European banks are closed for Easter Monday, so the first data that can increase volatility will appear only with the opening of markets in the US.

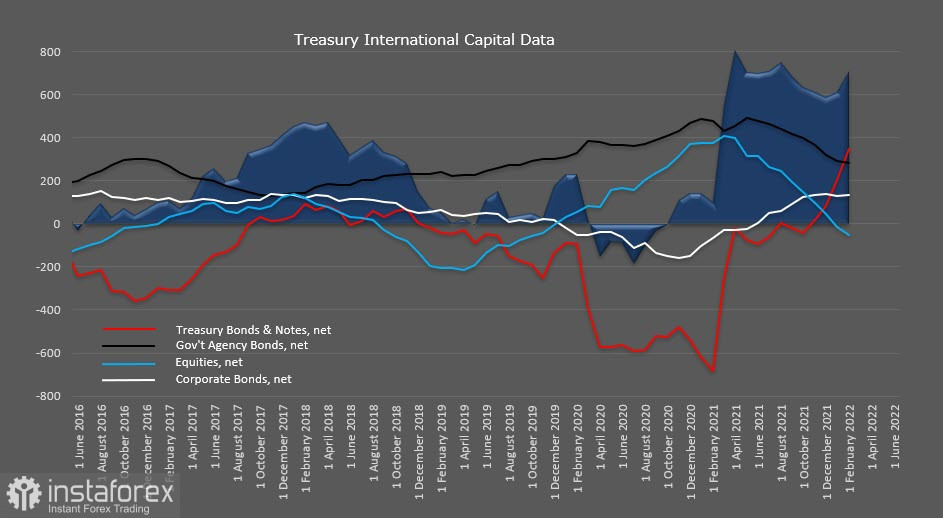

The Treasury's report on the inflow of foreign capital into US securities published on Friday showed an increase in the trends that emerged at the end of 2021. Firstly, foreign investors are actively exiting stocks, this exit began a year ago. In January it crossed the zero mark and went into negative territory, in February the accumulated total for 12 months amounted to -54.1 billion, that is, the collapse of the stock bubble is getting closer.

Secondly, the dynamics of bonds of state agencies and corporate bonds have not yet received a clear direction, capital inflows remain, but after the failure in 2021, a very strong inflow is observed in the treasury. It is obvious that the beginning of the military operation in Ukraine and the obvious deterioration of financial conditions in Europe will increase the flow of capital from Europe to the United States, which will give the Fed the necessary resource to try to control inflation.

The CFTC report confirmed the development of the current trend, a slight improvement in the Australian and Canadian dollars gives them a chance to resume growth, especially in crosses against the yen and franc, capital inflows into the US dollar remain the dominant factor in the foreign exchange market.

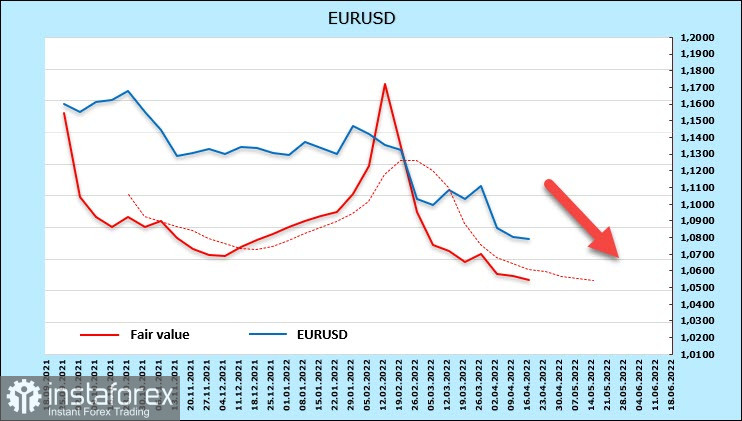

EURUSD

The ECB meeting last week did not add any new information to the forecasts for the euro. The decisions made 5 weeks prior have been generally confirmed, the purchases of the APP will be adjusted in the amount of 40 billion euros/30 billion euros/20 billion euros in April/May/June, respectively, and net purchases will be completed in the third quarter.

ECB President Christine Lagarde said that the ECB has no intention to accelerate the tightening of monetary policy, as concerns about a slowdown in economic activity at the current stage outweigh concerns about rapidly rising inflation. Here, it is necessary to bear in mind the possibility of abandoning energy carriers from Russia in order to persuade the Russian leadership to return gas trade on the same terms, or provoke a default against the background of economic and political costs associated with conducting a special military operation in Ukraine. The probability that Russia will make concessions seems low, but the lack of clear plans to normalize financial conditions may well turn the euro sideways.

The net long position on the euro, as follows from the CFTC report, increased slightly during the reporting week. However, the rapid growth of yields in the US does not give grounds to count on the growth of the euro, the estimated price is lower than the long-term average and is directed downward.

The bearish momentum remains strong, thus, the fall will likely continue. The immediate target of 1.0637 remains relevant, while the long-term target is 1.0320.

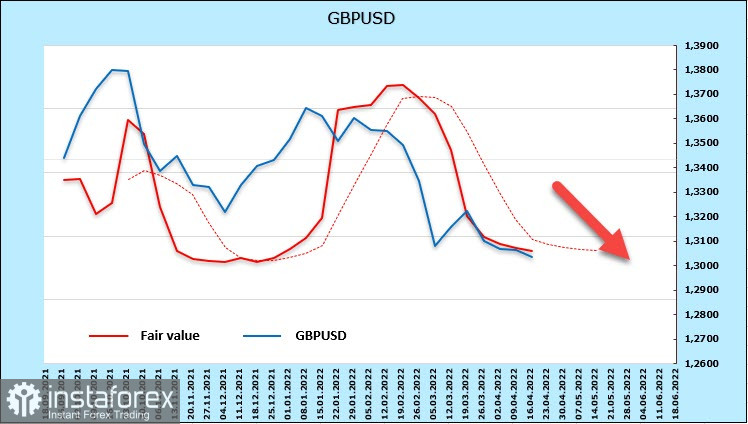

GBPUSD

Consumer inflation rose to 7% YoY in March, which is higher than February's 6.2% and forecasts. If such rates (+1.1% MoM) had been maintained for 12 months in a row, then inflation would have increased by 14% YoY.

Thus, inflation in the UK is accelerating. The military operation in Ukraine will accelerate inflationary processes, since wheat and fertilizers will inevitably rise in price, which means that food in general, electronics (neon shortage is expected in April), metals (gold, nickel, palladium, copper, aluminum), as well as the entire energy sector as a whole.

The National Institute of Economic and Social Research (NIESR), analyzing inflationary processes in the UK, draws attention to the fact that linking energy payments to the ruble and the ruble to gold can lead to a strengthening of the ruble and an additional increase in energy prices. NIESR sees the danger of inflation rising to 9.8% by the end of the year.

The estimated price remains below the long-term average, there are no fundamental reasons to expect a reversal of the pound upward.

We assume that the low of 1.2971 will be updated in the near future, the long-term target of 1.2650/80 remains relevant.