Long term outlook

The GBP/USD pair fell by 220 pips during the current week. The UK currency fell by 200 pips on Friday. This was a "black" day for the pound, but the reasons for such a powerful fall are not obvious. Let's try to analyze them from the very beginning. We have been saying for a long time that there is only one good reason for the British pound to show growth. It is the hawkish sentiment of the Bank of England, which has already raised the key rate three times. However, the pound growth factors come to an end here, and the US currency has much more at its disposal. The Fed can catch up and overtake the Bank of England in 2 to 3 months. The US economy is much stronger than the British economy according to their GDPs. The geopolitical conflict in Eastern Europe is more likely to negatively affect the British economy than the US one. The US dollar is in demand because of its safe-haven status, unlike the pound. Therefore, based on all these factors, we have predicted a further decline in the pound/dollar pair. The reason for the collapse of this currency on Friday, as it seems to us, lies on the plane of the set of problems, which we have listed above. It seems that traders were waiting for a convenient opportunity to resume the sales of the pound, and they got it on Friday when there was nothing interesting in the macroeconomic and fundamental background. The UK retail sales report was published in the morning, which was worse than the forecasted value. How many times can you remember when an average report triggered a decline of 200 points? Also, probably, the 1.3000 level factor" kicked in. Traders have tried to get above this level several times in recent weeks and failed. On Friday, bears made more effort to break through it, which led to such a strong downward move.

