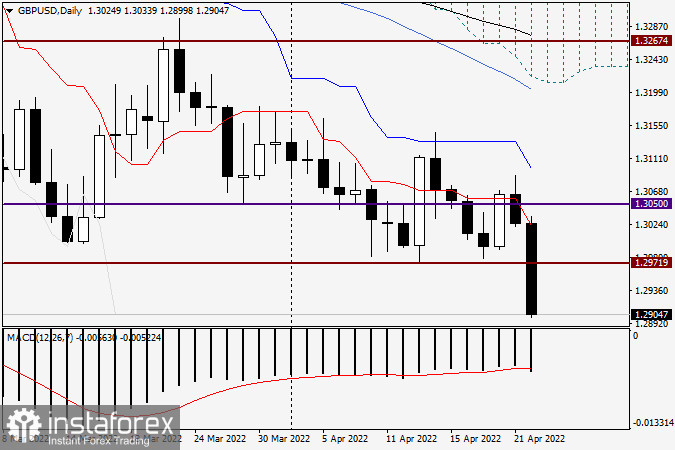

GBP/USD clearly on downward trend

Hi, dear traders!

GBP/USD has moderately decreased yesterday, but it did not affect the pair's situation much. However, several key developments can already be noted today.

Daily

At this moment, the pound sterling is under strong bearish pressure. There is a breakout of the support level at 1.2971, the lows of April 13. It is unclear whether it was caused by yesterday's statements by Fed chairman Jerome Powell on the war in Ukraine or not, though it does not seem likely. However, Powell did link the conflict with accelerating inflation in the United States. As a result, market players could assume the Fed is intending to tighten its monetary faster than previously planned. The president of Fed Reserve Bank of San Francisco Mary Daly stated in an interview with CNBC that it would be necessary to increase the interest rate to the neutral rate of 2.5%. She also did not rule out a 50 basis point hike at several upcoming Fed meetings. Even a 0.75% increase could be on the cards at one of the policy meetings. The Bank of England's position is obviously not as hawkish as the stance of its American counterpart. Today, UK retail sales data were released, which did not meet expectations and likely pushed the pound sterling down. In the US, services and manufacturing PMI data will be published during the New York session.

On the technical side, GBP/USD is clearly on a downward trend. A true breakout of the support at 1.2971 would derail all plans of bullish traders. In this scenario, opening short positions could be considered if the pair retraces to 1.2971 or enters the 1.2970-1.3000 area. There are no clear buy signals at this point - traders should wait until the end of the session and the trading week. Overall, opening short positions at this point at 1.2971 and the lower boundary of the trading channel does not seem appropriate. There could be a correction that would allow opening short positions at more attractive prices later on. Going short on GBP/USD is the main trading strategy at this point, but it is not the best time to do so. Traders should probably wait until more safe and profitable opportunities for opening short positions emerge.

Good luck, and see you next Monday!