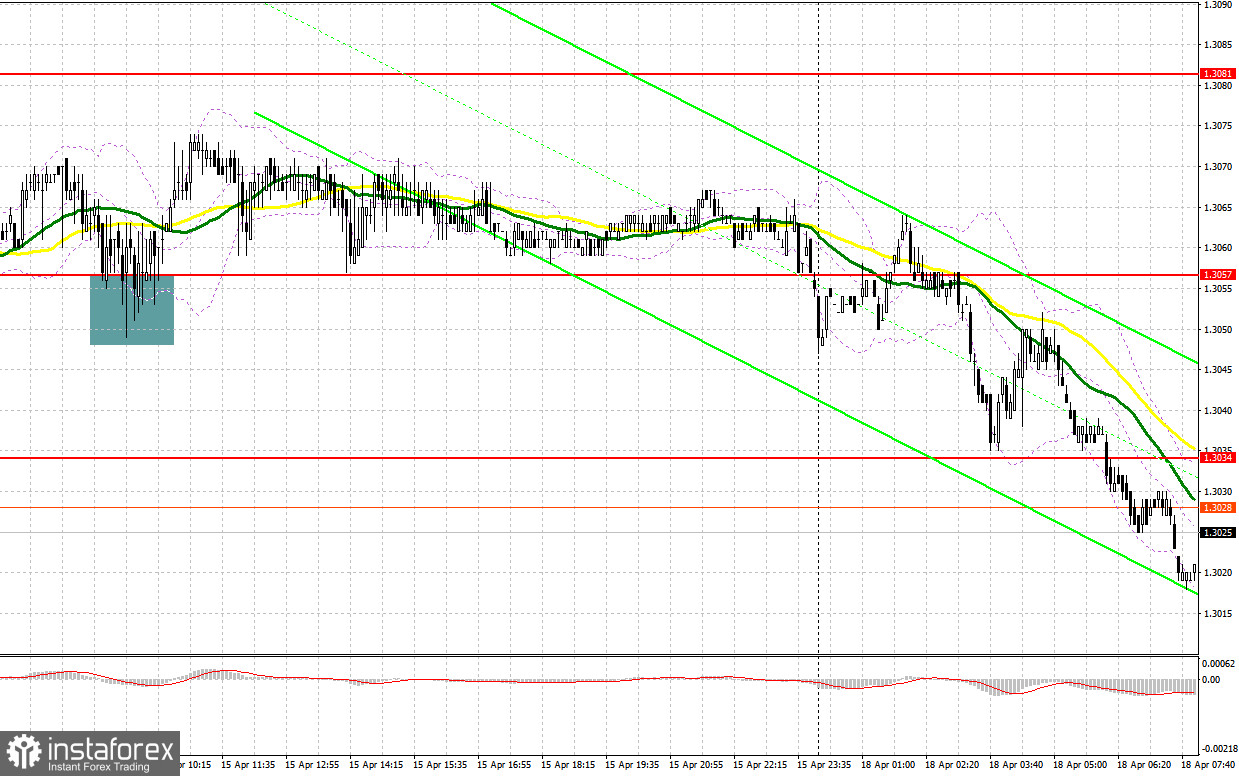

Last Friday, only one signal was formed to enter the market. Let's look at the 5-minute chart and figure out what happened. The low volatility of about 25 points did not allow the buy signal, which was formed in the first half of the day, to be properly implemented. A false breakout at 1.3057 led to a good entry point into long positions, but after moving up by 15 points, the bulls ran out of steam. The pair has been in a narrow horizontal channel all day and it has not come to an exit from it.

To open long positions on GBP/USD, you need:

Today, the pound has already sunk quite strongly in the Asian session, which completely negated all the growth observed on April 13. As I noted earlier, there were no objective reasons for such a rapid jump in the pound, so it was in vain to expect a continuation of the upward correction last week. There are no fundamental statistics for the UK today, as Easter Monday is celebrated and, most likely, the bulls will struggle to maintain the nearest support of 1.3019, formed following the results of the Asian session. Of course, it will not be quite right to count on long positions from this level, since it has already been tested, so I advise you to open long positions there only after another false breakout. If there are no people willing to buy the pound even at current lows, I advise you not to force events, and postpone entering the market until a larger support of 1.2992. But only the formation of a false breakout there will provide a signal to buy the pound. In case bulls are not active there, the optimal scenario will be long positions for a rebound from 1.2974, or from a new low of this month – 1.2950, based on an upward correction of 25-30 points within the day. An equally important task for bulls will be growth and consolidation above the resistance of 1.3048. Only a breakthrough and a reverse test of this level from top to bottom will provide a buy signal based on the pound's recovery to the area of 1.3072, where the moving averages are playing on the bears' side. This will be enough to reverse the downward trend in the pound and lock the pair in the horizontal channel. A breakthrough of 1.3072 will open a direct road to 1.3096 and 1.3122, where I recommend taking profits.

To open short positions on GBP/USD, you need:

This morning, the bears have already failed the pound quite strongly and are in full control of the market. Given the current economic situation, it is unlikely that we can count on a large growth of the pair in the near future. Today I'm betting again on low trading volume and weak volatility, so it's best not to rush into short positions. I advise you to wait for the return and the formation of a false breakout in the area of the nearest resistance level of 1.3048. While maintaining the pressure on the pound, the bears will need to try very hard to achieve a consolidation below 1.3019. It is not yet known whether there will be those willing to continue selling at current lows today or not. Only a breakout and a reverse test from the bottom up of 1.3019 will provide a signal to open short positions in the continuation of the downward trend with an exit at 1.2992. A breakdown of this range will also lead to forming another sell signal that can return the pound to the lows: 1.2974 and 1.2950, where I recommend taking profits. In case GBP/USD grows and lack of activity around 1.3048, bulls may try to pull the market to their side. Therefore, I advise you to postpone short positions to a larger resistance of 1.3072, below which the moving averages pass. I also advise you to open short positions there only in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from the high of 1.3096, counting on the pair's rebound down by 30-35 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for April 5 logged an increase in both short and long positions. However, there were more of the first ones, which once again led to an increase in the negative delta. Fears related to the state of the UK economy and the risks of high inflation, which is sure to further exacerbate the ongoing crisis of British households, have been confirmed. Recent GDP data indicated a very sharp slowdown in economic growth. Experts note that the situation will only worsen, as inflation risks are now quite difficult to assess, but it is clear for sure that the consumer price index will continue to grow in the coming months. At the same time, the soft position of the governor of the Bank of England will only push prices up. The only thing the bulls can count on now is the positive results of the negotiations between the representatives of Russia and Ukraine and progress towards a settlement of the conflict. Do not forget about the aggressive policy of the Federal Reserve, which is becoming more hawkish every day. In the US, there are no such problems with the economy as in the UK, so there the Fed can raise rates more actively, which it is going to do during the May meeting – another signal towards selling the pound against the US dollar. The COT report for April 5 indicated that long non-commercial positions rose from the level of 30,624 to the level of 35,873, while short non-commercial positions jumped from the level of 70,694 to the level of 77,631. This led to an increase in the negative value of the non-commercial net position from -40,070 to -41,758. The weekly closing price rose to 1.3112 against 1.3099.

Indicator signals:

Trading is conducted in below 30 and 50 moving averages, which indicates a difficult situation in the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator around 1.3080 will act as resistance. If the pound falls, the lower border of the indicator in the area of 1.3015 will provide support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.