Analysis of Tuesday's trades:

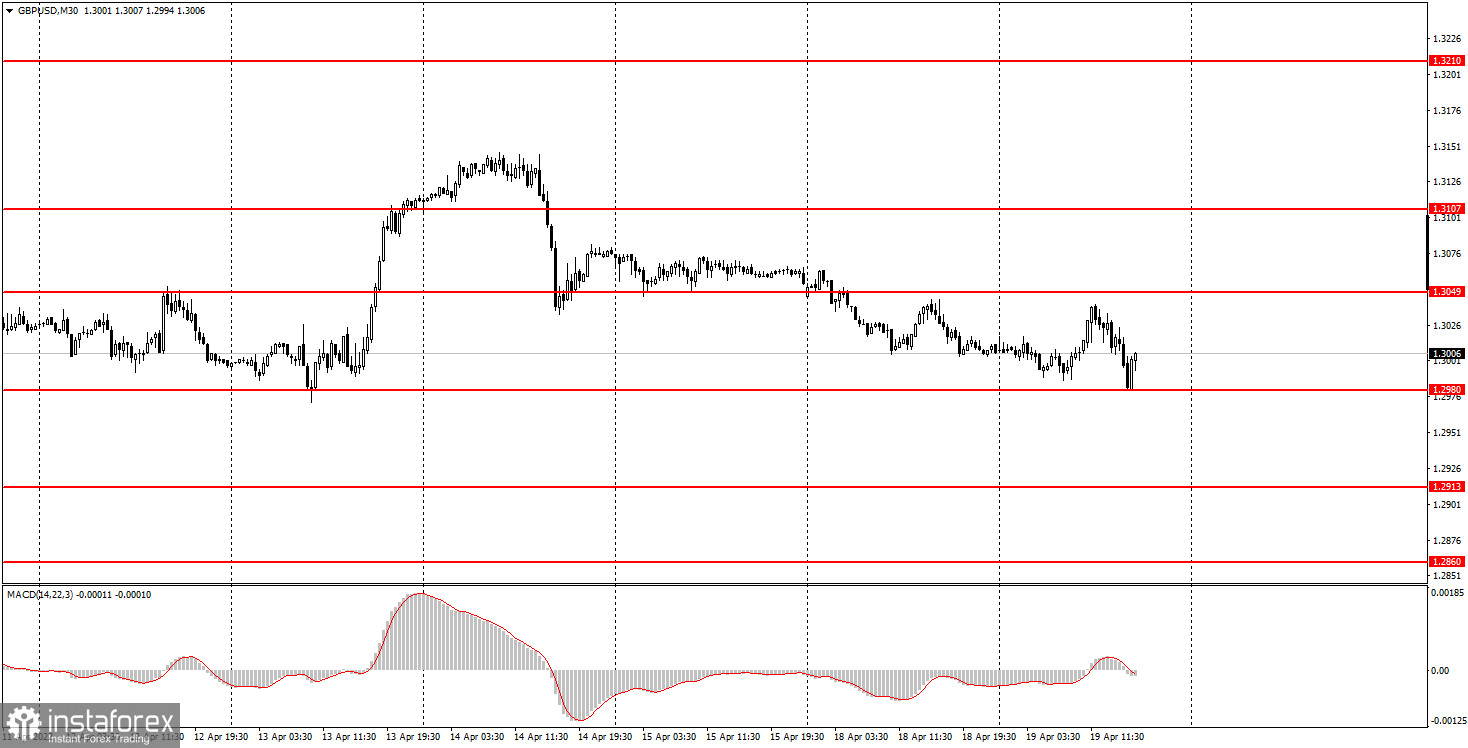

30M chart of GBP/USD

On Tuesday, GBP/USD returned to its swing 15-month low of 1.2980. It is a strong level, and the price has rebounded from it at least three times. However, the quote will break the barrier sooner or later. No important macro events unfolded in the United Kingdom and the United States on Tuesday. Nevertheless, traders find any excuse to sell the pound every day. At the same time, they do not find any reason to buy it. The geopolitical situation in Ukraine remains very tense. Experts say the military action in the Donbas will continue in the coming weeks, which means new destructions and new deaths among civilians and troops. In light of increasing geopolitical developments, demand for risk assets, including EUR and GBP, will decrease.

