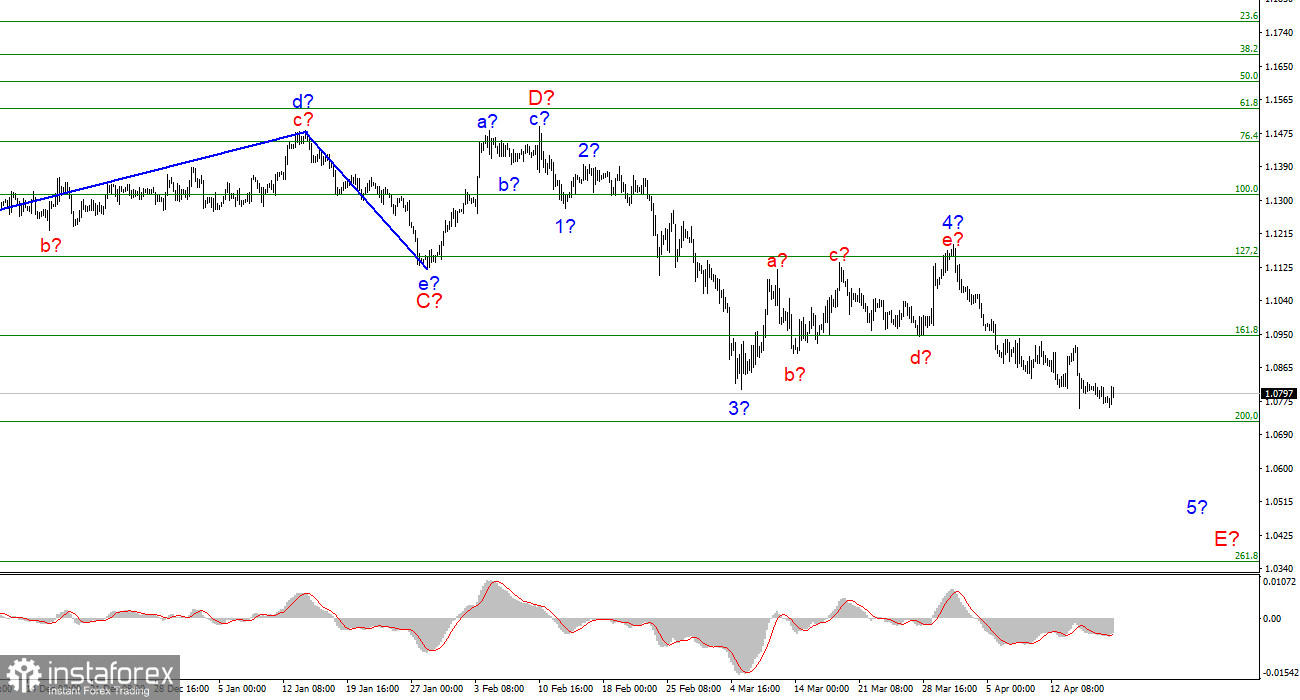

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not change at all. The intended wave 4 has already been completed, the tool continues to build wave 5-E. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since the wave may turn out to be a very long, five-wave in its internal structure. It may also turn out to be shortened, but so far wave E cannot be considered complete, since its internal wave structure does not give grounds for such conclusions. Thus, the instrument still has the potential to decrease. The first target is around 1.0721, which equates to 200.0% Fibonacci. An unsuccessful attempt to break through this mark may lead to a departure of quotes from the achieved low and the construction of an internal corrective wave consisting of 5-E. At the same time, much for the instrument in the coming weeks will depend not only on the economy but also on geopolitics, gas and oil prices, and new sanctions against Russia by the United States and the European Union.

The active phase of the military conflict between Ukraine and Russia may end within a week or two.

The euro/dollar instrument rose by 10 basis points during the day on Tuesday. Thus, the European currency has managed without serious losses today, but at the same time, the demand for it remains very low. A new phase of the military operation has begun in Donbas. This was stated by Aleksey Arestovich and Vladimir Zelensky in Kyiv and Sergey Lavrov and Dmitry Peskov in Moscow. Both sides agree on the fact that this battle will be decisive. Although Ukraine will not join NATO in the coming years, Moscow wants to continue the "special operation" and expand the borders of the LPR and DPR as much as possible and calls this goal "the goal of the entire operation in Ukraine", although a couple of weeks ago it was going to "denazify" and "demilitarize" the whole of Ukraine, and also to displace the current government of this country. But after the failure of military operations near Kyiv, Chernihiv, and Sumy, which were disguised as a voluntary withdrawal of troops to advance peace negotiations, it became clear that no "denazification" of a 40-million-strong country through a 200-thousand-strong army would be possible. Therefore, the Kremlin decided to focus on the LPR and the DPR.

