Analyzing trades on Thursday:

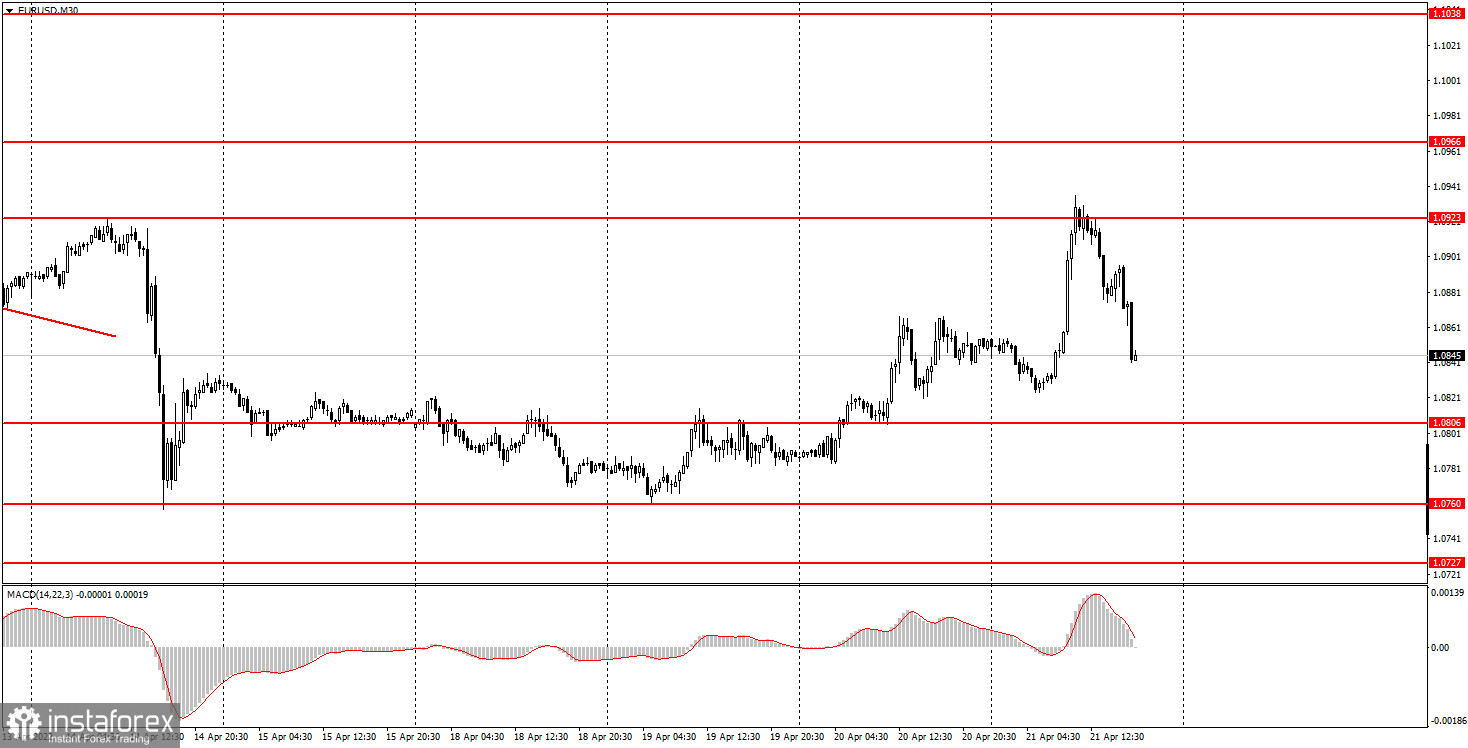

EUR/USD 30M chart

EUR/USD unexpectedly strengthened on Thursday. The uptrend started in the morning and continued for about 3 hours. However, when bulls failed to overcome the level of 1.0923, the pair reversed to the downside and began to fall rapidly. As a result, the euro returned to the point where it opened the day. Although the euro managed to complete a correction, it immediately pulled back with high chances for the resumption of the downtrend. Notably, the pair has rebounded from the level of 1.0923 at least 5 times in recent weeks, which proves that this is a very strong resistance level. The fact that the pair constantly fails to overcome it increases the likelihood of a new fall. Probably, yesterday's uptrend was caused by the speech of ECB Vice-President Luis de Guindos, who unexpectedly mentioned that rates could be raised as early as July. On the other hand, Christine Lagarde has stated several times that the regulator was not going to raise the rate in 2022. A sudden turn to a more hawkish stance could have pushed the euro higher, but given how quickly the euro slipped back, markets did not take these comments seriously.

