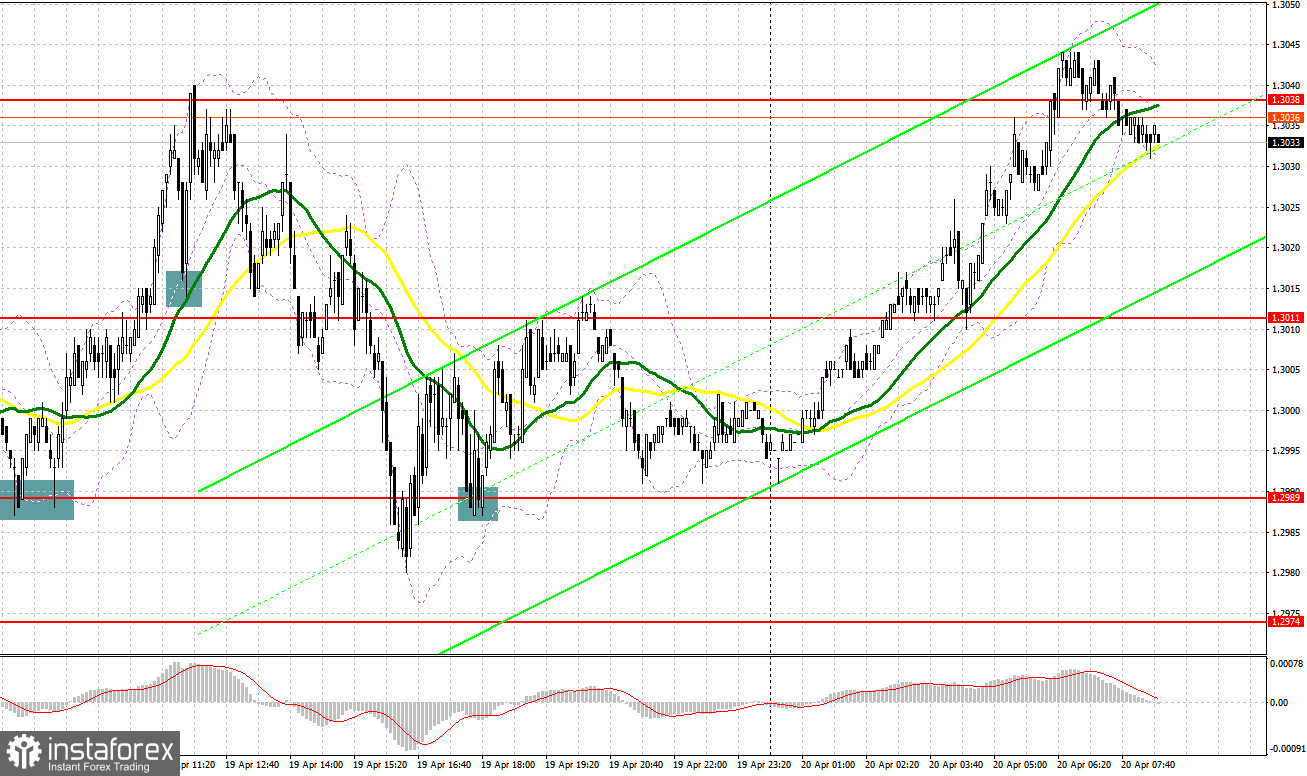

Yesterday, quite a lot of market entry signals were formed, which made it possible to earn. Let's take a look at the 5-minute chart and see what happened. In my morning forecast, I paid attention to the 1.2991 level and advised you to make decisions on entering the market from it. A false breakout at 1.2991 at the beginning of the European session, and then another failed attempt by the bears to move lower - all this resulted in creating two excellent signals to buy the pound in anticipation of a move up to 1.3016, which was not long in coming. A breakthrough and consolidation above this range formed another buy signal, as a result of which the pound went up about 25 more points and just barely missed 1.3042. In total, more than 50 points of profit could be taken from the 1.2991 level. The pound was under pressure in the afternoon, which led to a test and a false breakout of support at 1.2989. The signal to buy from this level made it possible to pull about 20 more points from the market, but this time it was not possible to rise above 1.3011.

