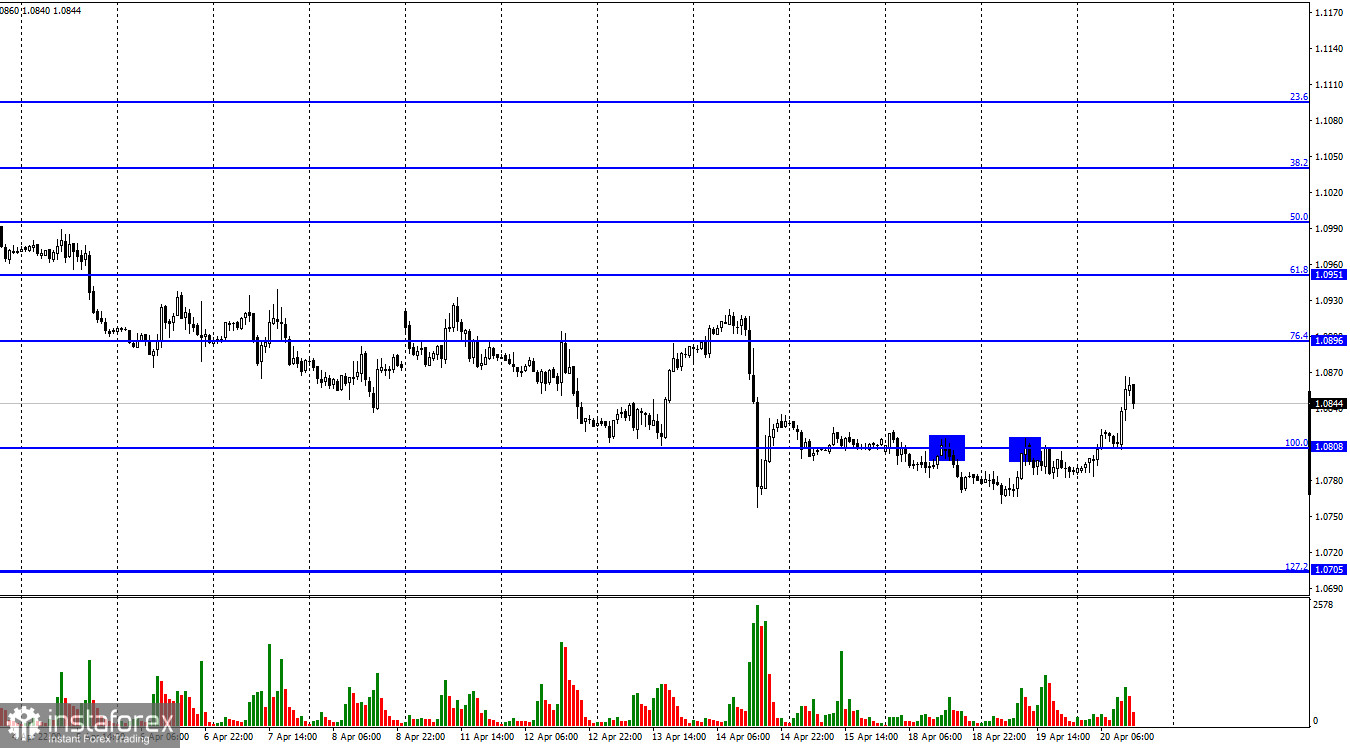

Hello, dear traders! On Tuesday, the EUR/USD pair made a new rebound from the correction level of 100.0% at 1.0808. However, it failed to continue further declining. Today, the pair has already consolidated above the level of 100.0%. Moreover, the pair rose towards the correction level of 76,4% at 1,0896. I believe this aspect is very strange. Please focus on the pair's movements during the last weeks. Its fall is evident, but bear traders repeatedly retreat from the market trying to undermine the bulls' positions. They went down 20-30 pips, then they accelerated and declined by another 20-30 pips. Bull traders cannot or do not want to change this situation or they hope there will be some reasonable grounds to buy the European currency. However, there are no such grounds. On Monday, Tuesday, and Wednesday, the most significant events were the speeches of FOMC members, in particular, St. Louis Fed President James Bullard and Chicago Fed President Charles Evans.

