Yesterday, the most commonly traded pair on Forex showed decent growth, having recovered above the key psychological and technical level of 1.0800. Notably, the ECB officials have mentioned several times the possibility of a rate hike this summer. Yet, these comments do not bring any clarity. In my opinion, the EUR/USD market has already priced in the policies of the ECB and the Fed but is lacking new drivers at the moment. Let's first take a look at the economic calendar and then move to the technical analysis of the euro/dollar pair.

Yesterday's data on the non-seasonally adjusted trade balance and industrial production in the euro area came in better than expected. This may have provided some support to the single European currency. Today, market participants will be focused on the consumer price index in the eurozone. Later, during the US trading hours, Christine Lagarde and Jerome Powell will speak at approximately the same time. This can cause increased volatility in the market, of course, if there is a reason for it. However, neither Christine Lagarde nor Jerome Powell can surprise the market now as their rhetoric is well-known.

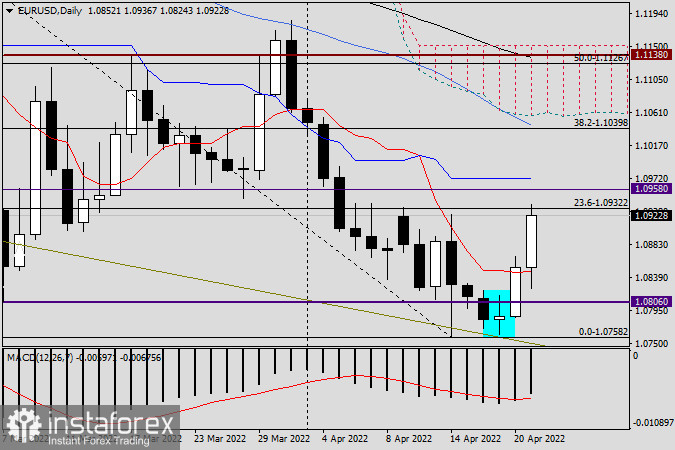

Daily chart

On the daily chart, we should pay attention to the candlestick formed on April 19 as it clearly has reversal potential. This was confirmed by yesterday's growth of EUR/USD which can continue today. Yesterday's closing price above 1.0800 clearly shows that the price is hesitating to consolidate below this important level. At the time of writing, the euro/dollar pair is trading firmly higher and approaching another significant level of 1.0900. The technical situation on this time frame suggests that the quote will keep rising further. Yet, it is still too early to drive a conclusion, especially given today's attempt of the pair to return above 1.0900.

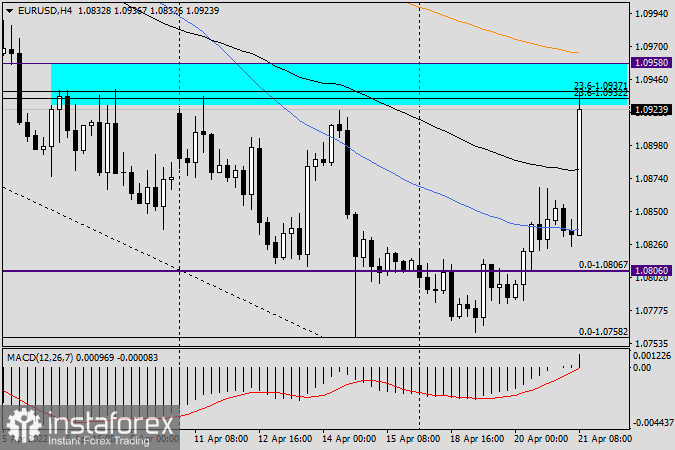

H4 chart

On the 4-hour chart, the 89-day exponential moving average is confidently heading upwards. If the price settles above the 89 EMA, you may consider buying the pair on a pullback to it. As for selling, the price area of 1.0925-1.0965 looks quite good for going short. This is where strong bullish resistance tested earlier is located along with the orange 200-day exponential moving average. To sum it up, there are both buying and selling opportunities for the pair. At least, that is what the technical picture shows us.

Good luck!