The Federal Reserve officials continue to implement its policy formulated by the central bank in March 2022. However, policymakers are forced to take more aggressive measures due to the oncoming rapid rise in inflation. Otherwise, the US economy will experience a recession, which the Fed is trying to avoid.

New York Fed President John Williams said recently that accelerating the pace of interest rate hikes in half-percent increments was a reasonable step for the Federal Reserve, taking into account the current low rates and how long they had been at their lows. "I think it's a reasonable option for us because the federal funds rate is very low," Williams said in an interview. "We do need to move policy back to more neutral levels."

Notably, the US central bank raised the benchmark interest rate by a quarter percentage point last month. It was the first rate hike since the Fed officials slashed it to nearly zero in March 2020 to combat the coronavirus pandemic. The increase of the interest rates was expected to continue gradually at 0.25% after the March meeting. However, in late March Jerome Powell made some statements on a more hawkish stance concerning the Fed issues. Investors expect the coming changes to occur in half-point increments instead of more typical adjustments. The first 0.5% increase is expected at the Fed's May 3-4 meeting.

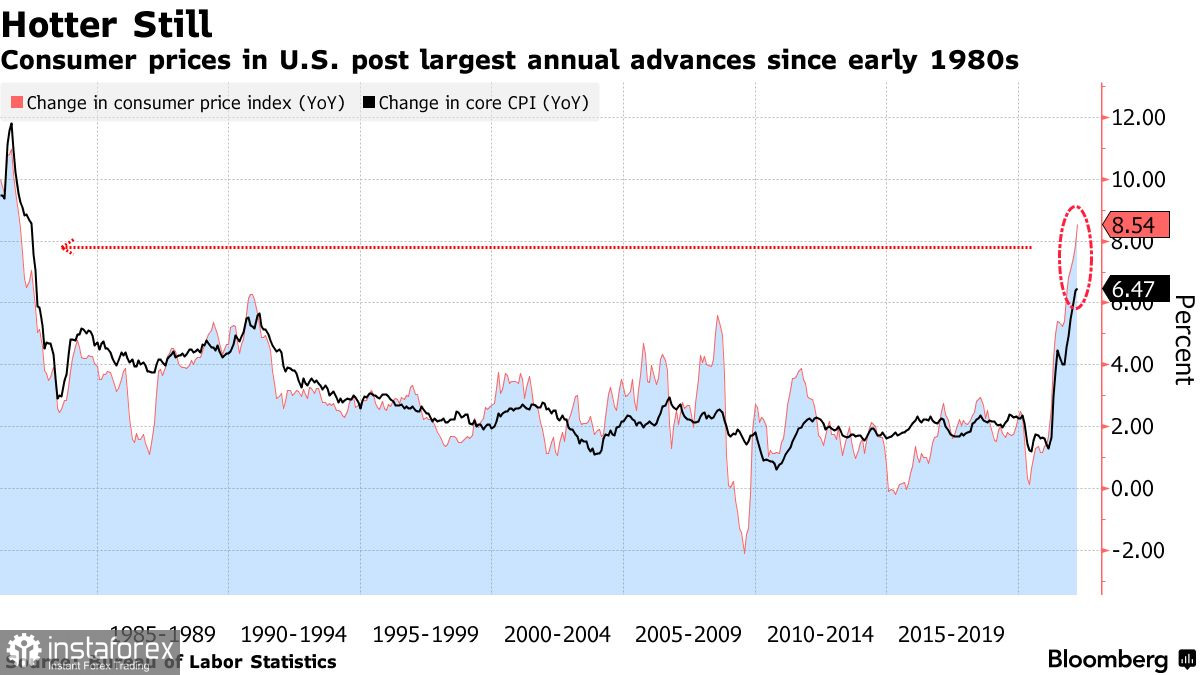

The Labor Department data released on Tuesday showed that US consumer prices had risen by 8.5% year-over-year indicating the fastest pace of growth since 1981. Moreover, the New York Fed President said that he and his partners should take drastic measures. John Williams added that he saw a neutral setting to be somewhere in the range of 2% to 2.5%. However, the Fed's pace to reach that level is extremely significant. Besides, it will also affect economic growth. A slow rate hike could lead to soaring inflation and a recession. A more aggressive tightening of monetary policy would also stunt economic growth due to more expensive credit instruments.

"We need to really focus on bringing inflation down to our 2% long-run goal, and do that over the next few years," Williams said. "So I do think from a monetary policy point of view, it does make sense for us to move expeditiously towards more-normal levels of the federal funds rate."

