EUR/USD

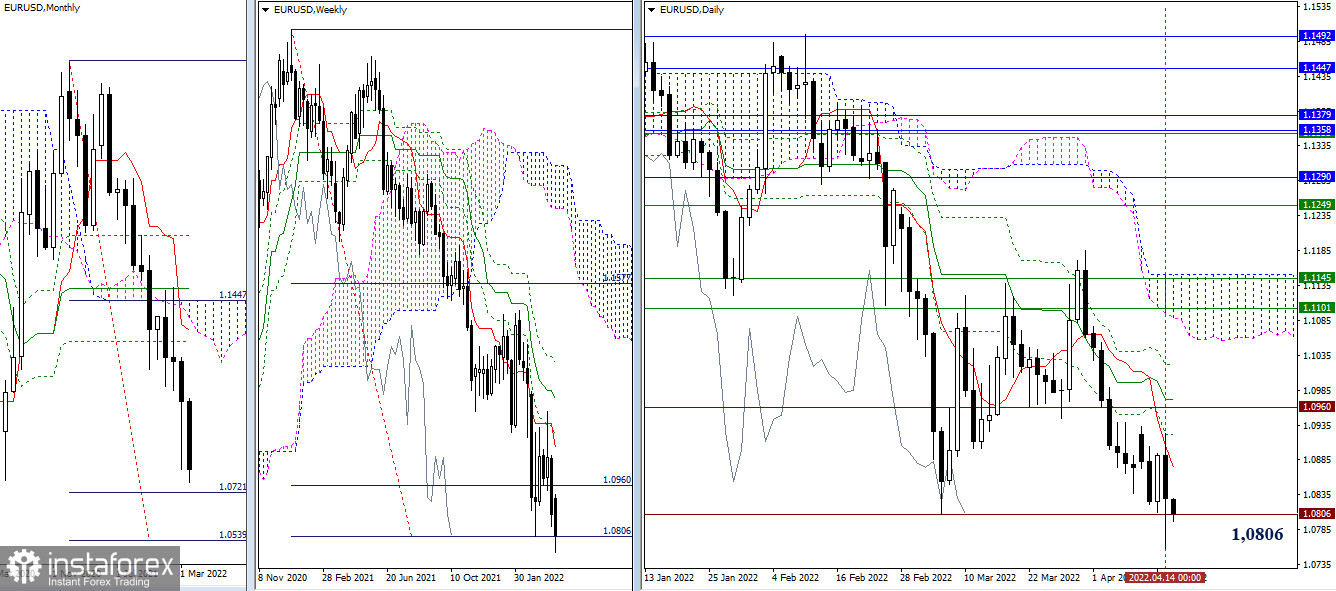

Higher time frames

Yesterday, bulls failed to push the pair up from support at 1.0806 after the price had rebounded. Consequently, bears were able to test the mark and attempted to break through it. The next downward target stands in the range of 1.0721 – 1.0539. The market closes for the weekend today. Therefore, in case of a breakout of the weekly target, bearish activity may well increase. Resistance is seen at 1.0874 (daily short-term trend) – 1.0921 (daily Fobo Kijun) – 1.0960-72 (daily mid-term trend).