Both of them emphasized the need to raise the interest rates. Bullard urged the Fed to raise the rate dramatically and stressed that the necessary level was around 3.5%, while Evans did not express his views directly. For example, he voiced the following thought: if the Fed raises the interest rate by 0.5% several times, it will total 2.0-2.5% by the end of the year. Moreover, these conclusions were obvious. The question is what decision the Fed will eventually take concerning the rate hike. However, Evans noted that inflation would play a key role. If the Fed's neutral rate does not return inflation to the target level, then it will continue to rise until inflation stability is achieved.

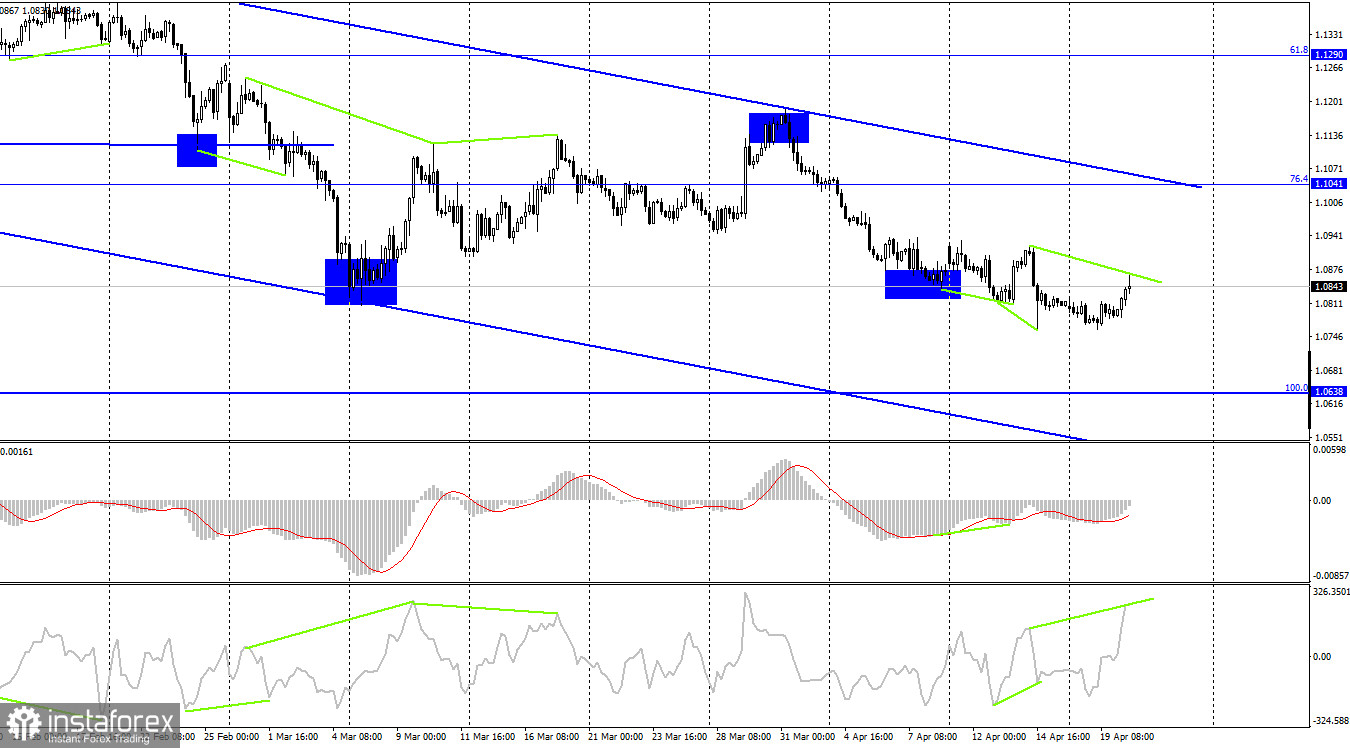

On the 4-hour chart, the pair made a reversal in favor of the EU currency and started rising. However, the bearish divergence may be favorable for the US dollar again and the pair might resume its decline towards the correction level of 100.0% at 1.0638. The downward trend corridor further indicates traders' bearish sentiment. The euro's significant rise is unlikely until the pair consolidates above this level.

