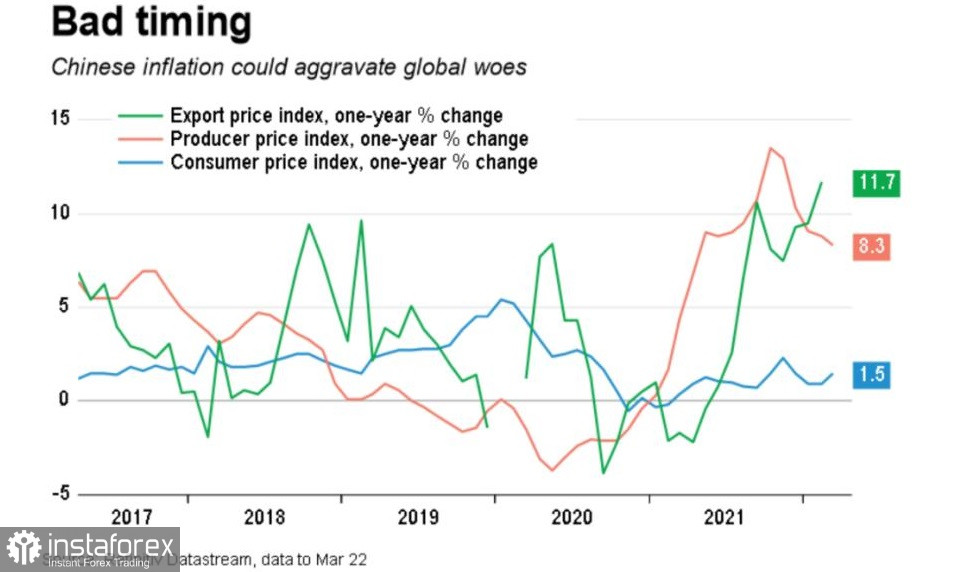

China's producer price index rose 8.3% in March from a year earlier, beating the forecast at 7.9%. Analysts predict that China's economic growth will slow to 5.0% in 2022 amid new outbreaks of COVID-19 and weakening global markets, which is an additional argument in favor of a dovish policy.

Get ready Asia: China slows down

Growth in the world's second largest economy has slowed since early 2021 as traditional engines of the economy, such as real estate and consumption, have stopped working. Exports, the last major driver of growth, are also showing signs of fatigue.

Some economists say the wide-ranging disruption to operations recently due to China's biggest COVID-19 outbreak since 2020 and tight lockdowns have raised the chances of a recession.

China's statistics office reported that consumer prices rose 1.5% year on year in March from 0.9% in February. It looks like the government will have an uphill battle to reach the 5.5% target.

Analysts have now adjusted their forecast growth for 2022 to below the 5.2% forecast for January. Further growth to 5.2% is predicted in 23.

The data showed that gross domestic product (GDP) likely rose 4.4% in the first quarter year-over-year, outpacing 4.0% in the fourth quarter due to a strong start in the first two months.

Analysts believe activity in March could be impacted by China's efforts to contain the largest COVID outbreak since the coronavirus was first detected in the country in late 2019.

"March activity data is likely to have deteriorated noticeably, but this will only be the tip of the iceberg, since economic restrictions only began in mid-March," Societe Generale analysts say. "However, real GDP growth may not fall below 4% thanks to infrastructure development, reporting methods and surprisingly strong data for January and February."

On a quarterly basis, growth is forecast to slow to 0.6% in the first quarter from 1.6% in October-December, the survey showed.

The government is due to release first-quarter GDP data along with March activity data on April 18.

As a reminder, China's GDP grew by 8.1% in 2021, the best performance in a decade, but during the past year the dynamics have noticeably decreased due to debt problems in the real estate market and antivirus measures that have undermined consumer confidence and spending.

Last year, policymakers also focused on containing property and debt risks in many high-tech industries, exacerbating the economic downturn.

Consumer inflation is also expected to pick up to 2.2% in 2022 from 0.9% in 2021 and then pick up to 2.3% in 2023.

Monetary incentives

Unprecedented measures to limit the spread of coronavirus undermine not only retail, but also the manufacturing sector.

This year, the government announced more fiscal stimulus, including more local bond issuance to finance infrastructure projects and tax cuts for businesses.

The government also said on Wednesday that China will use timely cuts in bank reserve requirements (RRR) and other policy instruments to support the economy as COVID-19 threatens to further dampen manufacturing momentum.

According to a survey of economists, the People's Bank of China (PBOC) is likely to cut RRR - the amount of cash that banks must hold as reserves - by 50 basis points (bps) in the second quarter of 2022. This will help banks survive in a difficult period, but will also raise a number of questions about their solvency for Western counterparties. It is possible that some financial institutions will receive lower ratings.

But the move could also reduce the likelihood of early medium-term lending, although the base lending rate (LPR) could still be cut on April 20.

Economists at Citi expect a 50 basis point cut to be announced as early as Friday, freeing up more than 1.2 trillion yuan ($188.52 billion) of liquidity that will likely go to boost imports.

