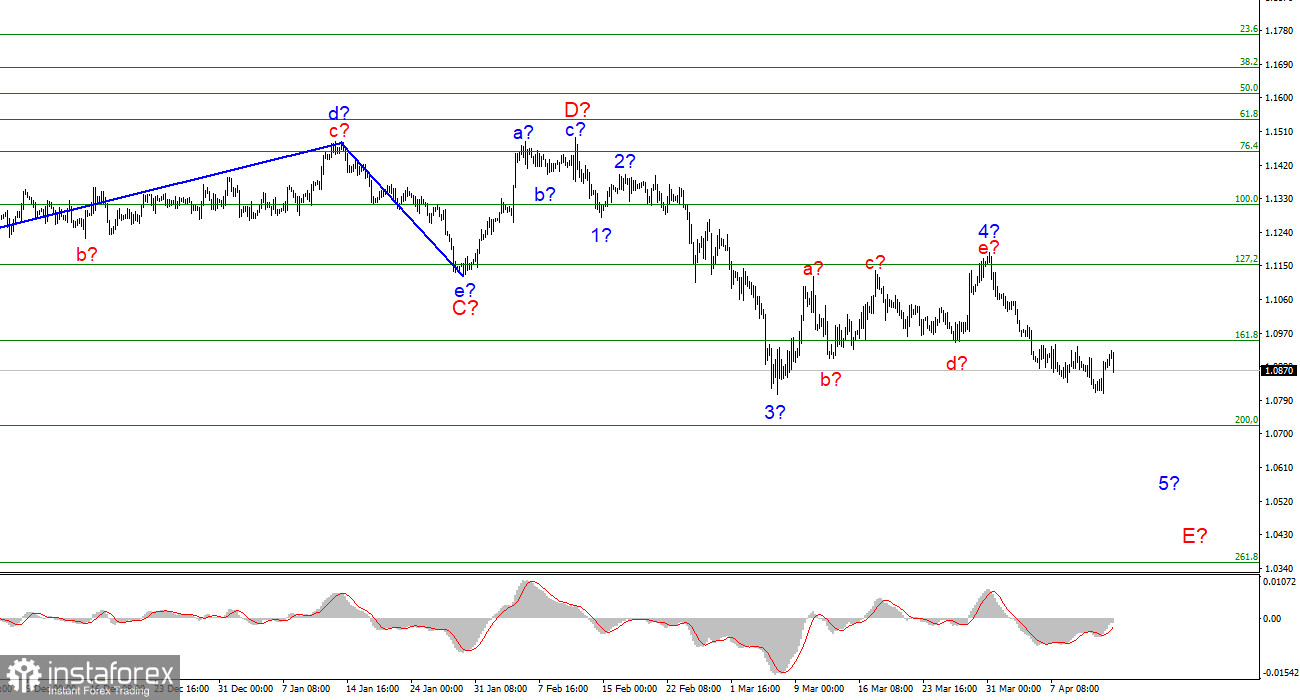

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The assumed wave 4 took a five-wave, corrective form. Nevertheless, now this wave is recognized as complete, and the wave pattern does not require any changes. The instrument has started and continues to build the expected wave 5-E. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks. At the moment, the entire wave structure of the descending trend section looks almost fully equipped, but wave 5-E is likely to also take a five-wave form. If this is the case, then at the moment the construction of only the first wave consisting of 5-E has been completed. If this does not happen, then the quotes still have not fallen under the low of wave 3-E, that is, wave E cannot yet be considered completed now in absolutely any case. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. At the same time, much of the instrument in the coming months will depend not only on the economy but also on geopolitics, gas and oil prices, and the expansion of the zone of military conflict on the territory of other countries.

The sharp and inexplicable decline of the dollar did not confuse the cards

The euro/dollar instrument increased by 65 basis points on Wednesday, although at the time of the release of my yesterday's article, the chances were zero. Thus, the demand for the euro currency began to grow almost in the evening, which makes us think about the reasons for the rather strong fall in the dollar. It is the "fall of the dollar", and not the "growth of the euro currency", since the British pound also rose very actively yesterday. Therefore, the reason was in the US and/or the US currency. I studied yesterday's news background very carefully and could not come to an unambiguous conclusion about what caused the drop in demand for the dollar. To be honest, there can be a huge variety of reasons. The market is a collection of players, large players who may not act in accordance with the news background or on their own, not intended for the masses of information. Perhaps yesterday was just such a case. At least I don't believe it was a "preparation" for today's ECB meeting or a reaction to the report on oil reserves in the United States.

