Last night, the number one cryptocurrency managed to recover above $40k after retesting the support area at $37.2k-$38.4k. Thanks to a strong rebound, the asset avoided massive profit-taking that was about to start at any moment. However, there is another side of this recovery. By performing a rebound yesterday, Bitcoin broke the correlation with the stock market. At the current stage, this looks like a temporary change in the trend, but on a larger scale, this could mean a change in the investment strategy on cryptocurrencies.

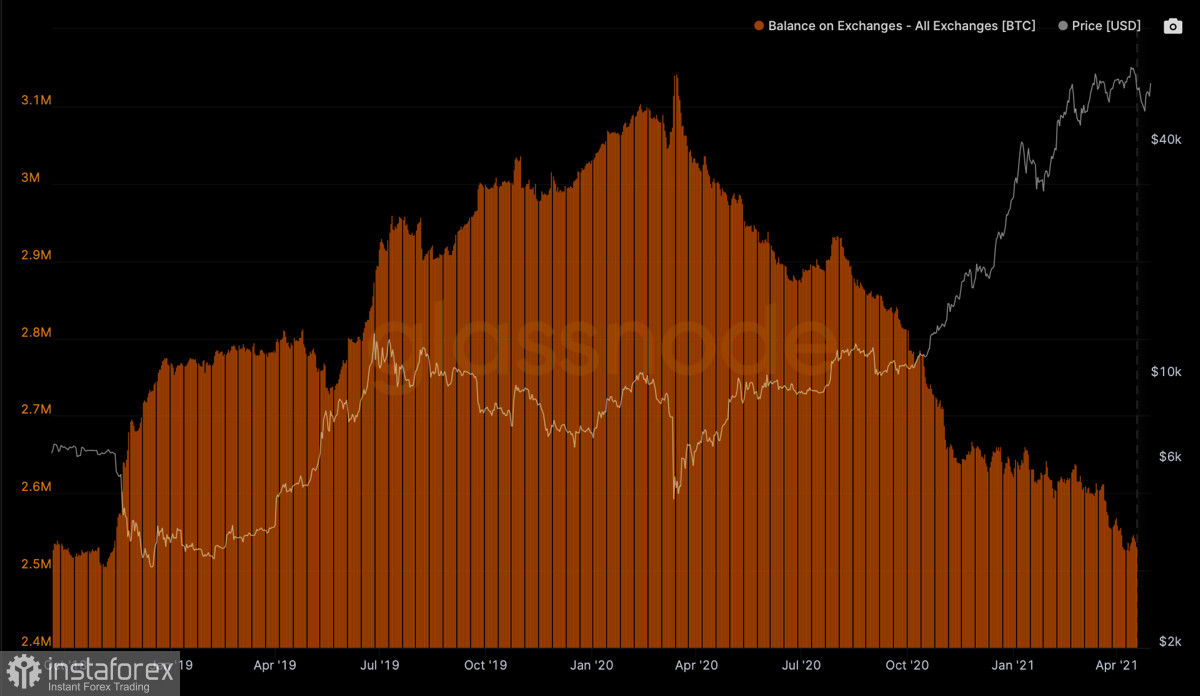

While Bitcoin was recovering above $40k, SPX formed a weak doji candlestick and did not move from there. Yet, Bitcoin's correlation with the NASDAQ index turned out to be stronger as both assets rebounded. This can be an indication that the correlation between BTC and the stock market is getting weaker. Institutional investors are buying up cryptocurrencies, and the number of coins held on exchanges has declined to a 4-year low. It is very likely that the current rebound served as a protection for the investments of large investors.

If BTC continues its upward movement in the near future, the correlation with stock indices is likely to weaken further. First of all, this will be due to the growing deficit of the asset. The supply of BTC coins on exchanges keeps declining, which indicates a massive phase of accumulation. Therefore, if the price continues to rise due to the volumes provided by institutional investors, the approach to BTC may significantly change.

The program of quantitative easing starts as soon as this May, promising a significant decrease in the market liquidity. Big capital is looking for alternatives, which is why gold has already reached the bottom of the March high. In this light, cryptocurrencies can compete with precious metals and consumer goods thanks to the combination of high profitability and a hedging function. Since there is no rigid state regulation of the crypto industry, the combination of these two factors can attract new institutional investors.

Big companies are the ones to contribute to the deficit of the asset in the market. Now Bitcoin needs to develop a bullish trend or recover to the area of $45k-$48k. In this case, interest in BTC as a hedge against inflation and a highly profitable instrument will increase significantly. The next week will show whether the market is ready to develop a proper rebound or whether the price will again get stuck in the range of $37k-$42k.

At the moment, the market confidence in the cryptocurrency as a hedge against the Fed's aggressive steps is rather low. The asset recovered to the $40.5k level, but investors did not support the upward momentum. Technical indicators turned sideways, confirming the weakness of the upside movement.

Strong rebounds of the price are observed only near the key support levels although they do not transform into a short-term or a medium-term trend. Some market players are capable of pushing the price to the range of $45k-$48k. But ahead of the liquidity squeeze in May, investors are acting cautiously and hesitating to develop a bullish rally in Bitcoin.