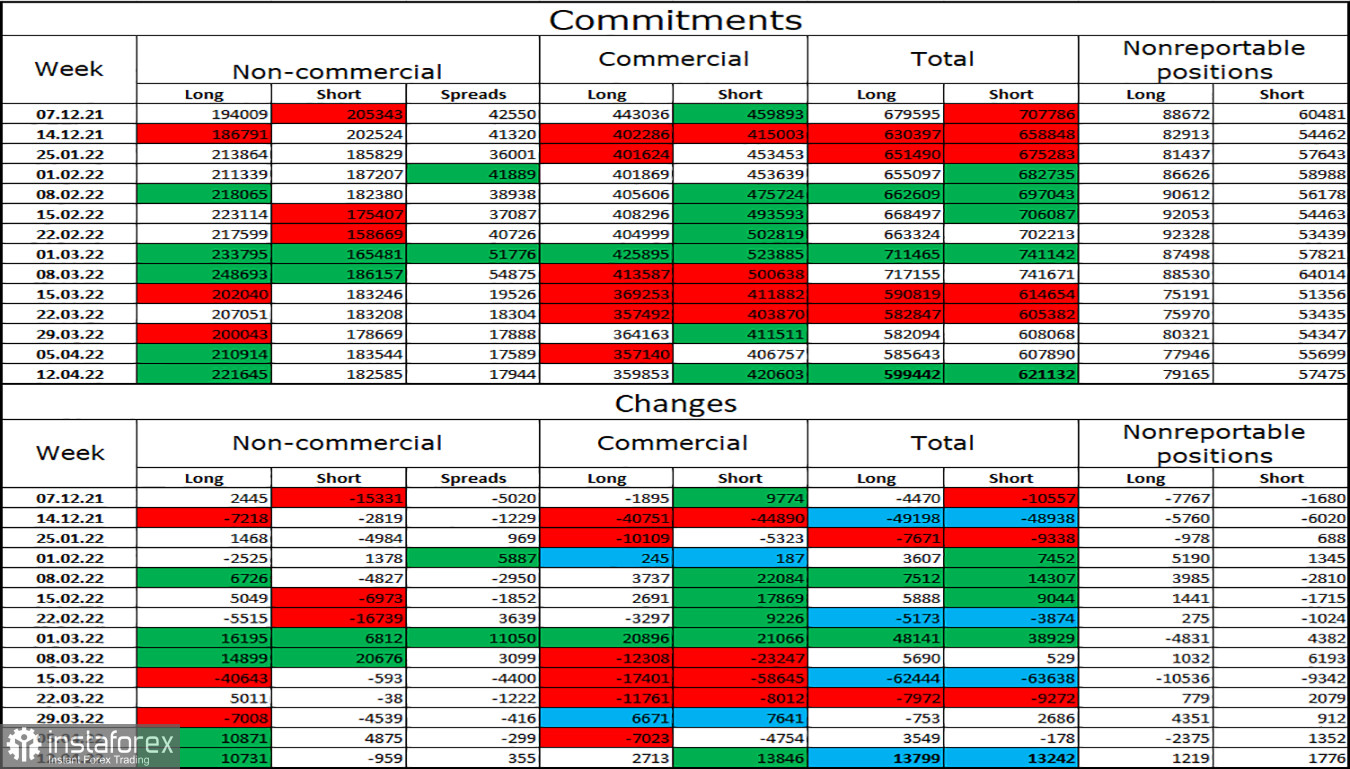

COT report:

Last week, speculators opened 10,731 long contracts and closed 959 short contracts. This means that the bullish sentiment of major players has increased dramatically. The total number of long contracts held by major players is currently 211,000, while the total number of short contracts totals 182,000. Therefore, the general sentiment of "non-commercial" traders is considered bullish. In this case, the European currency should rise. However, on the contrary, it has been declining steadily. Consequently, it is currently impossible to make logical conclusions taking into account the COT reports. Traders' sentiment is seriously affected by further hostilities in Ukraine, deterioration in relations between the West and Russia, and new sanctions against Russia.

US and EU economic news calendar:

EU - Industrial Production Change (09-00 UTC).

US - FOMC member Charles Evans to give a speech (16-05 UTC).

US - FOMC member Mary Daley to deliver a speech (14-30 UTC).

US - Publication of the Fed's Beige Book economic review (18-00 UTC).

On April 20, the industrial production report was released in the EU. It turned out to be worse than traders' expectations. The euro was rising today. Therefore, there was no reaction of traders to this report. Today, the speeches of the FOMC members may provide significant data for the interest rate issue.

EUR/USD outlook and recommendations for traders:

I recommend new sales of the pair if a bearish divergence is formed on the 4-hour chart or the pair rebounds from the level of 1.0896 on the hourly chart with targets 1.0808 and 1.0705. I do not recommend buying the pair as the euro will most likely fall again.