To open long positions on GBP/USD, you need:

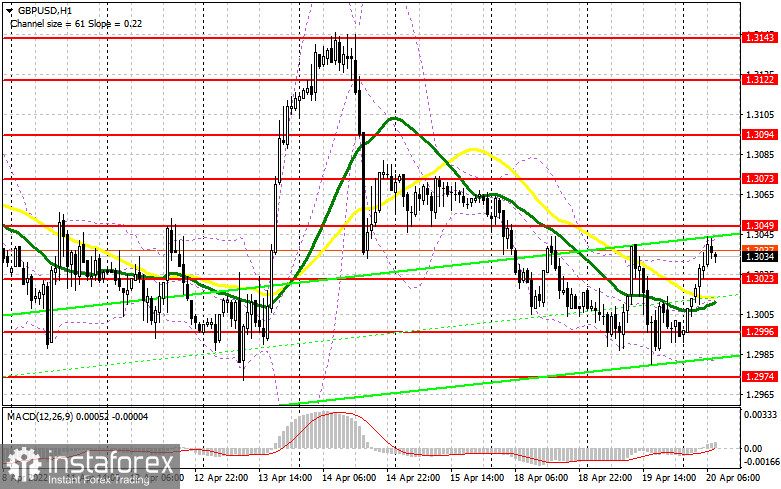

The pound rose very sharply during the Asian session, which led to a complete revision of the technical picture of the pair. There were no objective reasons for such a rapid upsurge, so it would be in vain to expect a continuation of the upward correction. We already faced such a sharp growth last week and I think everyone remembers what it led to. The pound will remain under pressure as long as trading is carried out within the horizontal channel. Today there are no statistics on the UK, which is undoubtedly a good thing for pound bulls, who are counting on the pair's growth during the European session. For this reason, the bulls have every chance of maintaining the nearest support of 1.3023, formed at the end of the Asian session. Of course, it would not be entirely correct to count on long positions from this level, since it is intermediate, so I advise you to open long positions there only after a false breakout. If people are not willing to buy the pound there, I advise you not to force things, and postpone entering the market until the larger support of 1.2996. Forming a false breakout there will provide a signal to buy the pound. If the bulls are not active there - the best scenario would be long positions for a rebound from 1.2974, or from this month's new low at 1.2950, based on an upward correction of 25-30 points within the day. An equally important task for today is to rise and consolidate above the resistance of 1.3049, before the test of which there was quite a bit lacking during the morning trading. Only a breakthrough and reverse test of this level from top to bottom will provide a signal to buy in anticipation of the restoration of the pound to the area of 1.3073. This will be enough to reverse the downward trend for the pound and more tightly lock the pair in the horizontal channel. A breakthrough of 1.3073 will open a direct road to 1.3094 and 1.3122, where I recommend taking profits.

To open short positions on GBP/USD, you need:

This morning the bears capitulated and now it's time for them to think about how to defend the rather important resistance at 1.3049. I advise you to wait for growth and a false breakout to form at this level, and only open short positions in the hope of resuming the bearish trend if these conditions are met. With the pound under pressure, the bears will have to work very hard to achieve consolidation below 1.3023. It is not yet known whether there will be those willing to sell at current levels in the first half of the day, so the emphasis will be placed more on the US session and on the release of a number of important statistics on the US. A breakthrough and reverse test from below 1.3023 will provide a signal to open short positions in the continuation of the downward trend with an exit to 1.2996 - slightly above this range are the moving averages, playing on the bulls' side. A breakdown of this area will also lead to forming another sell signal, which can return the pound to the lows: 1.2974 and 1.2950, where I recommend taking profits. With the GBP/USD growth scenario and lack of activity around 1.3049, the bulls may try to pull the market over to their side. Therefore, I advise you to postpone short positions until a larger resistance at 1.3073. I also advise you to open short positions there only in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from a high like 1.3094, counting on the pair's rebound down by 30-35 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for April 12 logged an increase in short positions and a reduction in long ones. All this once again confirmed the attitude of traders to the British economy, which is teetering on the brink of recession mixed with the highest inflation for a long period of time. The sharp rise in the consumer price index in March this year to another high of 7.0% once again proved the complexity of the situation in which the Bank of England (BoE) found itself, but the report on UK GDP, on the contrary, did not please traders much. The situation will only worsen, as future inflation risks are now quite difficult to assess due to the difficult geopolitical situation, but it is clear that the consumer price index will continue to grow in the coming months. At the same time, the soft position of the governor of BoE will push prices up. The pressure on the pound is also increasing due to the aggressive policy of the Federal Reserve, which is becoming more hawkish every day. In the US, there are no such problems with the economy as in the UK, so there the Fed can raise rates more actively, which it is going to do during the May meeting – another signal in the direction of selling the pound against the US dollar. The COT report for April 12 indicated that long non-commercial positions decreased from the level of 35,873 to the level of 35,514, while short non-commercial positions jumped from the level of 77,631 to the level of 88,568. This led to an increase in the negative value of the non-commercial net position from -41,758 to -53,054. The weekly closing price decreased from 1.3112 to 1.3022.

Indicator signals:

Trading is just above the 30 and 50-day moving averages, which indicates an attempt by the bulls to show their strength.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator around 1.3040 will act as resistance. If the pound falls, the lower border of the indicator in the area of 1.2980 will provide support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.