Analysis of Wednesday's trades:

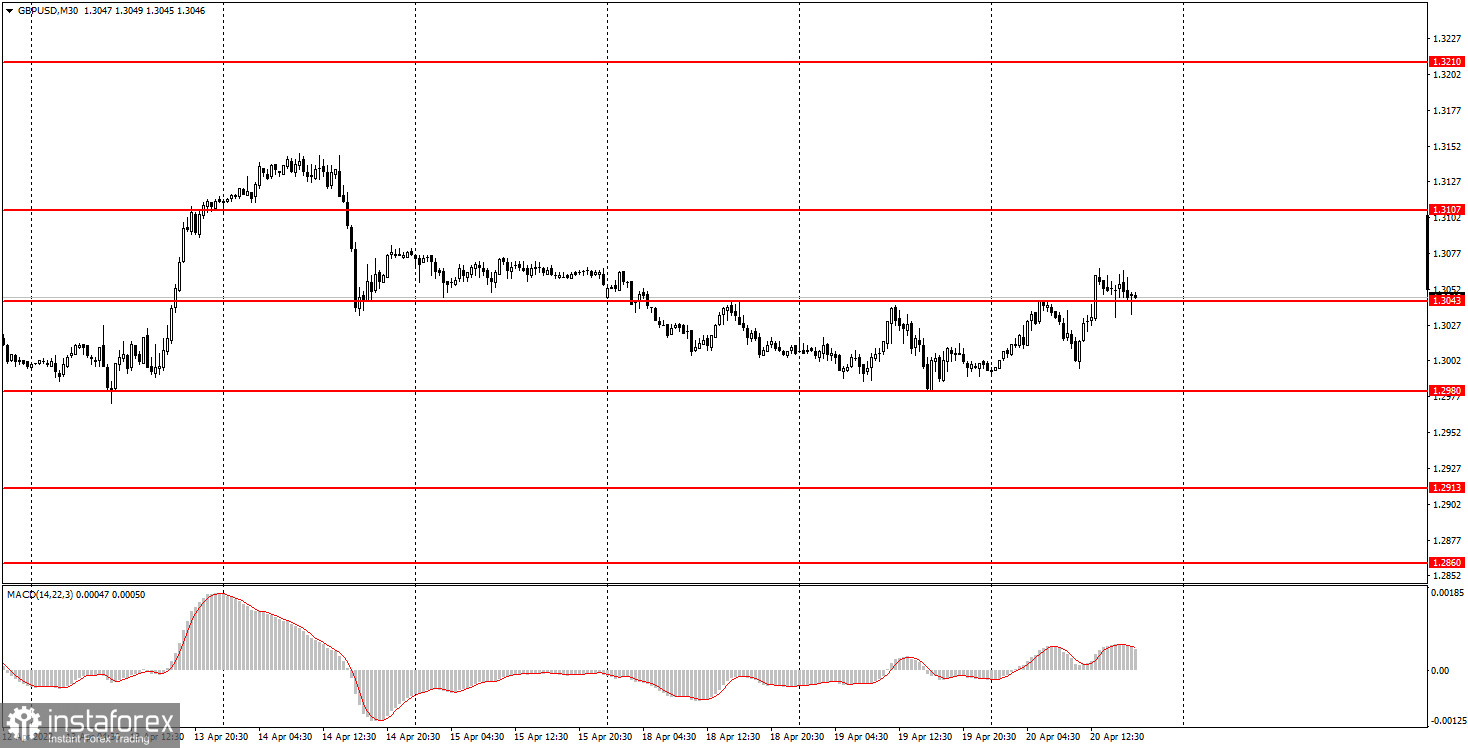

30M chart of GBP/USD

On Wednesday, GBP/USD retraced up slightly, leaving the narrow sideways channel of 1.2980-1.3043. Daily volatility totaled 74 pips. The corrective move began when the pound/dollar pair failed to break through the swing low around 1.2980. The pair's technical picture is similar to that one of EUR/USD. The Kremlin's new peace talks offer provided additional support to the euro and the pound on Wednesday. As a reminder, geopolitical developments in Ukraine are one of the primary reasons for weaker risk assets. Whenever positive news on this front comes in, EUR and GBP may show growth. Alas, the overall situation in Ukraine is only getting worse due to intense military activity in the Donbas. So far, there have been no reasons for stronger EUR and GBP. Above all else, neither trend line nor channel has formed in the M30 time frame.

