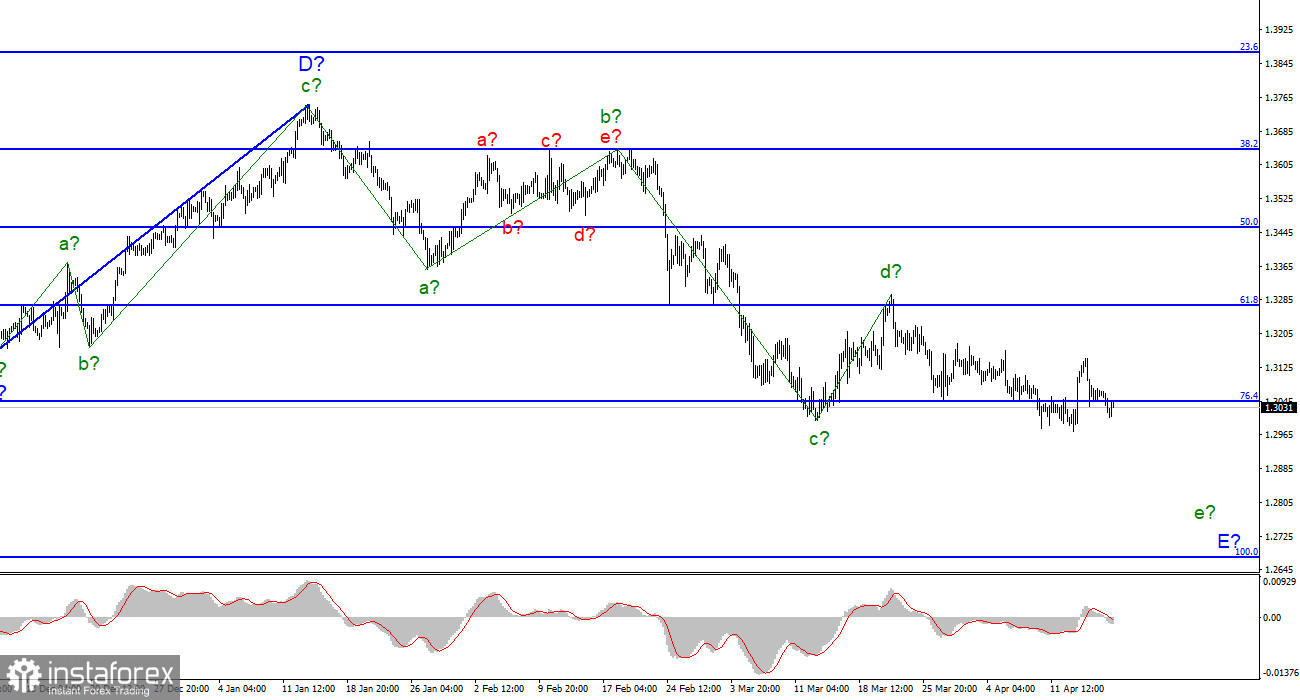

For the pound/dollar instrument, the wave markup continues to look very convincing, even taking into account the strong growth last Wednesday. The assumed wave d-E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time within the wave e-E. An unsuccessful attempt to break through the low wave c-E did not allow the market to continue selling the instrument. Near this mark, the instrument turned sharply upwards and began a powerful increase, which also quickly ended. Thus, the wave e-E should be more extended than it is now. Since the low of the supposed wave c-E is still broken, then theoretically the wave e-E can end at any moment. However, I still expect that the decline in the British dollar within this wave will be much stronger, given the current situation in Ukraine and the economic background in the UK, USA, and Europe. In general, the wave pattern still looks very organic. I am not considering alternative options yet.

Britain: gas to the European Union, weapons to Ukraine

The exchange rate of the pound/dollar instrument on April 18 decreased by literally 10 basis points, although the activity of traders during the day was not too weak. Let me remind you that today is Easter Monday, so the market is working half-heartedly. Nevertheless, on the approach to two or three of its previous low, the instrument was again unable to continue the decline. The Briton has been standing on the edge of the abyss for more than a week, and it seems that any push will send it into a new prolonged fall. The supposed wave e-E can end at any moment. I could have, if not for geopolitics and politics. With geopolitics, everything is more or less clear. The UK takes the toughest position against Russia, has already imposed all the sanctions that could be imposed, and has declared its readiness to supply its own and transit gas to the European Union to rid it of energy dependence on the Russian Federation. In addition, the UK continues to pump Ukraine with weapons. If at the beginning of the confrontation it was only about defensive weapons, now Britain and the United States have started supplying heavy weapons and aircraft to Ukraine. Thus, the Ukrainian-Russian conflict, no matter which side is involved in it, will probably drag on for at least another few months. The longer it drags on and the more it flares up, the more chances there are of a new decline in demand for the British.