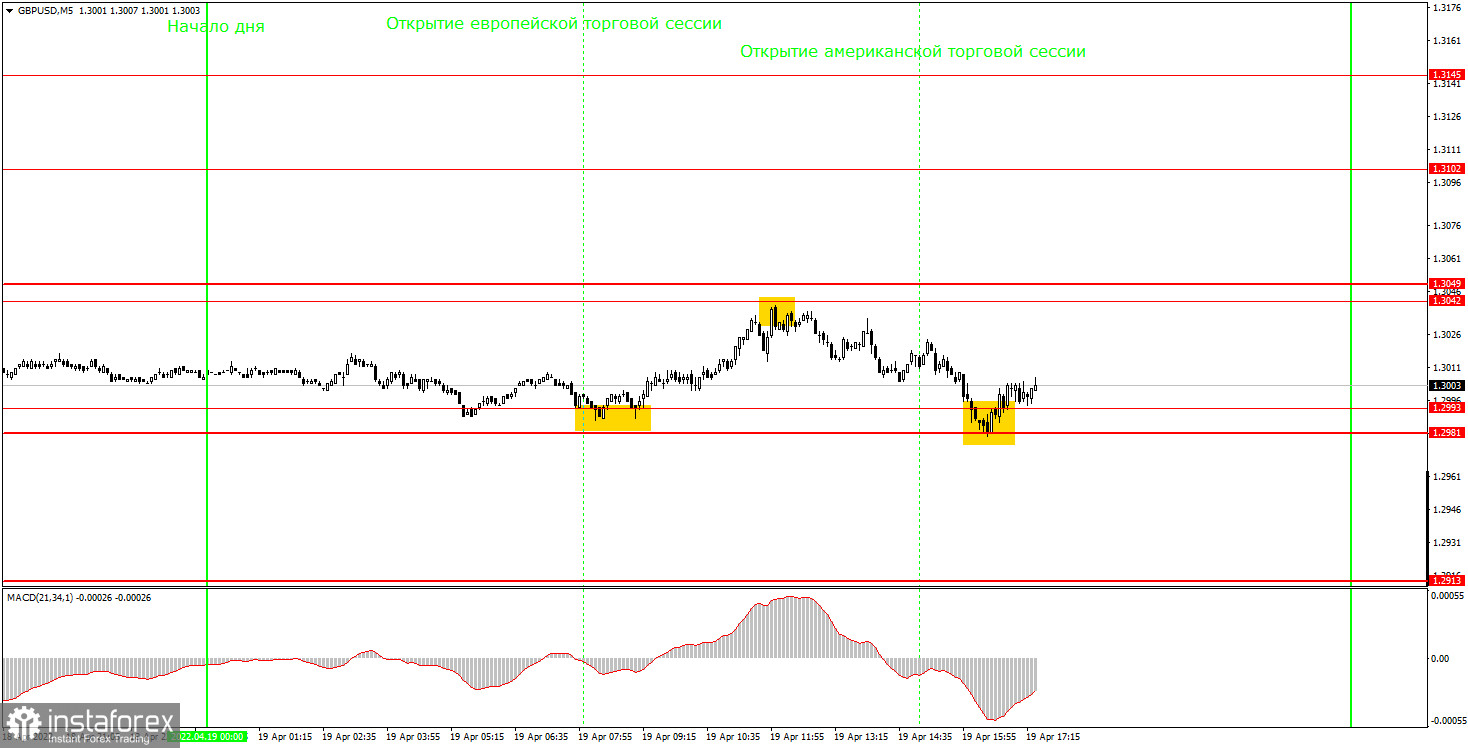

5M chart of GBP/USD

In the 5M time frame, the pound kept trading sideways on Tuesday. At least three trading signals were created with the two of them being good enough. As soon as the European session opened, the quote rebounded from 1.2993 and went up to the upper limit of the channel at 1.3042. However, it failed to reach it and stopped 2 pips below the level. That move should have been interpreted as a sell signal. Consequently, the first buy trade could have brought a profit of about 25 pips. After a sell signal had been made, a short position should have been opened. The price then returned to 1.2993. Generally speaking, beginner traders could have additionally yielded a 25 pips profit. The third signal to buy the instrument was made near the 1.2981-1.2993 range. Yet, it was a false one because the pair failed to rise to 1.3042. So, positions should have been closed manually by the end of the day. It was an unprofitable signal. It brought absolutely no profit because the pair had failed to consolidate below 1.2981 by that time.

Trading plan for Wednesday:

In the 30M time frame, the pound keeps trading in accordance with its own rules and logic. The pair either shows strong movements or trades sideways. One way or another, the bearish trend continues. Therefore, we may expect the pound to break through 1.2980 and go further down. On Wednesday, the target levels in the 5M time frame are seen at 1.2913, 1.2981-1.2993, 1.3042-1.3049, 1.3102, 1.3145. A stop-loss order should be set at the breakeven point as soon as the price passes 20 pips in the right direction after a trade has been opened. The macroeconomic calendar in the UK and the US will not contain any important releases on Wednesday. A report of secondary importance, the Beige Book, will be published in the US. In other words, we may not expect volatility to increase. Nevertheless, should bears break through the 1.2980 mark, the downtrend would get deeper.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to the Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or produce no signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.