The EUR/USD currency pair continued to move down smoothly on Monday. Recall that last Friday the pair set an anti-record of volatility, and on Monday it continued to move very sluggishly and weakly. Nevertheless, even with such a sluggish movement, a downward trend is visible. Last week, despite the upward jerk on Wednesday evening, the pair failed to gain a foothold above the moving average line, so all trend indicators of the Linear Regression Channels system continue to indicate a downward trend. Consequently, the European currency now has no grounds for growth, even technical ones. We have already talked about macroeconomic, geopolitical, and fundamental foundations more than once, they simply do not change and cannot change in a day or two. Thus, there is nothing else to wait for now, except for the continuation of the fall of the European currency. We could now once again report that there is a gap between the monetary approaches of the Fed and the ECB at this time, that the dollar is in demand based on its status as a "reserve" currency, but all this has long been known to traders. Therefore, let's take a closer look at geopolitics today and understand what to expect from the Ukrainian-Russian conflict in the coming weeks.

Negotiations between Ukraine and Russia were initially doomed to failure.

Military operations have been going on between Ukraine and Russia for almost 2 months. Maybe it's Russia conducting a "special operation" in Ukraine, but Ukraine is desperately defending its territories. 2 months after the start of this conflict, it is safe to say that all of Moscow's goals have not been fulfilled. Recall that in February, both in Moscow and in the West, they declared publicly that Kyiv could be captured in three days. And the entire military operation will take a maximum of two weeks. As you can see, these forecasts turned out to be akin to forecasts for the future value of bitcoin. At the moment, we can assume that Russian troops occupied only Kherson and Mariupol. Moreover, fighting continues in Mariupol, and Ukrainian rallies of civilians take place in Kherson every other day. Rocket attacks continue throughout Ukraine, but now we will focus on something else.

What hypothetical way of this conflict can be? Kyiv wants to live its own life, and not be an appendage of Russia. Ukraine has long chosen the "European" path of development, and whether it is good or bad is the choice of the whole people, and Vladimir Zelensky is the legitimate, world-recognized president of Ukraine. Thus, the Ukrainian people have the right to independently decide their fate and determine the path of their development. The Kremlin, it seems, does not believe that Ukrainians should have the right to choose, and also does not want NATO military bases on the territory of Ukraine. However, this is exactly what Russia can get in the end, since Finland and Sweden want to join NATO this summer, which means that US military bases can be located just 200 km from St. Petersburg. It is unlikely that the Kremlin will want to conduct another "special operation" now in Finland.

NATO has already officially stated that they will not take Ukraine there in the coming years, and in Kyiv, they said that NATO should ask them to join them, and not vice versa. Then why does the conflict continue at all, if Ukraine will not be in NATO? From our point of view, the NATO issue is just a screen. Moscow wants to have control over Ukraine, so the military "special operation" continues, which now has the goal of occupying as much territory of the neighboring state as possible. As it was with Donbas. Of course, you can hold as many referendums as you want among the local population, but imagine if the States send troops to Mexico and start holding referendums there for joining themselves as the 52nd state. So you can attach absolutely any state to anything, the main thing is to introduce troops. Based on all of the above, the key point of this conflict remains the Ukrainian territory. Kyiv will not give up its land, especially with the strongest support of the European Union and the States. He will not give up Crimea and Donbas. Moscow will not give up these territories either. Consequently, this conflict will persist until the complete defeat of one of the parties or until the change of power in Ukraine or Russia.

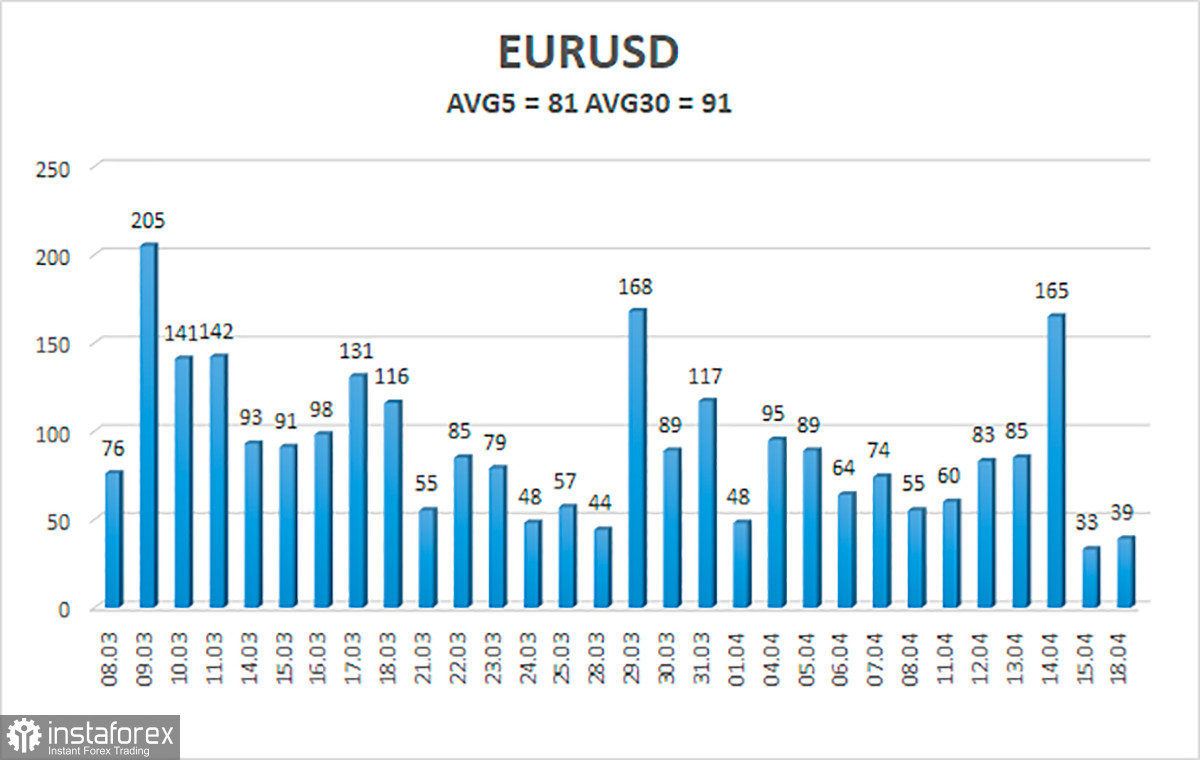

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 19 is 81 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0710 and 1.0872. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now it is necessary to stay in short positions with targets of 1.0742 and 1.0710 until the Heiken Ashi indicator turns upwards. Long positions should be opened with a target of 1.0986 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.