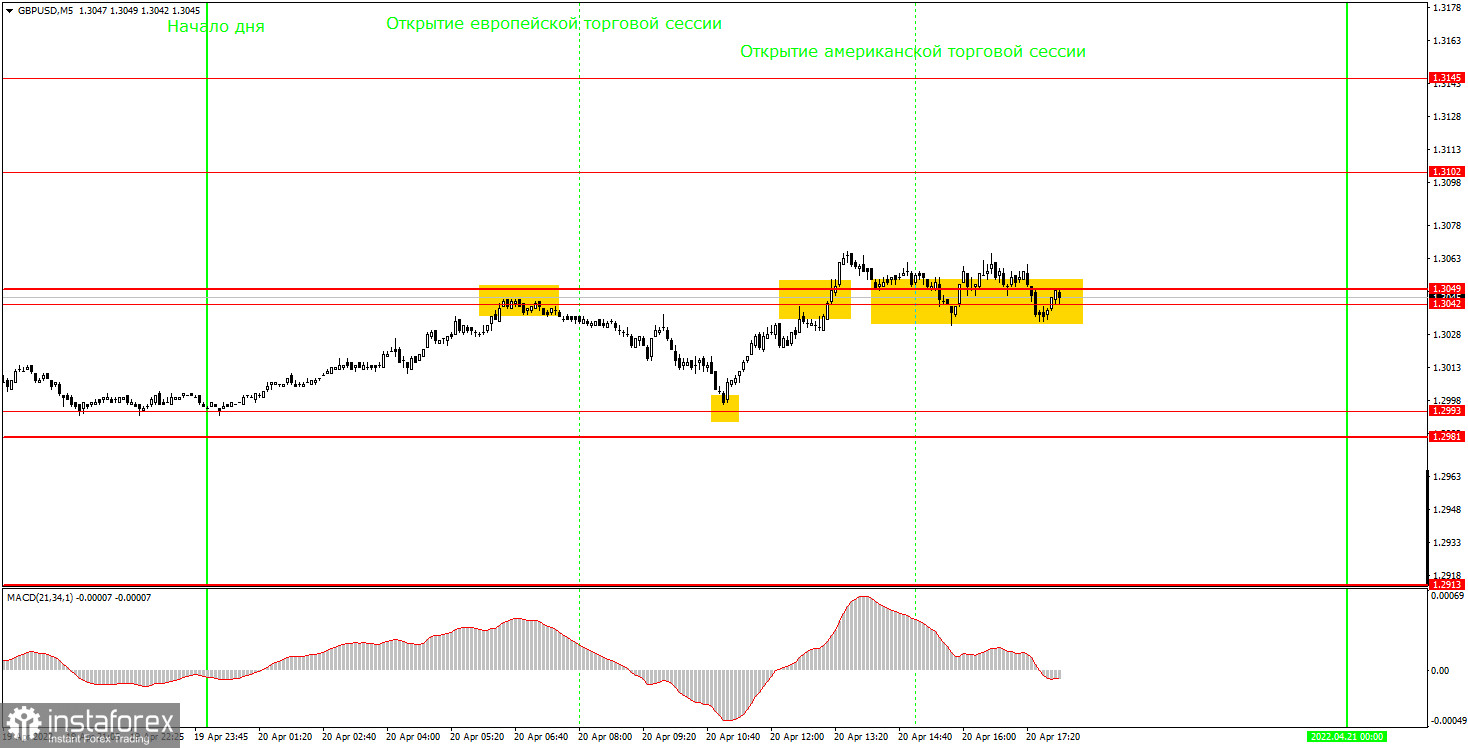

5M chart of GBP/USD

In the M5 time frame, the sideways move continued on Wednesday. The price remained within the 1.2981-1.3049 channel after briefly consolidating slightly above it. That move was not enough to be considered the beginning of a bullish correction. Nevertheless, a number of trading signals were made during the day. The first one had been created even before the opening of the European session. The quote bounced off 1.3042 but remained to hover around the entry point at the opening of European trade. It was time to go short. Later, the price fell to 1.2993 and rebounded. So, market players had to close their short positions and open long ones. In a matter of hours, the pair returned to 1.3042 and broke through 1.3049. Although the bullish move stopped, the bearish one did not begin. The quote then traded sideways along with the 1.3042-1.3049 range until the close of the trading day.

Trading plan for Thursday:

In the 30M time frame, the bearish trend goes on despite the price's strange behavior in recent weeks. In the higher time frames, the bearish trend is visible to the naked eye. It has not stopped because the pair has been unable to rise or even retrace up. Therefore, we may expect a weaker pound. On Thursday, the target levels in the 5M time frame are seen at 1.2913, 1.2981-1.2993, 1.3043, 1.3102, and 1.3145. A stop-loss order should be set at the breakeven point as soon as the price passes 20 pips in the right direction after a trade has been opened. Heads of British and American central banks, Governor Bailey and Chairman Powell, will speak on Thursday. No important macro releases are scheduled for the day. However, the speeches of the governors of the two regulators would be enough to trigger market jitters.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to the Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or produce no signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.