"A rate hike is possible in July, depending on data," ECB Vice President Louis de Guindos said Thursday. In his opinion, Eurozone inflation is close to peaking, and there is no reason why Asset Purchase Program cannot end in July.

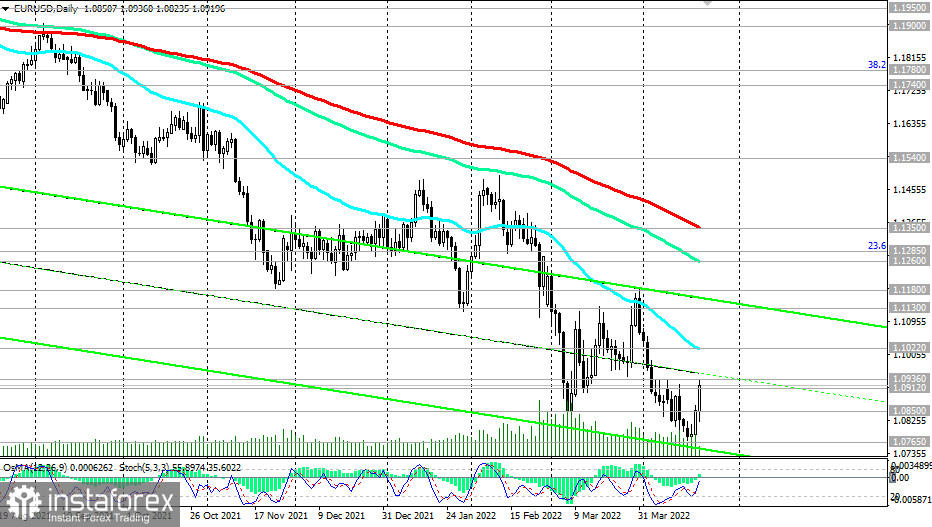

The euro strengthened sharply after Guindos' speech. The EUR/USD jumped to 1.0936, a 10-day high at the start of today's European session. The euro also strengthened in the main cross-pairs.

The opinion of the ECB Governing Council members was probably also influenced by macro statistics published on Wednesday, according to which the German producer price index accelerated to 4.9% in March (+30.9% in annual terms from 25.9% in February), while the forecast assumed growth of +2.6% (+29.1% in annual terms). After the publication of these data, Governing Council members Martins Kazaks and Joachim Nagel also called for an interest rate hike in July, according to media reports.

Statistics released today (at 09:00 GMT) also pointed to an acceleration in the annual consumer inflation rate in the eurozone, which is another evidence of increasing price pressure, including due to strong consumer demand, rising energy prices, and disruptions in international supply chains.

According to data released today by Eurostat, the consumer price index (CPI) rose by 2.4% in March (against a preliminary estimate of 2.5%) and by 7.4% (in annual terms) after rising by 5.9% in February.

Thus, the annual inflation in the Eurozone accelerated again, reaching a historical maximum, although it turned out to be slightly lower than the preliminary estimate. Energy prices continue to rise against the background of the military conflict in Ukraine, which contributes to further acceleration of inflation (in March, energy prices rose by an average of 44% compared to March of the previous year).

Nevertheless, there is no consensus on the possibility of a faster pace of monetary policy tightening as follows from the comments of the ECB Governing Council. ECB President Christine Lagarde recently confirmed the existence of additional risks for the region's economy, including due to the ongoing military crisis in Ukraine, stating that "the longer the war lasts, the higher the economic costs will be and the greater the likelihood we end up in more adverse scenarios."

Today, market participants will pay attention to the latest data on consumer confidence in the eurozone (at 14:00 GMT). Consumer confidence in the eurozone is expected to weaken significantly in April. The indicator dropped to -20 after -18.7 in March and -8.8 in February. Such data are comparable to the values in the first wave of the pandemic. Since the creation of the single European currency, the decline in the indicator in March to -18.7 from -8.8 in February was the second-largest decline in this indicator. Now, an even greater decline (-20) is expected.

The euro may be under additional pressure if Marine Le Pen wins the second round of voting in France (April 24). Macron's widely expected victory is likely to calm the markets somewhat. Nevertheless, it will not become a turning point in the dynamics of the euro, which will be prone to further weakening, including due to the above-mentioned factors (further deterioration of the geopolitical situation in the Eurozone and a rapid increase in inflation).

Falling consumer confidence, rising inflation against the background of the central bank's inaction, and the unstable geopolitical situation in the eurozone are extremely negative factors for the European currency.

Probably, its current growth provides an excellent opportunity to build up short positions on it, including in pair with the dollar.

At the time of writing this article, EUR/USD was trading near 1.0918, down slightly from today's high of 1.0936. In our main scenario, we expect the pair to resume its decline. Following this scenario, we would enter short positions at current prices with an additional pending sell order (Sell Limit) located near today's local high of 1.0936 with immediate targets near 1.0850 and more distant ones near 1.0765.