On Monday, there is a pronounced tendency to avoid risk, oil is losing more than 3%, the stock indices of the Asia-Pacific countries are traded in the red zone, and there is no doubt that Europe will open with a decline. On Friday, both the American and European sessions closed at daily lows, one of the most likely reasons for the rapid increase in negativity is the possibility of Beijing being quarantined after recording 21 new local positive cases of COVID infection. The threat of lockdown expansion in China will inevitably send markets further down as a global recession becomes more likely.

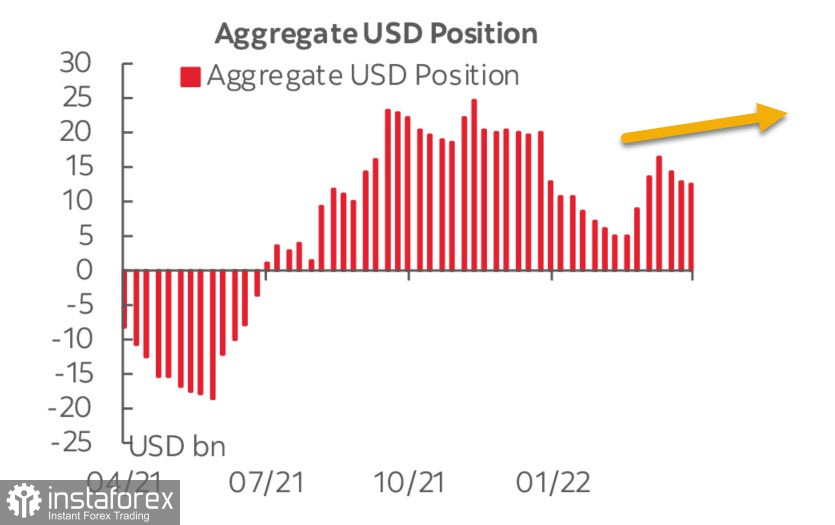

The CFTC report turned out to be uninformative, there were no global changes in the positioning of speculators. Losses are recorded in the euro and the pound, but most other currencies bounced back a little against the dollar, the total position on which fell for the third time in a row. The decline is minimal, and the bullish preponderance of the dollar remains, however, the pace has been lost and further direction is not yet visible.

The dollar, by indirect signs, is unlikely to continue to decline, as a large amount of the bullish position in gold (-3.257 billion) has been lost, and oil is under pressure, which makes demand for commodity currencies unsustainable.

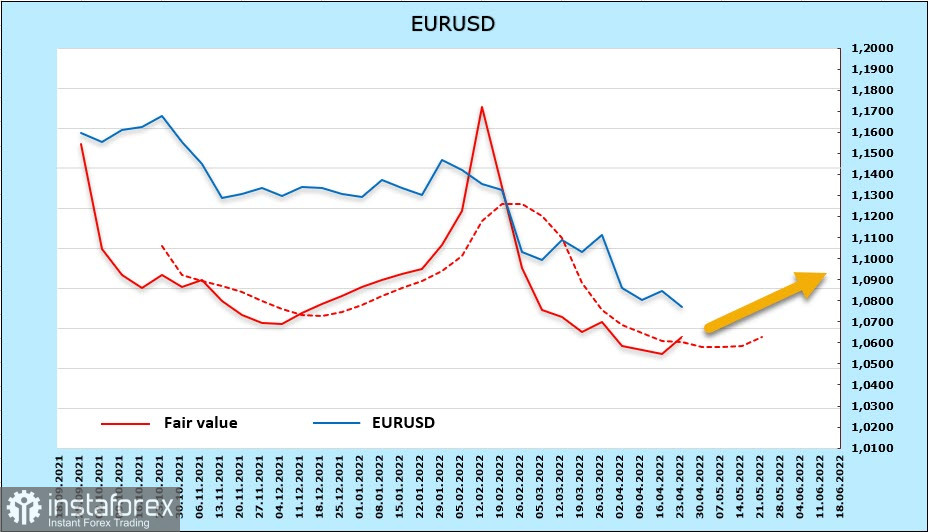

EURUSD

Emmanuel Macron won the second round against Marine Le Pen, this factor is regarded by the markets as positive for the euro, but it is unlikely to change anything in the global scenario.

