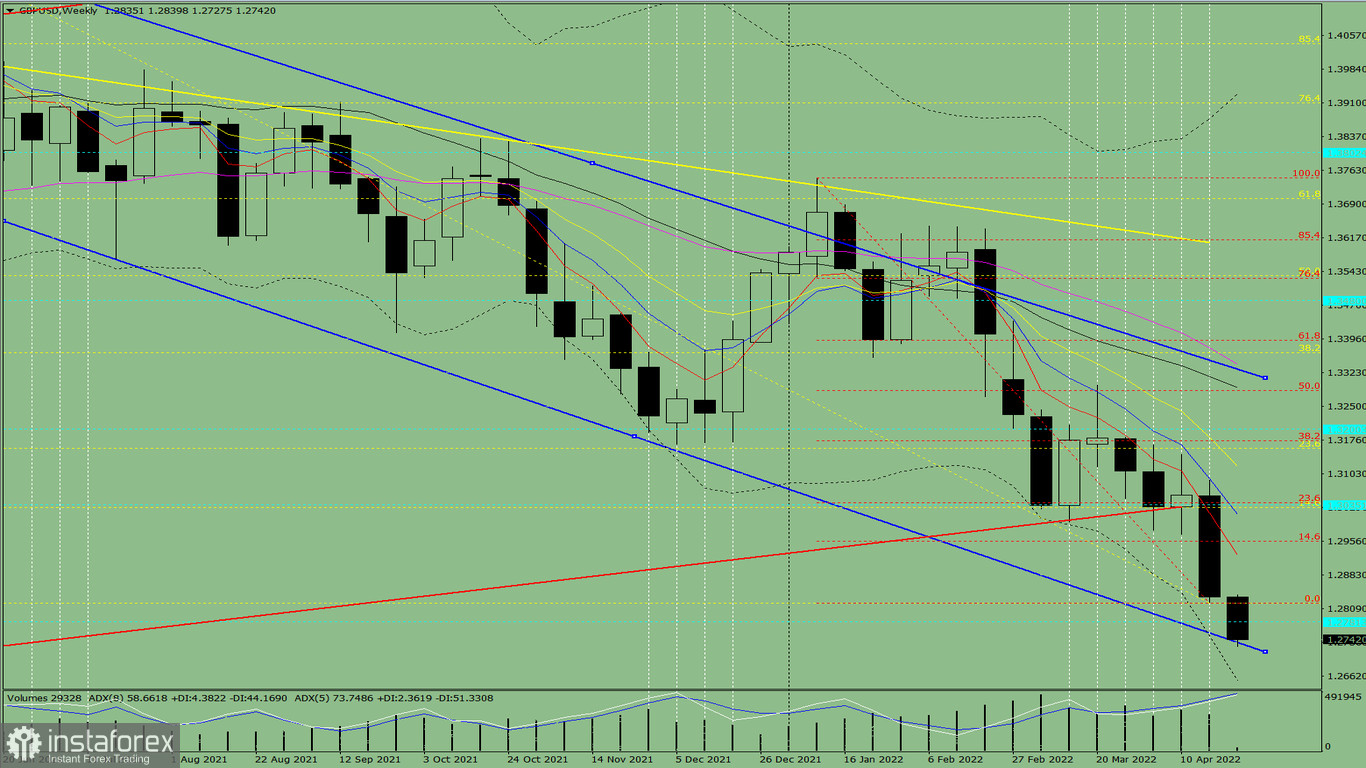

Trend analysis

GBP/USD is likely to fall deeper this week, from 1.2835 (closing of the last weekly candle) to the support line at 1.2728 (thick blue line). After that it will go to the lower fractal at 1.2820 (red dotted line), then bounce up.

Fig. 1 (weekly chart)

Comprehensive analysis:

Indicator analysis - downtrend

Fibonacci levels - downtrend

Volumes - downtrend

Candlestick analysis - downtrend

Trend analysis - downtrend

Bollinger bands - downtrend

Monthly chart - downtrend

All this points to a downward movement in GBP/USD.

Conclusion: The pair will have a downward trend, with no first upper shadow on the weekly white candle (Monday - down) and no second lower shadow (Friday - down).

And during the week, the price will decrease from 1.2835 (closing of the last weekly candle) to the support line at 1.2728 (thick blue line), move to the lower fractal at 1.2820 (red dotted line), then bounce up.

Alternatively, the pair could dip from 1.2835 (closing of the last weekly candle) to the support line at 1.2728 (thick blue line), then move further down to 1.2650, the lower limit of the Bollinger Band indicator (black dotted line).