Analysts expect the PBC to cut its annual LPR, its benchmark lending rate, by 10 basis points in the second quarter, the poll showed.

The last time it cut annual LPR by 10 basis points was in January and the last time it cut RRR by 50 basis points was in December.

In the last two rounds of RRR cuts in 2021, the corresponding relaxation announcements were made two to three days after they were noted by the State Council.

"We expect the PBC to cut the RRR by 50 basis points and possibly cut interest rates as well in the next few days," Goldman Sachs wrote in a note on Thursday.

Most private forecasters now expect a 50 basis point (bp) decline in the RRR, freeing up more than 1 trillion yuan ($157 billion) in long-term funds that banks can use to boost lending.

A commentary from the state-run Securities Times said April 15 would be a window to watch.

In general, China's measures to reduce the amount of cash held in banks set aside as reserves and increase lending increase traders' expectations of an early policy easing. But economists say any loosening of credit may not be enough to fend off a deep economic downturn that looms on the horizon.

Is it soft enough?

Despite concrete steps to ease fiscal stimulus, some analysts still question the effectiveness of lowering RRR now. The reason is the lack of demand for credit as factories and businesses struggle and consumers remain cautious in a very uncertain economy.

Transmission channels for regular RRR and rate cuts are heavily congested due to COVID-related lockdowns and logistics disruptions, according to the Nomura Foundation.

"When households rush to stock up on food and private corporations prioritize survival over expansion, demand for credit is weak," Nomura analysts said.

"With so many lockdowns, roadblocks and curbs, the most worrying issues are mainly on the supply side, and simply adding leverage and marginally lowering lending rates is unlikely to effectively boost final demand."

Fund officials also say China faces "growing risk of recession" as 45 cities are now fully or partially closed, representing 26.4% of the country's population and 40.3% of its GDP.

The rate is expected to be cut by 10 basis points shortly to 1-year medium-term credit line (MLF), 1- and 5-year prime lending rates (LPR) and 7-day reverse repo rates.

But at the same time, no changes in the annual MLF rate are expected on Friday (the date of the extension by the central bank of medium-term loans for 150 billion yuan).

After a sharp cut in key rates in January, China kept its base annual LPR rate unchanged at 3.70% and the five-year LPR rate at 4.60%.

"Monetary policy is not a panacea for all problems," the Securities Times commented.

"Unlocking supply chains and production chains, allowing businesses to receive orders and allowing people to generate income, will be the only way to improve the cash flow of the real economy and achieve a natural recovery."

Global markets at risk of getting many new holes

China's indefatigable fight against Covid-19 is reflected not only in the domestic consumption and production market. It is also hitting the global economy, in addition to the conflict in Ukraine.

Chinese manufacturing and logistics centers are shutting down as authorities crack down on new outbreaks.

Despite talk of supply chain diversification, the global reliance on Chinese factories is only increasing, as evidenced by 2021 export data. China's share of global exports rose to 15.4% last year, surpassing the pre-pandemic level of 13.1% in 2019, Bernstein analysts estimate.

Roughly three-quarters of China's 100 largest cities, which account for more than half of the nation's GDP, had implemented varying degrees of pandemic restrictions as of April 6, according to research firm Gavekal.

Most of Shanghai's 26 million residents have been chained to their homes for more than two weeks (initially quarantined for 5 days), which has led to the closure of warehouses and the restriction of access to the world's busiest container port.

iPhone supplier Pegatron has halted production at two nearby factories.

Extreme measures were also taken in March in Jilin Province, a vital corn producer. Toyota and Volkswagen factories are also located here.

In turn, the Guangdong export hub is bracing for another blow by restricting travel, closing schools and rolling out mass testing.

On the other hand, shipping giant Maersk is warning of overburdened container terminals, shortages of trucks and reduced air travel.

The government's plan so far has always been to completely suppress the infection at all costs. Draconian lockdown measures have allowed China to quickly restart factories after an early outbreak in 2020, but the Omicron variant is more contagious.

Alas, the economic losses will increasingly be felt outside of China.

The disruptions caused by the trade war with the United States and then the pandemic have led many governments and leaders to discuss plans to hedge their dependence on Chinese suppliers.

For example, World Bank Chief David Malpass recently said that diversification "is likely to benefit everyone."

But so far it hasn't really changed much.

Extended outages to global factories are likely to trigger additional price increases around the world.

At the same time, inflation in the US is already at its highest level in 40 years, and prices in the eurozone rose to a record 7.5% in March. Rising energy and raw material prices are also responsible for higher-than-expected increases in China's selling and consumer prices in March.

Actually, blocking has already hit trade.

A week earlier, the European Chamber of Commerce in China said that the volume of Shanghai ports, according to their estimates, decreased by 40% compared to the previous week.

If coronavirus lockdown policies remain as tight next year, global markets will eventually have to really look for new sources of commodity production, move production to other developing countries and, in general, look for a replacement for Chinese trade expansion.

China is set to release March industrial production and retail sales data on Monday, April 18, which is expected to reflect the impact of COVID-related restrictions, as well as first-quarter gross domestic product data.