Having reached a local high of 0.8510 at the end of last month, EUR/GBP subsequently moved to a decline, returning to a long-term downward trend that began in January 2021.

EUR/GBP is likely to decline while staying in the zone below the important long-term resistance levels of 0.8450 (200 EMA on the daily chart) and 0.8625 (200 EMA, 144 EMA on the weekly chart). A breakdown of the key support level of 0.8145 (200 EMA on the monthly chart) will finally move the currency pair into the long-term bear market zone.

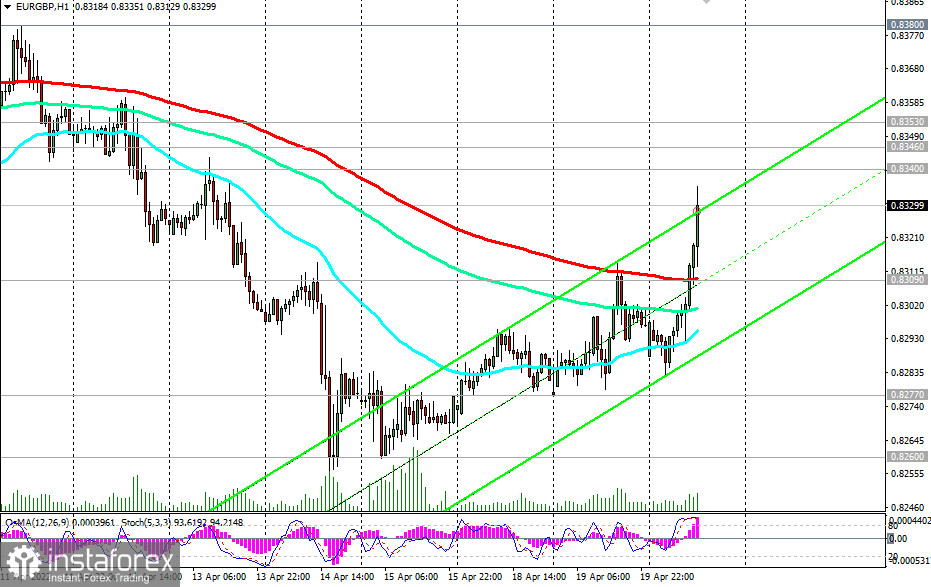

However, there is currently an upward correction after hitting a local 5-week low at 0.8249 last week. As the pair remains under pressure below the key resistance levels of 0.8412 (144 EMA on the daily chart) and 0.8450, the current rise can be seen as an opportune time to enter short positions, both on the market and when reaching resistance levels of 0.8340 (144 EMA on the 4-hour chart), 0.8346 (200 EMA on the 4-hour chart), and 0.8353 (50 EMA on the daily chart).

For more cautious traders, a sell signal will be a breakdown of the support level of 0.8309 (200 EMA on the 1-hour chart).

We are not considering an alternative scenario and growth above the resistance level of 0.8353, including against the background of strong fundamental factors.

Support levels: 0.8309, 0.8300, 0.8277, 0.8260, 0.8230, 0.8200, 0.8145

Resistance levels: 0.8340, 0.8346, 0.8353, 0.8380, 0.8400, 0.8412, 0.8450

Trading tips

Sell Limit 0.8340, 0.8346, 0.8353. Stop Loss 0.8385.

Sell Stop 0.8305. Stop-Loss 0.8337. Take-Profit 0.8300, 0.8277, 0.8260, 0.8230, 0.8200, 0.8145