Key data on the growth of inflation in the country were published in New Zealand today. On the one hand, the most important report impressed, although the main indicators came out in the red zone, falling short of the forecast level. Most experts predicted a more significant breakthrough, and this fact did not allow NZD/USD bulls to develop corrective growth. The kiwi still follows the US currency, which in turn follows the yield of treasuries.

In general, the NZD/USD pair is within the downward trend that has been observed since the beginning of April. The kiwi has fallen by more than 300 points in three weeks, but has stayed at the base of the 67th figure. Despite the growth of New Zealand inflation and the hawkish attitude of the Reserve Bank of New Zealand, it is advisable to use any corrective pullback on the pair to open short positions. Given the prevailing fundamental background, bears may test the 0.6700 support level again in the very near future (the lower line of the Bollinger Bands indicator on the daily chart).

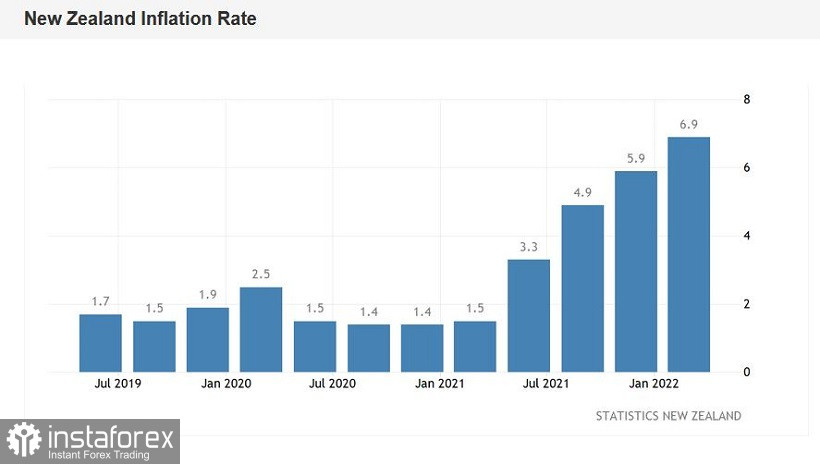

Returning to today's inflation report, it should be noted that the market actually ignored this release. Although the report was really impressive, despite the "red color". Thus, in the first quarter of this year, the consumer price index rose to 1.8% year-on-year. At the same time, in the fourth quarter of last year, this indicator rose to only 1.4%. In annual terms, the index has already set a multi-year record, jumping to 6.9%. This is the strongest value in the last 30 (!) years. It is noteworthy that the main engine of inflation growth was not the energy market (although its contribution is very, very significant), but the segment of utilities and the real estate market (the cost of new residential buildings jumped by almost 20 percent in the first quarter). This "anomaly" is observed for the first time in the last 37 years. In addition, during the reporting period, gasoline prices increased significantly (by 32%) compared to the same period in 2021.

Traders reacted phlegmatically to this release for two reasons. Firstly, the jump in inflation in the first quarter is a widely expected event. This was also discussed by indirect (more operational) inflation indicators, and representatives of the New Zealand central bank. As a result, the index really grew significantly, but at the same time it fell a little short of the forecast values. Secondly, today's report appeared after the April meeting of the Reserve Bank of New Zealand, so in a sense its relevance has decreased. Let me remind you that following the results of the April meeting, the members of the central bank agreed on the so-called path of least resistance, the essence of which is to hold several rounds of a 50-point increase ("raise more now, not later"), after which to take a break. This approach was interpreted by the market as a sign of a slowdown in the process of tightening monetary policy. Actually, for this reason, kiwi weakened its position after the meeting, despite the fact that the central bank not only increased the rate by 50 points, but also declared its further growth.

Well, the downward trend of NZD/USD is due to the strengthening of the US currency. The US dollar index has been gradually losing ground in recent days, but it is still above the hundredth mark, in the area of two-year highs. It is obvious that the Federal Reserve is only at the very beginning of the "long road", in the context of tightening the parameters of monetary policy. Most experts are now confident that the Fed will raise the rate by 50 basis points not only at the May meeting, but also at the June one. And the closer the date of the next meeting (May 3-4) is, the stronger the hawkish expectations factor will "work".

Thus, the upward bursts of NZD/USD can still be used as an excuse to open short positions. Please note that yesterday's corrective pullback ended at the borders of the 68th figure. Even New Zealand inflation did not help the pair's bulls: against the background of a fairly strong report, the price is gradually sliding down. This indicates the priority of the downward scenario.

From a technical perspective, the pair has broken through the upper boundary of the Kumo cloud ("from top to bottom") on the daily chart and is currently heading towards the lower boundary, that is, to the 0.6730 mark. This is the first downward target for the NZD/USD pair. The main goal is the 0.6700 target. This is a psychologically important support level, which corresponds to the lower line of the Bollinger Bands indicator on the D1 timeframe. Overcoming this level will open the way to the 0.6650 mark, but it's too early to talk about it today: apparently, the downward momentum will temporarily fade at the very base of the 67th figure.