The US dollar is on the rise amid aggressive Fed rethoric and geopolitical uncertainty. However, the US currency is approaching its turning point, Jeffrey Gundlach, CEO of DoubleLine Capital said.

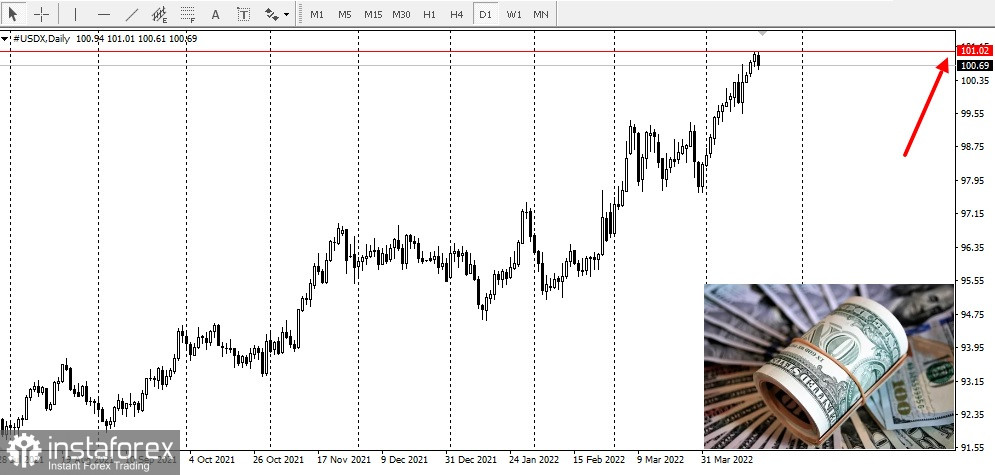

Renewed save-haven demand has boosted the world's reserve currency. The US dollar index (DXY) has reached a 2-year high, rising above 101. The DXY was last at 100.70.

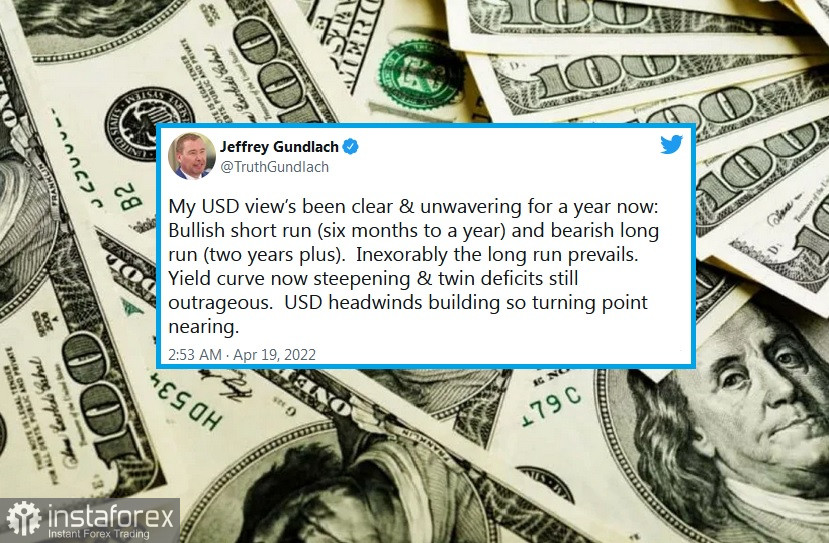

After seeing solid moves of USD, Gundlach reiterated his views that he is bullish on the dollar in the short term and steadfastly bearish in the long-run. He noted that the greenback's turning point is approaching.

After seeing solid moves of USD, Gundlach reiterated his views that he is bullish on the dollar in the short term and steadfastly bearish in the long-run. He noted that the greenback's turning point is approaching.

"My USD view's been clear & unwavering for a year now: Bullish short run (six months to a year) and bearish long run (two years plus). Inexorably the long run prevails. Yield curve now steepening & twin deficits still outrageous. USD headwinds building so turning point nearing," Gundlach tweeted.

He added that the steep yield curve will test the Federal Reserve's ability to tighten monetary policy aggressively.

He added that the steep yield curve will test the Federal Reserve's ability to tighten monetary policy aggressively.

"Yield curve has been steepening a whole lot lately, testing the Federal Reserve's stated resolve to absolutely 'use our tools' to fight the inflation the Fed itself failed to predict," DoubleLine Capital's CEO tweeted.

On Tuesday, James Bullard, the president of the Fed Reserve Bank of St. Louis, stated that he is not ruling out a 75 basis-point increase but noted that it is not his "base case."

According to the CME FedWatch tool, the market is pricing in a 91% chance of a 50-basis-point rate hike at the next Fed meeting in May.

During a March webcast, Gundlach said that inflation in the U.S. could surge to 10% before hitting its peak, forcing the Federal Reserve to be more aggressive.

"The magnitude of this move is almost the same size as the magnitude of the move going into the global financial crisis. A big up in commodities, in particular energy, is often a catalyst and in a post-mortem is determined to be part of the causes behind recessionary periods," he said.