The EUR/USD currency pair on Tuesday came close to the Murray level of "0/8" - 1.0742. Thus, only about 100 points remain before the 5-year lows, which are located near the level of 1.0636. The pair continues to fall almost every day. Although it is not strong, nevertheless, if the pair loses even 10-20 points, but every day, it means that it falls by 300 points per month, which is quite a lot. And the European currency now, in any case, has no other option but to continue falling. During the first two trading days of the week, the situation in the world, in Ukraine, in economic and geopolitical terms has not changed in any way. The "battle for Donbas" has begun in Ukraine, which, according to many military experts, will decide the fate of this conflict. There are two options for the outcome of this battle. The first is that Russia will be able to seize a significant part of Eastern Ukraine and in this case, will receive a new trump card in peace negotiations with Kyiv. The second is that Russia will not be able to seize a single new square kilometer of Ukrainian land, so the conflict will be frozen for many years, as the conflict in the Donbas was frozen at one time.

Many experts believe that in the coming weeks Russia will completely exhaust its military reserves, so it will simply lose the opportunity to continue advancing on Ukraine. It can continue to bombard large Ukrainian cities with missiles, but there will be no land offensive. At the same time, Ukraine continues to receive powerful weapons from Western countries in almost unlimited quantities. In the States, the lend-lease law was adopted, which allows, bypassing the bureaucracy in Congress and the Senate, to provide Ukraine with any weapons in any volume, and to calculate their cost, make mutual settlements, and so on, after the end of this conflict. Thus, it is becoming more and more difficult to carry out this "special operation" every day, which still gives hope for the completion of the active phase of this conflict in a month and a half. This does not mean that the conflict itself will be over, but at least active clashes between the Ukrainian and Russian armies will end.

The United States is going to supply oil and gas to Europe.

Meanwhile, the whole world is slowly beginning to understand and fully realize that the Ukrainian-Russian conflict is not only a problem for Ukraine and Russia. Recall that Ukraine and Russia feed most of Europe, Africa, and Asia. At least, food supplies to these regions are very large. Now the export of goods from Ukraine can be significantly reduced, and it will be much more difficult to make up for it than oil if the import of hydrocarbons from the Russian Federation is refused. In any case, oil is oil, but the food is still the primary need of any person. It has already been estimated in Europe that the harvest of cereals, vegetables, and fruits in Ukraine in 2022 may decrease by 25-50%. And this is provided that the military conflict now does not go beyond the borders of Eastern Ukraine. And supplies from Russia may decrease significantly due to sanctions.

Thus, Europe is interested in the speedy end of this conflict, not only because military actions are taking place almost on its porch. In this situation, of course, it is better to provide Ukraine with any weapons that increase its chances of defending its territory than to deal with Ukraine as part of the Russian Federation later, when it will have to negotiate everything with the Kremlin again. And now we will have to sit not only on the "oil and gas needle" of Russia but at the same time on the "food needle". Thus, the actions of the European Union are logical. The US actions are even more logical since any war weakens all its participants. Since the Russian Federation remains one of the two main opponents of the United States on the world stage, any large-scale war in which the Russian Federation participates is very good for the United States. Not to mention the fact that the States will benefit from any war financially, as it was during the Second World War. Washington is already preparing to export LNG to Europe, and President Biden has lifted the moratorium on the development of oil fields. Therefore, the United States will increase oil production to possibly replace Russian oil on the European market.

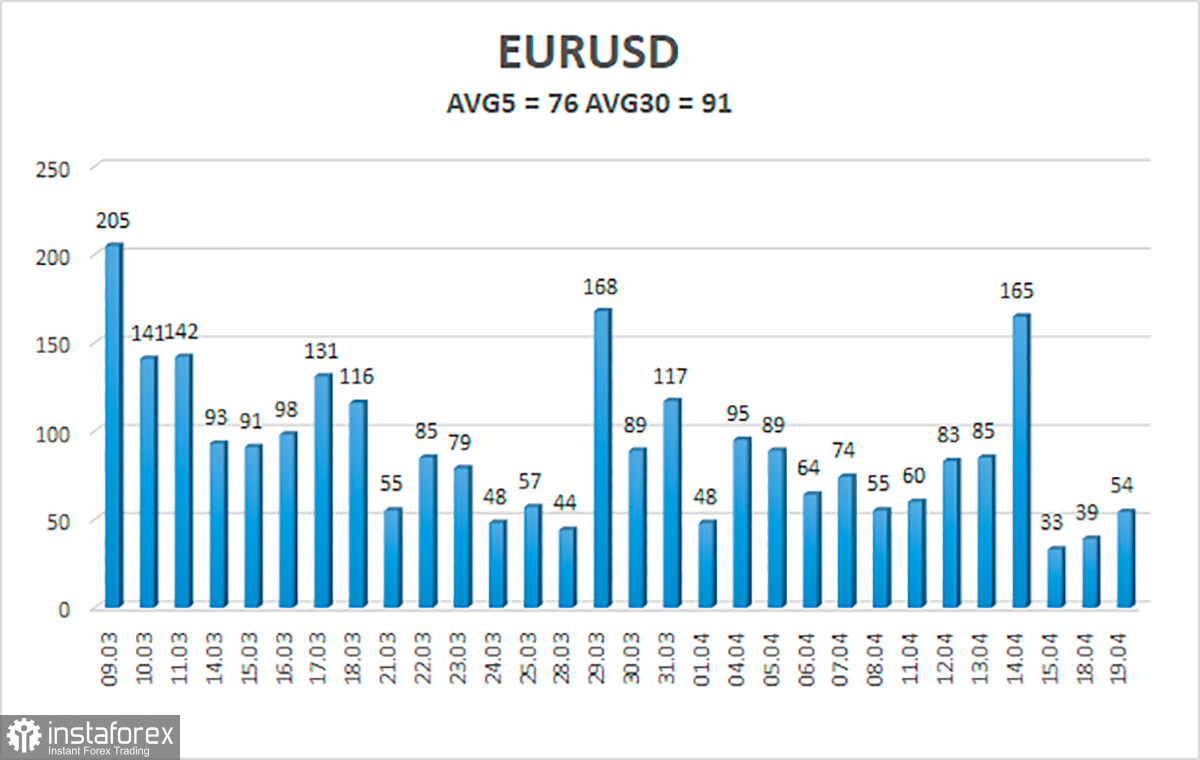

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 20 is 76 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0710 and 1.0866. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1,0742

S2 – 1,0620

S3 – 1,0498

Nearest resistance levels:

R1 – 1,0864

R2 – 1,0986

R3 – 1,1108

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now it is necessary to stay in short positions with targets of 1.0742 and 1.0710. Long positions should be opened with a target of 1.0986 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.