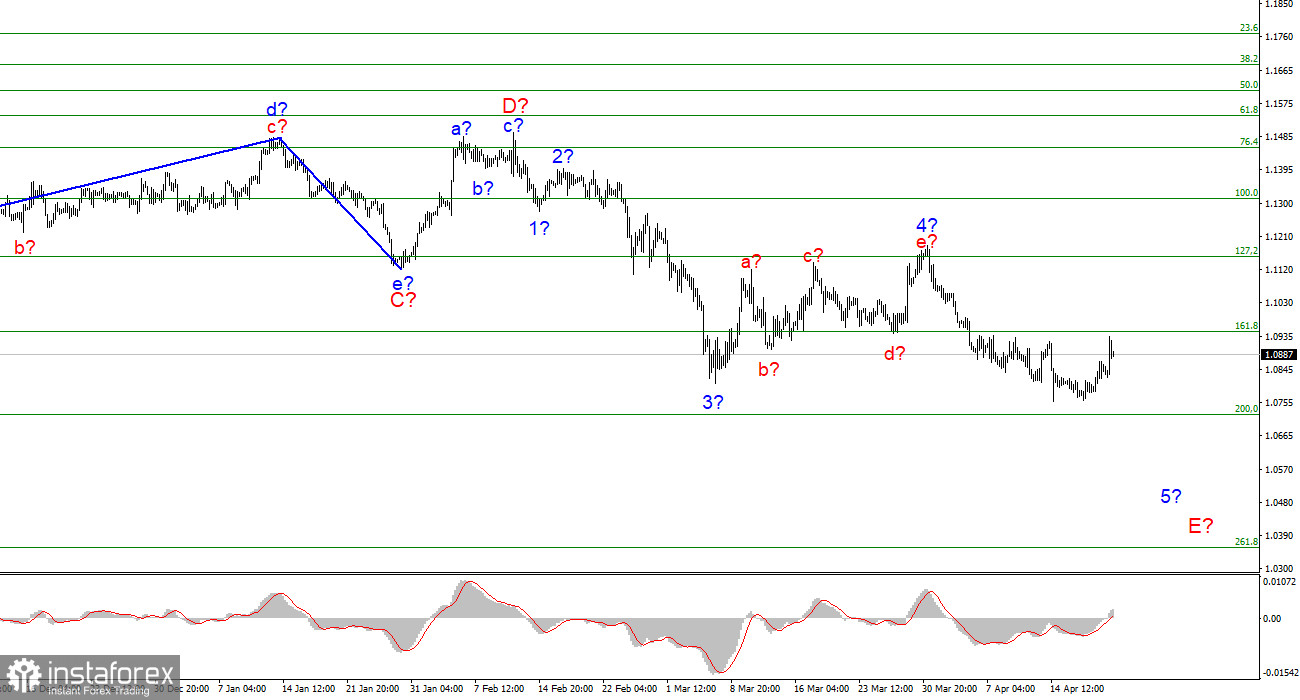

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing, despite the increase today. The tool continues to build a wave of 5-E. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since this wave may turn out to be a very long, five-wave in its internal structure. However, it may also turn out to be shortened and be already completed, since the instrument fell below the low of the previous wave 3-E. Thus, the euro still has the potential to decline, but it can still complete it. The target remains 1.0721, which equates to 200.0% Fibonacci. Today, the quotes of the euro currency have risen to the level of 161.8% by Fibonacci, and I propose to consider this level decisive. If a successful attempt is made to break through this level, then you should forget about selling for a while, since the construction of a new upward trend section may begin. An unsuccessful attempt to break through the 1.0948 mark will indicate that the market is not ready to buy the instrument.

Inflation in the EU is very high.

The euro/dollar instrument rose by 40 basis points on Thursday. The increase in euro quotes began early in the morning and it was most likely connected with the speech of some representatives of the ECB, who announced their readiness to raise the interest rate in July. Let me remind you that ECB President Christine Lagarde has repeatedly drawn attention to the unwillingness of the European economy to tighten monetary policy. The ECB has not even gotten rid of the economic stimulus program yet. However, a member of the ECB monetary committee, Martins Kazaks, said that the regulator could take such a step in July. He positively commented on the statement of ECB Vice President Luis de Guindos, who expects inflation to slow down in the second half of the year, and agreed with his conclusion. Luis de Guindos also said that there are no obstacles to raising the rate in July. Against the background of these statements, the probability of tightening monetary policy has increased above 50%, and the demand for the European currency has increased. I wouldn't be too happy about this, since Christine Lagarde hasn't said her word yet.