Asked if the Fed risked plunging the economy into recession, Williams voiced confidence that it could achieve a soft landing. "I think the economy can withstand real interest rates at neutral or a bit above," he said. "We've seen a dramatic and significant movement in yields and financial conditions over the past several months and that's already positioning policy well to get supply and demand back into balance."

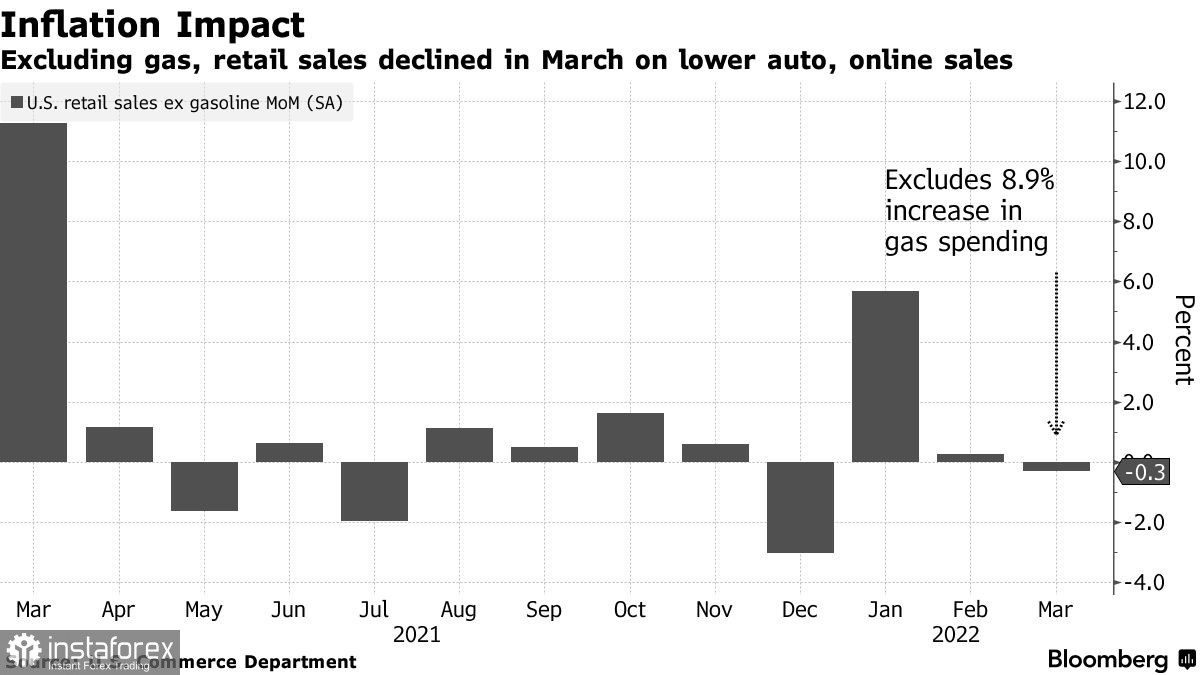

US retail sales rose in March triggered by a surge in gasoline revenues. Although consumers faced fairly high inflation, there was no sharp decline in retail sales. According to the report of the US Department of Commerce, retail sales were up 0.5% in March 2022 compared to February. February's data were revised upward to 0.8%. The increase in March was due to an 8.9% jump in gasoline prices. If that component is excluded from the calculations, sales fell by 0.3% in March. Moreover, these figures have not been adjusted for inflation yet.

The labor market data is also significant. The Labor Department report indicated that initial jobless claims for the week had risen by 18,000 to 185,000. However, the volatility of the weekly reading has not affected the market significantly.

Technical picture of EUR/USD pair

The euro failed to grow. Consequently, the trading instrument came under pressure again and the pair showed another decline. The heightened geopolitical tension due to the start of Russia's hostilities on the territory of Ukraine is exerting even more pressure on risky assets. Taking into account the Fed's aggressive policy, further strengthening of the dollar is more likely. To regain control of the market, the euro buyers have to break above 1.0835. This move is essential to build a correction to the highs of 1.0885 and 1.0930. In case the pair declines, the buyers can find support around 1.0760. Its breakout will push the trading instrument to the lows of 1.0710 and 1.0640.

Technical picture of GBP/USD pair

The pound's dramatic rise turned out to be a fake one. Consequently, the pair lost more than 70% of the whole movement. Currently, the buyers of risky assets should focus on the breakout and consolidation above the resistance level of 1.3080. If the pair manages to break through this range, a further bullish scenario will be possible. Moreover, the pair is likely to renew its new local highs near 1.3100 and 1.3130. In case the trading instrument comes under pressure again, the buyers will probably be active near 1.3030. However, they may appear around 1.3050. A larger support is seen near 1.3010.