ECB President Christine Lagarde said on Sunday that while both Europe and the US are struggling to contain inflation, they still face different situations. According to Lagarde, 50% of inflation in the eurozone is due to rising energy prices, and even if rates are raised, energy prices will not change. Probably, this statement levels the increased expectations for the ECB in favor of an earlier rate hike and knocks the ground out from under the euro bulls.

The net long position on the euro decreased by 1.066 billion, which is a factor in favor of a further decline in EURUSD. However, Lagarde's comments and the ECB's reassessment of the ECB's orientation to an earlier start of rate hikes played a role, the settlement price tried to turn up.

We assume that if any growth is recorded, it will be exclusively corrective in nature and will be immediately sold off. The probable limit for corrective growth is 1.0850/60, where sales can recover. In the event of a breakdown of the 1.0758 support, the fall may accelerate, in which case the 1.0637 target will become relevant again.

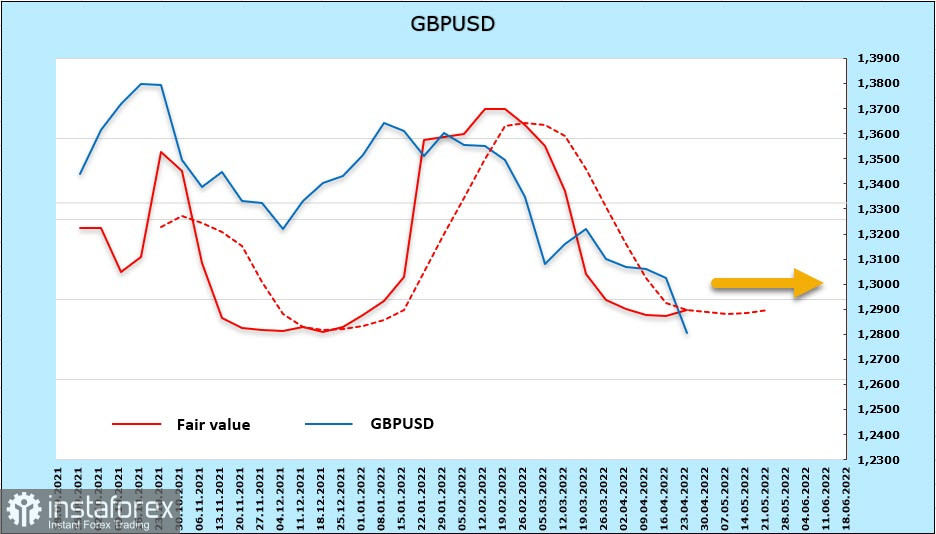

GBPUSD

The pound continues to fall rapidly, because the bulls, as it turned out, have nothing to rely on in the current conditions. Inflation is growing at a very high rate and is capable of crossing the 10% barrier this year, the GDP growth rate in Q1 may suddenly turn out to be negative, and the latest data does not inspire any optimism. Retail sales in March suddenly fell by 1.4%, and the PMI index in the services sector, which accounts for more than 70% of the entire economy, slowed in April from 62.6 to 58.3, which turned out to be worse than forecasts.

Bank of England Governor Andrew Bailey on Friday did not give any hint that the rate would be raised to 1.75% by the end of the year, which was seen by the markets as a risk of the BoE falling behind the Fed, respectively, the yield spread would change in favor of the dollar.

Speculators have again built up their short position on the pound (weekly change -475 million, total overweight -4.786 billion), and there are no fundamental reasons for an upward reversal. The estimated price is without direction, which indicates an increased chance of a technical correction.

The rapid decline of the pound below 1.28 was not unexpected, the target of 1.2650/80 is getting closer. The pound has dropped almost to the lower border of the channel, which increases the probability of correction, but for this, in any case, you need to look for signs of weakening momentum, which are not yet visible.