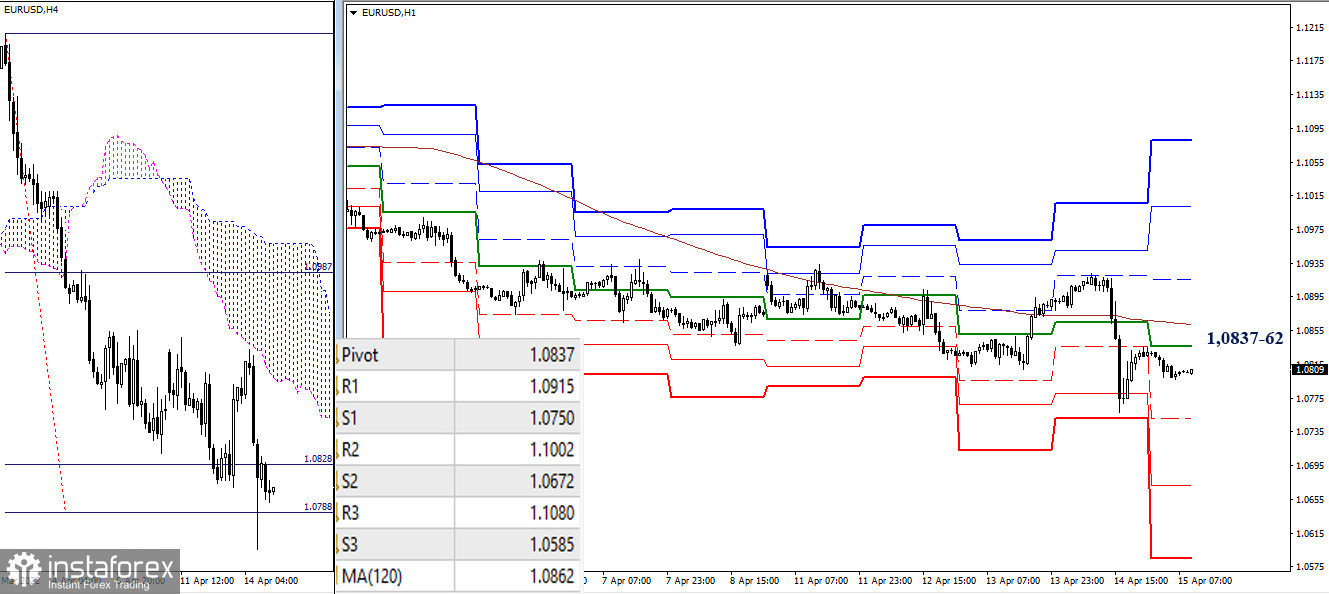

H4 – H1

Yesterday, bulls failed to consolidate at the achieved levels, and sentiment turned bearish. Should the price break through support at 1.0788 in the 4-hour time frame, classical Pivot levels will become support (1.0750 – 1.0672 – 1.0585). Bullish sentiment will return if buyers consolidate above the key support levels of lower time frames. They now stand in the 1.0837-62 range (central Pivot level + weekly long-term trend).

