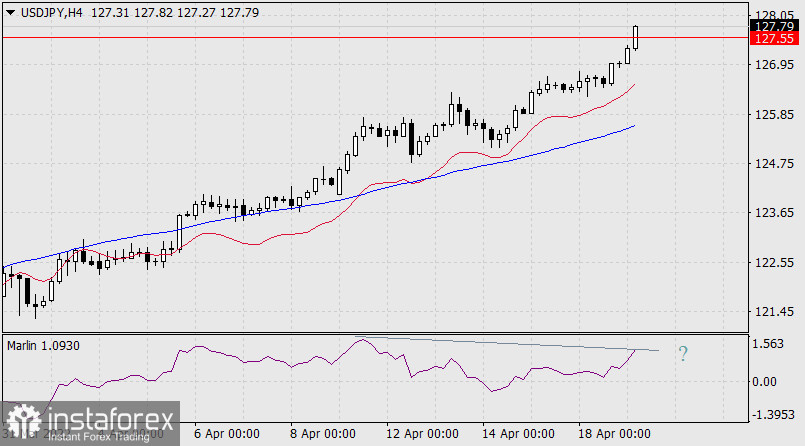

The dollar's growth against the yen played out in earnest. After 13 days of continuous growth, this morning the price reached our target level (127.55) set at the May 1997 high. At the same time, the embedded weekly green price channel line was also reached. The bears' next target may be the next price channel line around 129.12, but the price has little chance of reaching it. The main technical reason for this is the price divergence with the Marlin Oscillator that has been forming for a week now. Today, the bears have a good opportunity to realize themselves by reversing the price from the achieved resistances. Their main task is to consolidate the divergence, which takes 2-3 days. If a reversal does not occur today, then it may be a little later, in the range of 127.55-129.12, that is, we will see a false price exit above the current resistance.

On the four-hour scale, there is a similar price increase with a ripe condition for the formation of a divergence. It remains only to wait for developments. It is not advisable to open trading positions in any direction in the current situation.