USD/JPY is trading around 132.55 above the 21 SMA and below the 200 EMA. We can see a technical bounce after the yen reached the support of 131.29. We may see an exhaustion of the bullish force and the bearish cycle is likely to resume only if the yen falls below 132.20.

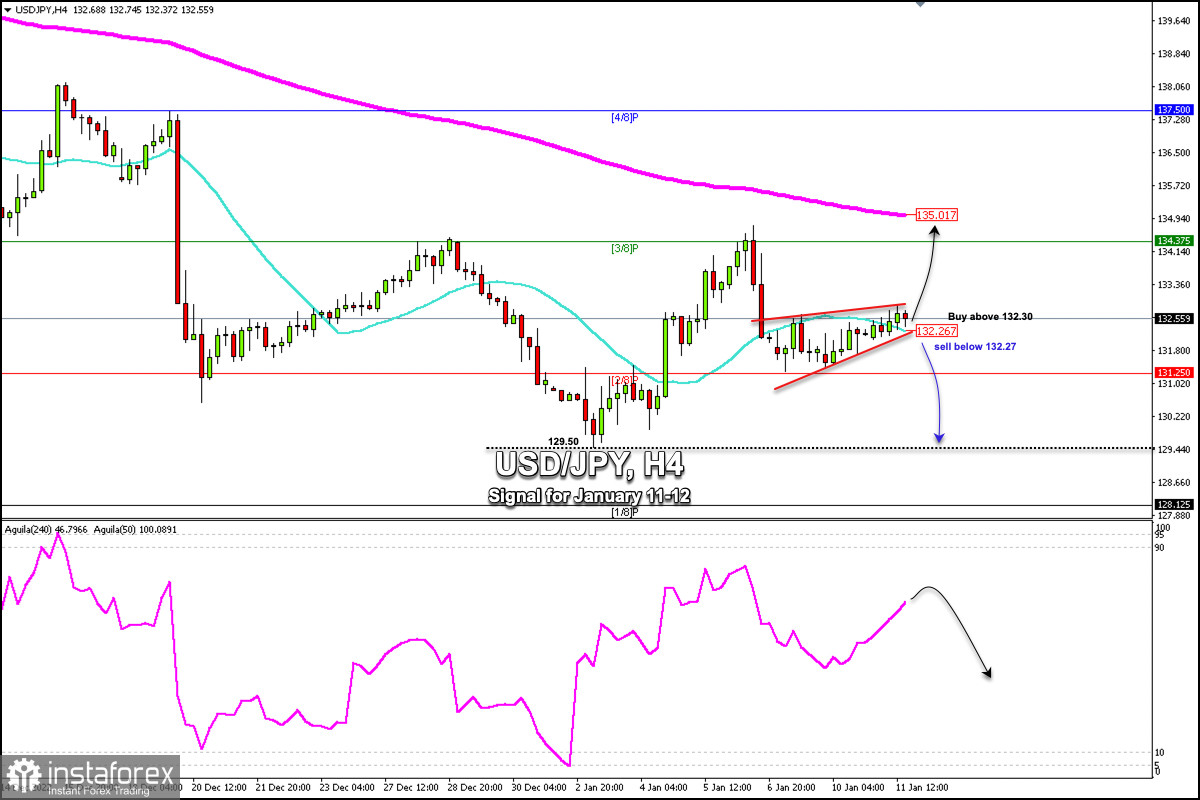

According to the 4-hour chart, we can observe the formation of a symmetrical triangle. If the Japanese yen consolidates above 132.27 in the next few hours, it is expected to continue to rise and could reach the area of 133.00. With a daily close above this level, the currency pair could go up to the 200 EMA, which coincides with the psychological level of 135.00.

Investors are speculating that the Bank of Japan will phase out its ultra-loose monetary policy. In case this happens, the USD/JPY pair could fall to the psychological level of 130.00 in the medium term.

In the short term, traders are anticipating the release of US consumer inflation figures scheduled for Thursday. For this reason, they are avoiding opening directional positions and prefer to trade in a range zone.

The key to the yen's further rise is that it should consolidate above 132.26. Then, it could reach the 3/8 Murray at 134.37 and the 200 EMA at 135.01.

A sharp break and a close below 132.27 on the daily chart could mean a sharp drop for the USD/JP pair. It could reach 2/8 Murray at 131.25 and even the low of January 3 around 129.50.