According to military analysts, the grouping of Russian troops, which is now concentrated in the East of Ukraine, can move deep into the country, but it is unlikely to be very deep. Forces, weapons, and reserves will be enough for one or two weeks of active military operations. After that, the Russian army will have to dig in the occupied territories and hold the defense, as it was in the Donbas in 2014. There are no more military reserves in Russia. At least, those that could be sent to Ukraine. After all, we should not forget that Russia is a huge country with a long border. And all borders should be guarded. You can't just take and transfer all the parts, and equipment from all over Russia to Ukraine. The group that is capable of attacking in the Donbas will not be enough for constant attacks, pressure, and advancement, but the fighting in the coming weeks will be fierce. However, after two weeks, the active phase may end for several months or years. In this case, the euro and the pound will breathe more calmly.

General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". In the next few days, an internal correction wave of 5-E may be built, after which I expect a new decline in the instrument.

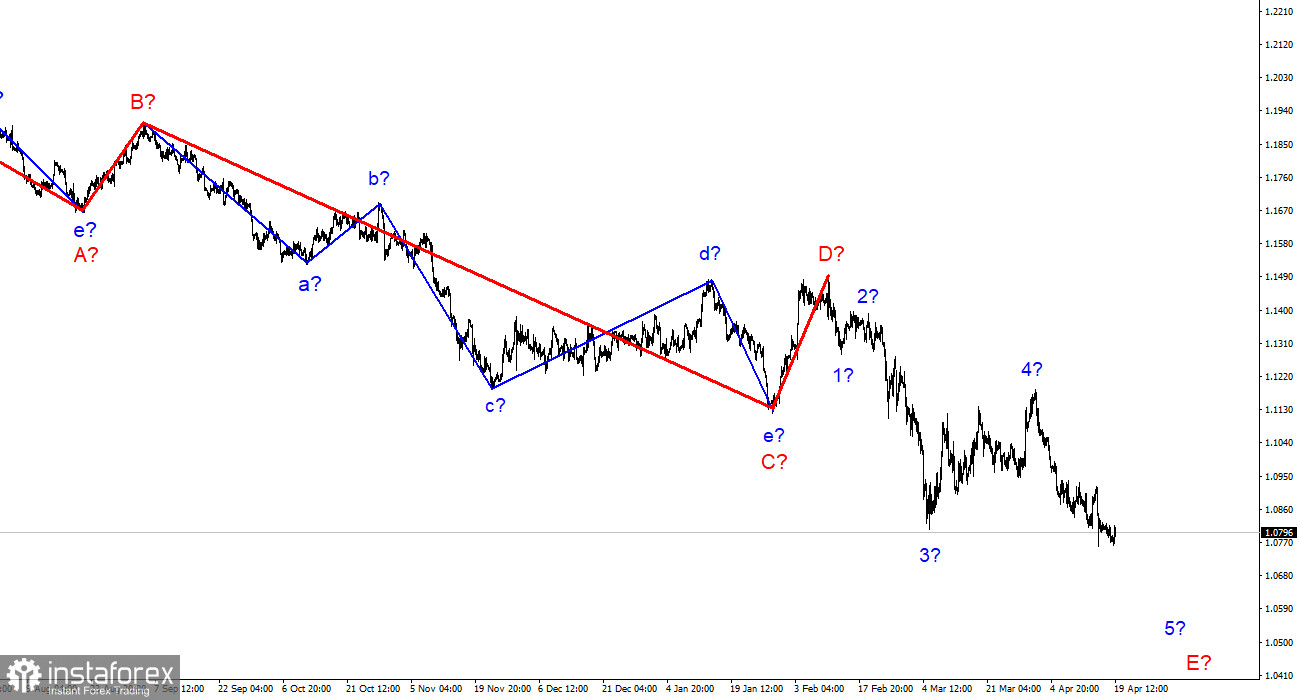

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.