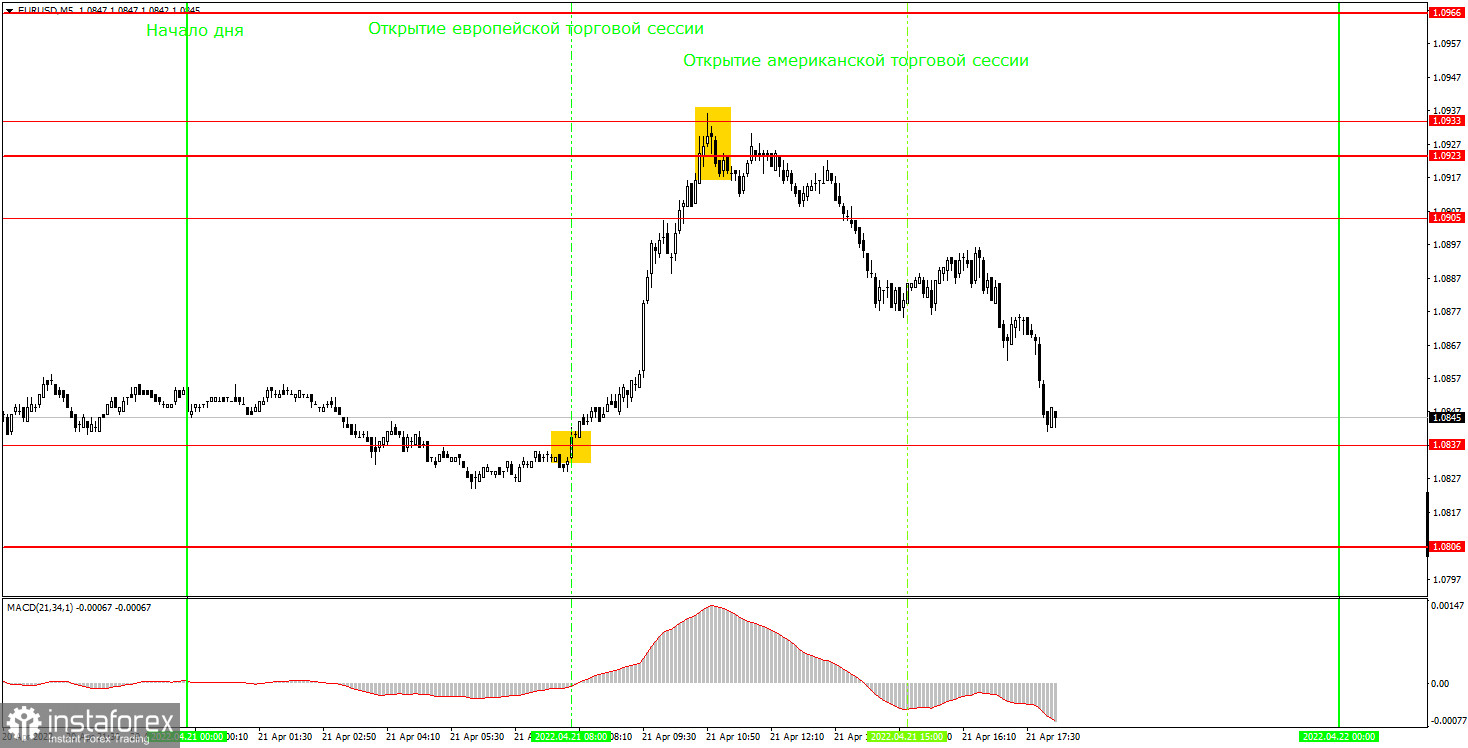

EUR/USD 5M chart

On the 5-minute time frame, the technical picture looked great. After days of uncertain trading, the pair finally showed a good trend movement. Most importantly, strong signals were formed. The first buy signal was formed at the very beginning of the European session when the price broke through the level of 1.0837. After that, the pair went up by about 90 pips, overcoming 1.0905 along the way, and stopped at the area of 1.0923-1.0933, from where it made a rebound. Naturally, this buy signal should have been followed. The rebound from the 1.0923-1.0933 area was quite accurate and also required traders to open a short position. Then, the price fell rapidly, overcame the level of 1.0905, and dropped almost to its opening level at 1.0837. This trade should have been closed manually in the late afternoon as the level of 1.0837 was not formally tested. Beginners could have earned 65 pips on the first trade and about 55 pips on the second one. Thus, Thursday turned out to be a very successful day.

Trading tips on Friday:

On the 30-minute time frame, the downtrend is still relevant, which is especially clear on higher time frames. However, on the 30-minute time frame, the movement took too long to develop, so now you can't even say that the downtrend is still there. Given that the pair failed to overcome the level of 1.0923, we believe that the probability of falling back to the level of 1.0760 is higher. On the 5-minute chart on Friday, it is recommended to trade at the levels of 1.0727, 1.0760, 1.0806, 1.0837, 1.0905, and 1.0923-1.0933. You should set a Stop Loss to breakeven as soon as the price passes 15 pips in the right direction. On Friday, the European Union will publish the data on business activity in the manufacturing and services sectors. Also, ECB President Christine Lagarde will speak. In the US, the index on business activity will be published. We believe that the PMI is not the most important data under the current circumstances. Yesterday, volatility was high even though there were no key reports. It seems that the statement by Christine Lagarde will be of more importance to the market.

Basic rules of the trading system

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours, when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.