Long-term perspective.

The EUR/USD currency pair continued to fall during the current week and updated its 15-month lows. Now the pair has set a course for its 5-year minimum, which is located near the 6th level. Only 200 points. During the current week, the euro currency has fallen by another 60 points. It seems to be a little, but the downward movement is stable, and upward corrections and pullbacks are weak and rare. The Ichimoku indicator indicates a downward trend, like most other indicators on other timeframes and other trading systems. In recent months, the euro currency has not even managed to gain a foothold above the important Kijun-sen or Senkou Span B lines, so there are still no technical grounds for starting an upward trend now. This week, such an important event as the ECB meeting also took place. However, we warned the day before that there is nothing to expect from the European regulator now. We have repeatedly analyzed the situation in which the ECB got into. It does not have the opportunity to tighten monetary policy now, so it has nothing to fight against rising inflation. This means that the European economy is now sliding more into a new recession, which should be prevented in a good way. And it is possible to prevent the decline in economic growth only by new incentives and a new reduction in rates. But where to lower rates even further if they are already negative? And the new monetary stimulus will provoke an even greater increase in prices, as there will be more money in the economy. In addition, rising energy prices are also pushing up inflation, and the military conflict in Ukraine is putting Europe on the brink of a food crisis. Sanctions against Russia lead to a break in logistics chains, which provokes a drop in production volumes and creates a shortage of certain categories of goods. All this again contributes to the growth of inflation, which there is nothing to fight with.

COT analysis.

The latest COT reports are more and more discouraging because the big players continue to build up long positions in the euro currency. During the reporting week, the number of buy contracts increased by another 10.8 thousand, and the number of shorts from the "Non-commercial" group decreased by 1 thousand. Thus, the net position increased by 12 thousand contracts. This means that the bullish mood has intensified. It is "bullish" since the total number of buy contracts now exceeds the total number of sell contracts for non-commercial traders by 40 thousand. The green line of the first indicator in the illustration above clearly signals that the mood of professional players has been "bullish" in the last 3.5 months. Accordingly, the paradox lies in the fact that the mood of traders is "bullish", but the euro continues to fall almost non-stop, which is also clearly seen in the illustration above. We have already explained in previous articles that this effect is achieved by higher demand for the US dollar. The demand for the dollar is higher than the demand for the euro, which is why the dollar is growing in tandem with the euro. Based on this conclusion, the data of the COT reports on the euro currency now do not make it possible to predict the further movement of the pair. They are, one might say, meaningless. However, if the demand for the euro currency also begins to fall among professional players, this may lead to an even greater fall in the euro exchange rate, since the demand for the dollar is likely to remain high due to complex geopolitics and macroeconomics.

Analysis of fundamental events.

During the current week in the European Union, apart from the ECB meeting and Christine Lagarde's speech immediately after it, there is nothing to note. And we consider the most important event of the week to be the report on inflation in the United States, which showed an acceleration of the indicator to 8.5%. Although traders did not react with violent purchases of the dollar, nevertheless, the US currency continues to grow. So everything is logical. As for the significance of the report itself, who is surprised by the increase in inflation now? A few months ago, it could have been said that another acceleration in the consumer price index increases the likelihood of a tightening of the central bank's monetary policy at the next meetings. However, now the Fed is almost guaranteed to raise the rate by 1% in May and June, and will also begin to reduce its balance by about $ 100 billion every month. And the ECB will continue to "wait by the sea for the weather," since it has nothing to influence high inflation with. Therefore, at this time, the inflation data no longer have such a strong impression on traders as before.