Today, the European Union released an inflation report for March, which showed a final value of +7.4% year-on-year. This report was released and after it, the demand for the European currency began to decline. I draw readers' attention to the fact that at the moment, after an increase of 110 basis points, the instrument is only 20 points above the opening levels of the day. That is, the advantage of the euro currency remained for several hours, after which the demand for it began to decline again. Based on this observation, I expect that the descending wave 5-E will still turn out to be more extended, not shortened. I expect a new decline in quotes based on the fact that the military conflict in Ukraine is not approaching its resolution. Many military analysts continue to claim that military operations will last from several months until the end of 2023. And if we also take into account passive warfare, then this conflict can drag on for many years. The consequences for the European economy from it will be serious.

General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". In the next few days, an internal correction wave of 5-E may be built, and an unsuccessful attempt to break through the 1.0948 mark will herald its completion.

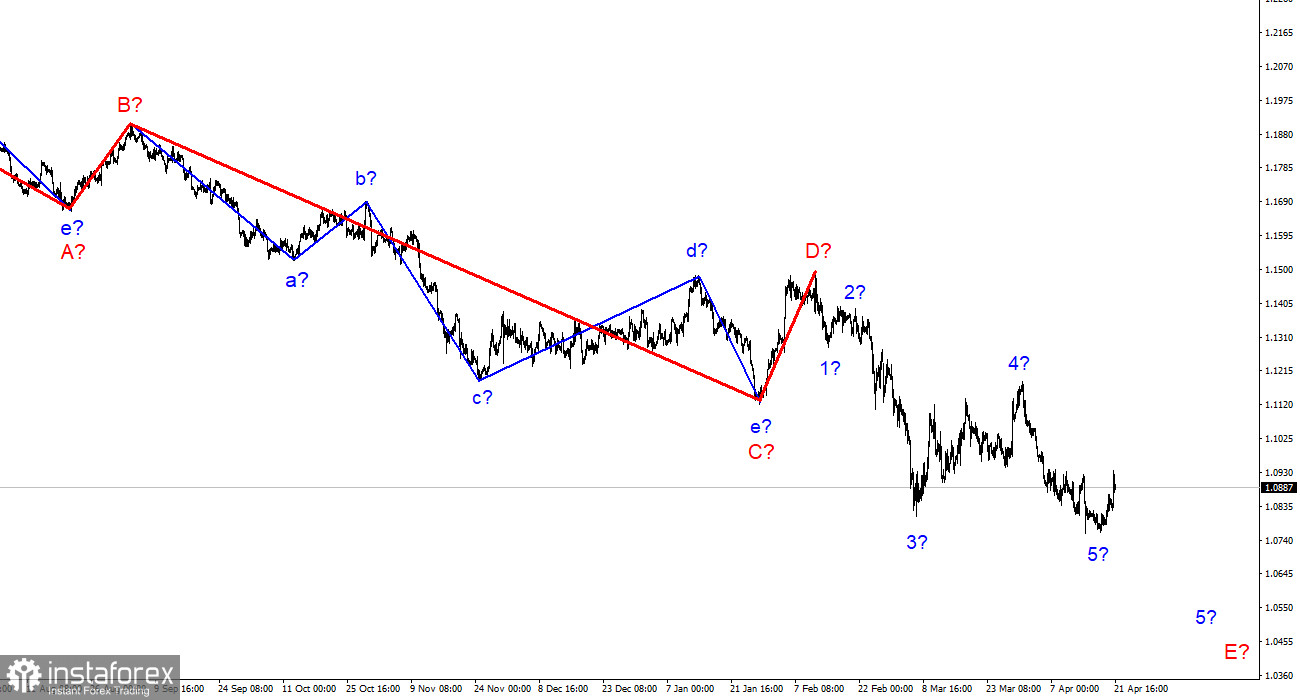

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.