Meanwhile, military analysts are also waiting for serious actions by Moscow against countries that help Ukraine. In particular, Western experts admit that Moscow may launch a preemptive nuclear strike on one of the NATO member countries, may try to bomb convoys with military assistance, may try to inflame the situation on the Russian-Finnish border to provoke NATO to take the first step. I do not believe that such steps are possible, but it is impossible to completely exclude them. Nevertheless, the NATO-Russia clash is not needed by anyone, because it will be a world war. But the conflict in Ukraine is no longer a conflict between Ukraine and Russia, it is a conflict between Ukraine + Europe + the USA + a dozen more countries against Russia.

General conclusions

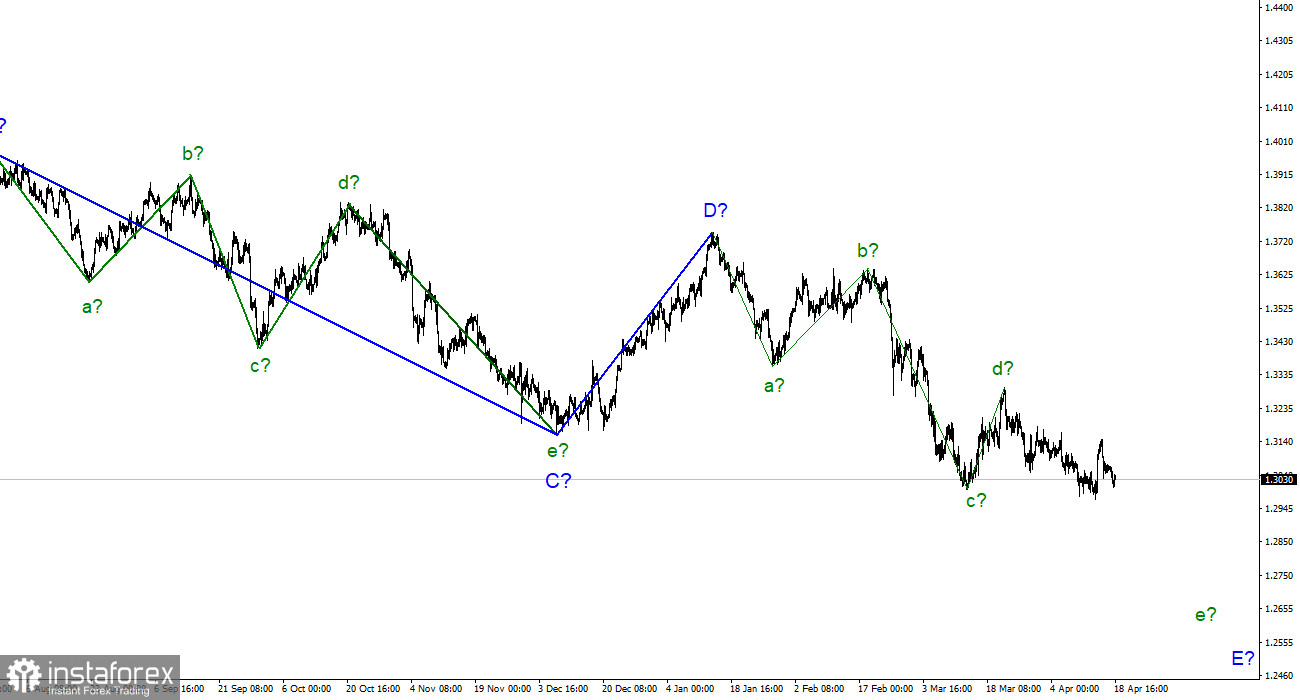

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave e-E does not look fully equipped yet. Maybe this wave won't be too long, but it doesn't look complete right now.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the quotes of the British near the 27th figure.