The main cryptocurrency is already feeling the consequences of the Fed's monetary policy. In its fight against inflation, the Fed has greatly strengthened the US dollar and also supported government bond yields. As a result, the capital fled from the crypto market to instruments based on the US currency. Despite this, long-term investors still believe in Bitcoin although they refrain from active trading in the face of monetary tightening.

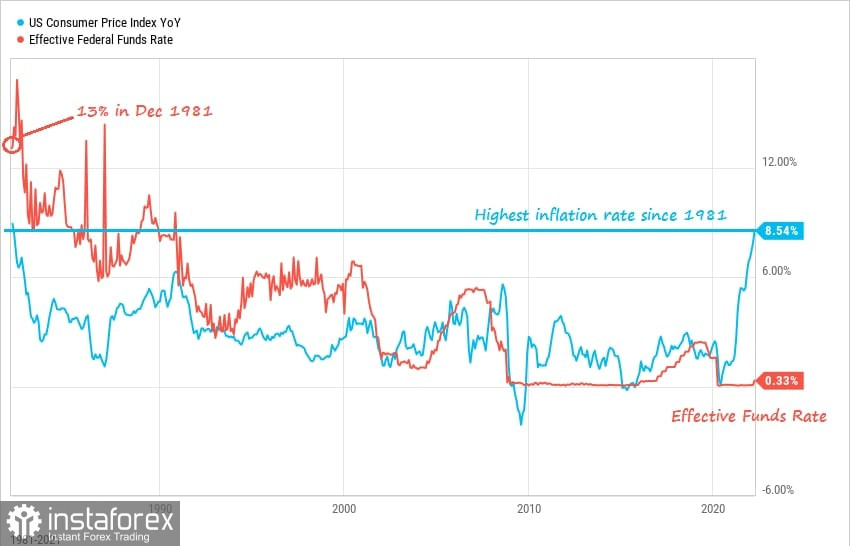

However, the situation can get worse. We have already noted that the Fed's strategy of monetary tightening was developed without taking into account the situation in Ukraine. Sanctions pressure and disruptions to supply chains facilitated the rise in inflation to 8.5% in March. After that, members of the regulator took a more aggressive stance on the rate hike. Thus, James Bullard said that in May the rate could be raised to 0.75%. This is an extremely negative signal, given that the rate is currently around 0.25%. An increase of 50 basis points at once indicates a rush and the need for a more serious liquidity squeeze.

And now let's talk about how this will affect Bitcoin and the cryptocurrency market. According to Arcane Research, the positive correlation of the crypto asset with the NASDAQ continues to grow. This suggests that investors at the current stage perceive BTC as a high-risk asset comparable to stocks. As a result, the cryptocurrency found itself in a situation where the policy of a central bank is directed against it. A rate hike will not only reduce liquidity and cause an outflow of funds from the crypto market but also diminish the status of BTC as a means for hedging risks.

According to Fed officials, inflation is expected to reach the target of 2%-3% by the end of 2022. At the same time, it is planned to increase the key rate to 3% over the next 8 months. This is an extremely short period for such a massive reduction in liquidity. Inflation may eventually slow down, but in this way, Bitcoin will lose its relevance as a long-term hedge against inflation. Given the upcoming reduction in liquidity, Bitcoin may have limited potential as a safe-haven asset and a profitable investment. Besides, gold has already proven its status as a store of value.

That is, if BTC does not survive the decline in liquidity and the outflow of institutional investors, it will lose its attractiveness as a hedge against risks. The asset will not be able to recover to local highs, which will not allow traders to take profit so that they can invest in the cryptocurrency again. With falling liquidity, BTC is perceived as a Titanic, not a lifeboat. Despite this, the deflationary component of the asset has not gone away. So, when all worries ease after the rate hike, a large percentage of investors risk staying outside of the boat.

As of April 25, BTC/USD managed to reach a local high at $43k. Subsequently, sellers knocked out buyers thanks to massive selling volumes and correlation with stock markets. The lack of liquidity may affect the ascending structure and lead to a decline to the $32k-$35k area. If in the coming days the price breaks through the support at $39k, BTC will nosedive towards $35k-$35.7k. If the support is strong enough and buyers increase their activity, then the asset has a chance to break through $40k and jump into the $43k-$45k channel supported by bullish momentum. However, according to the current state of the market and further macroeconomic events, investors may not be so optimistic in the near term.