***

GBP/USD

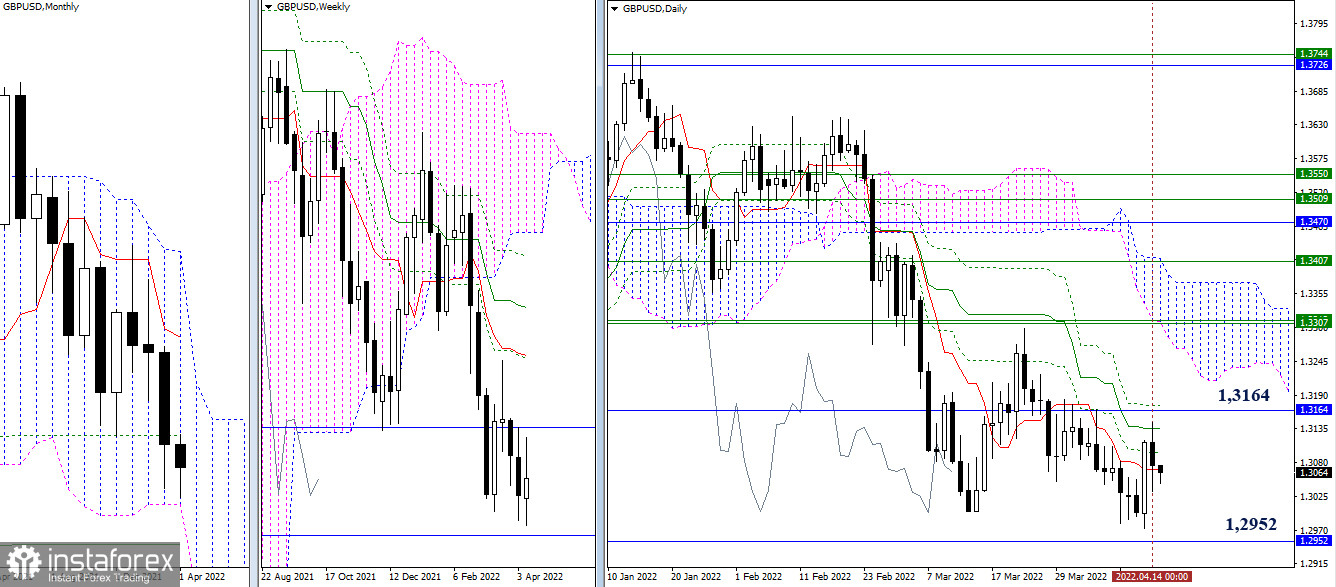

Higher time frames

Bulls failed to push the pair up after a rebound on Wednesday. Yesterday, they partially incurred losses. The instrument now trades in the range between 1.3135 Kijun-sen and 1.3069 Tenkan-sen. Bulls will try to break through the daily cross and settle above monthly resistance at 1.3164. The downward target is still the same – to break through support, in line with the lower limit of the monthly cloud, 1.2952.

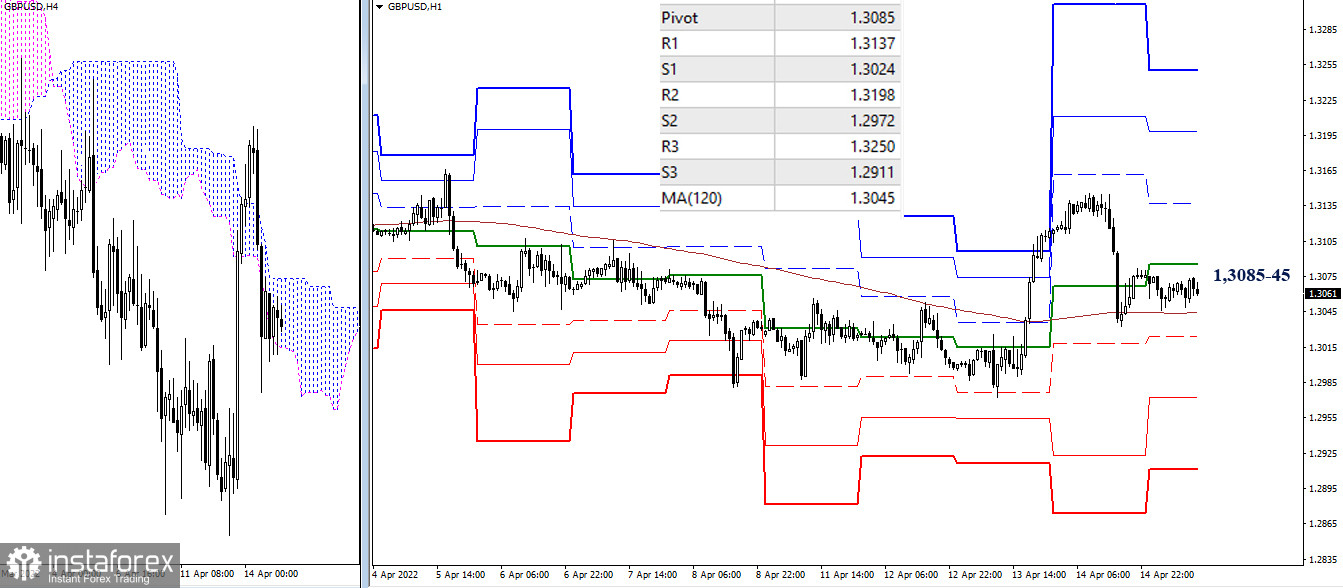

H4 – H1

The quote now trades in the range between 1.3085 (central Pivot level) and 1.3045 (weekly long-term trend). Upward intraday targets are seen at 1.3137 – 1.3198 – 1.3250 (classical Pivot resistance levels). Downward targets stand at 1.3024 – 1.2972 – 1.2911 (classical Pivot support levels).

***

Technical indicators used:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (classical) + Moving Average 120 (weekly long-term trend)