Trading plan for the week of April 18-22:

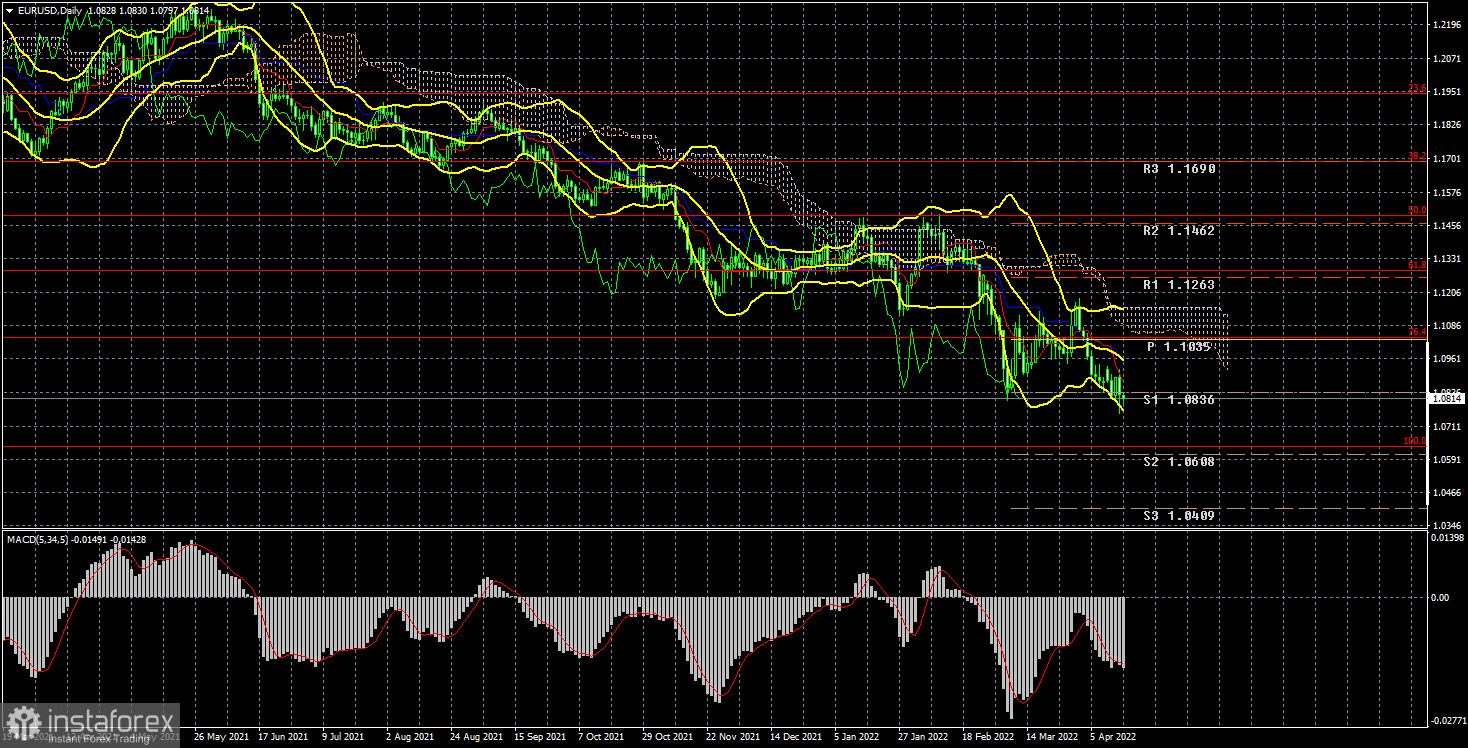

1) In the 24-hour timeframe, the pair resumed its downward movement and is preparing to fall to 1.0636 - the 100.0% Fibonacci level. Almost all factors still speak in favor of the growth of the US dollar, and not vice versa. The price is below the Ichimoku cloud, so there is still little chance of euro growth. At the moment, sales remain the most relevant.

2) As for purchases of the euro/dollar pair, it is not recommended to consider them now. First, there is not a single technical signal that an upward trend may begin. Second, the "foundation" and "macroeconomics" continue to exert strong pressure on the euro. Third, "geopolitics" can continue to put pressure on traders and investors who still believe that in any incomprehensible situation it is necessary to buy the dollar. Fourth, Europe is on the verge of an energy and food crisis. Only overcoming the Senkou Span B line we would consider as the basis for a new upward trend.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.