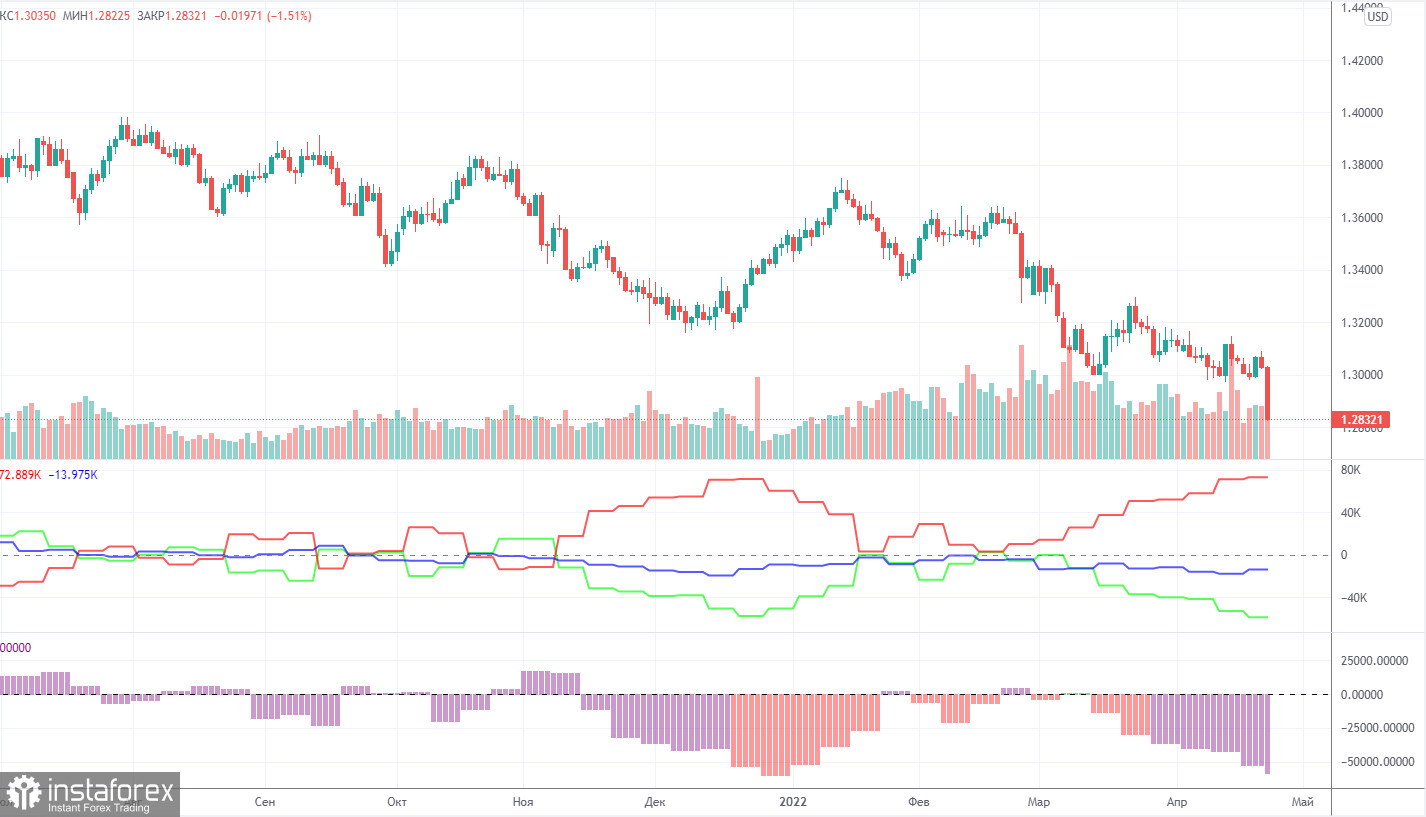

COT report analysis

The latest COT report on the British pound showed a new intensification of the bearish sentiment among professional traders. During the week, the Non-commercial group opened 1,300 buy contracts and 7,100 sell contracts. Thus, the net position of non-commercial traders decreased by another 6,000. Such changes are significant for the pound. The Non-commercial group has already opened a total of 95,700 sell contracts and only 36,800 buy contracts. Thus, the difference between these numbers is almost threefold. It means that the sentiment of professional traders now is clearly bearish. Thus, this is another factor, which speaks in favor of the continuation of the decline of the British currency. Let us note that in the case of the pound, the COT report data reflects very accurately what is happening in the market. The sentiment of the big players on the pound is changing every couple of months, but at the moment it is fully consistent with the movement of the pound/dollar pair. The net position of the Non-commercial group has already fallen to the levels where the previous decline in the pound falling has finished (green line in the first indicator). Therefore, it is even possible to assume that in the coming weeks, the pound will try to start a new rise. However, the current fundamental and geopolitical background does not give strong reasons to expect strong growth of the British currency.

Fundamental events analysis

There were almost no macroeconomic statistics in the UK during the reporting week. There were no important ones. We can mark only the retail sales report on Friday, after which the British pound collapsed. Indexes of business activity in manufacturing and services in the UK and the US turned out to be quite neutral. Only the US service sector PMI, which unexpectedly fell to 54.7, was noted by the market. Therefore, the most important events were the speeches of Jerome Powell and Andrew Bailey. However, the head of the Fed only confirmed that the Fed was ready to raise the rate in May by 0.5%. At this time, the market is already actively discussing the possibility of a 0.75% rate hike. And the BA head said that the regulator would launch the QE program only when the markets are stable. Actually, these statements were definitely not the ones that could trigger a strong movement. On Friday, it was not required as the pound was falling all day at a great pace.

Trading plan for April 25-29:

1) The pound/dollar pair fell to 1.2830 - 50.0% Fibo, which we talked about in the last weekly reviews. Now, if the pair bounces from it, it may start an upward correction to the critical line. However, taking into consideration the general market sentiment, the COT reports, geopolitical and fundamental background, we can hardly expect a strong rise in the British currency now. Hence, there is a big probability of breaking through that level and further downside with the target at 1.2500.

2) The GBP/USD pair's outlook is still rather unclear and there is no reason to buy the pair so far. Even the technical indicators speak about it, as the price did not manage to renew its previous local peak or overcome the critical line during the last growth spurt. Geopolitics speaks of it, as the pound remains a riskier currency, than the US dollar. The macroeconomics confirms this, as the economy in the UK is in a worse condition than in the US. There are no reasons to buy the pair on a strong downtrend.

Notes to screenshots:

Price levels of support and resistance, Fibonacci levels, which are targets for the opening of long or short positions. Take-profit orders can be placed near them.

Ichimoku indicator (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the size of the net position of each category of traders.

Indicator 2 on the COT charts - the size of the net position for the non-commercial group.