Today, by the way, there were no special results of the ECB meeting. And the European currency has declined from the peak of the day by 50 points. Thus, the market comes to its senses very quickly and understands that there is no reason to buy the euro currency now. The ECB left the deposit and loan rates unchanged and said that the asset purchase program will be completed in the third quarter of 2022, and the rate increase will not begin until the end of the QE program. That is, in the next two quarters, the ECB will continue to stimulate the economy. Inflation due to these actions will continue to grow, the regulator does not even plan to stop its growth in the coming months. Work on reducing the consumer price index will begin no earlier than the fourth quarter, when the indicator may already exceed 10%. Such is not rosy news.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". In the next few days, an internal correction wave of 5-E may be built, after which I expect a new decline in the instrument.

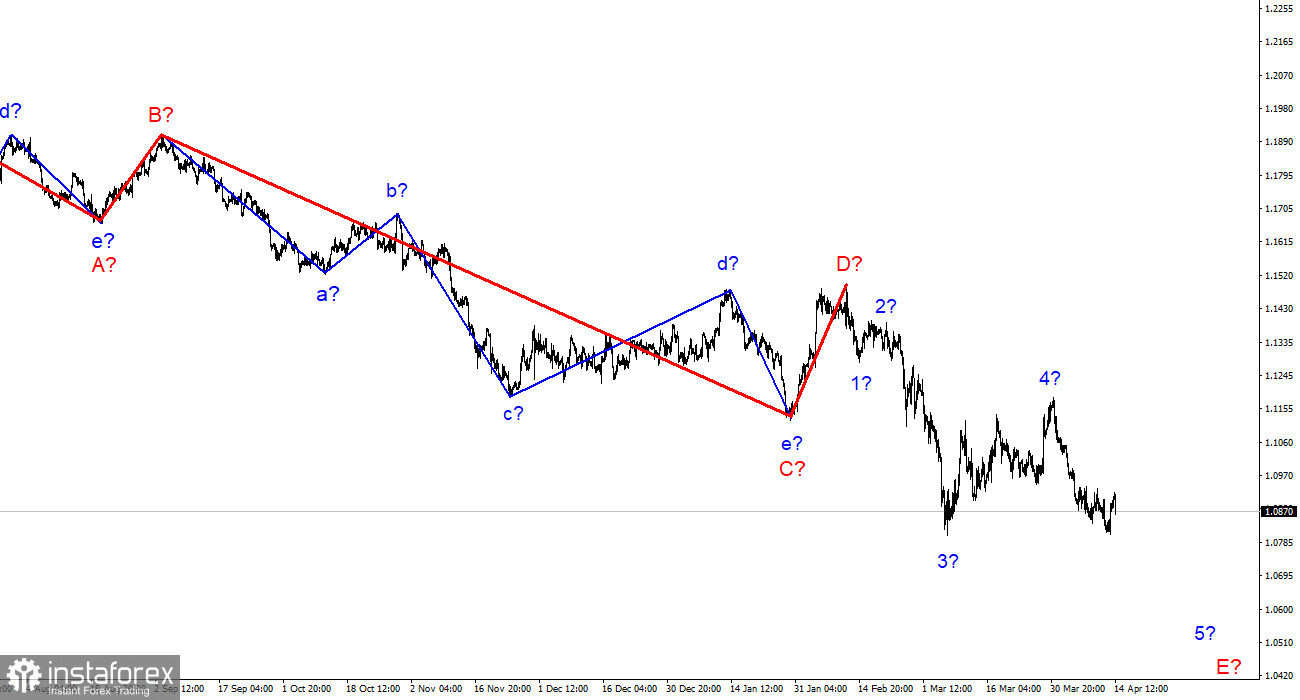

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.