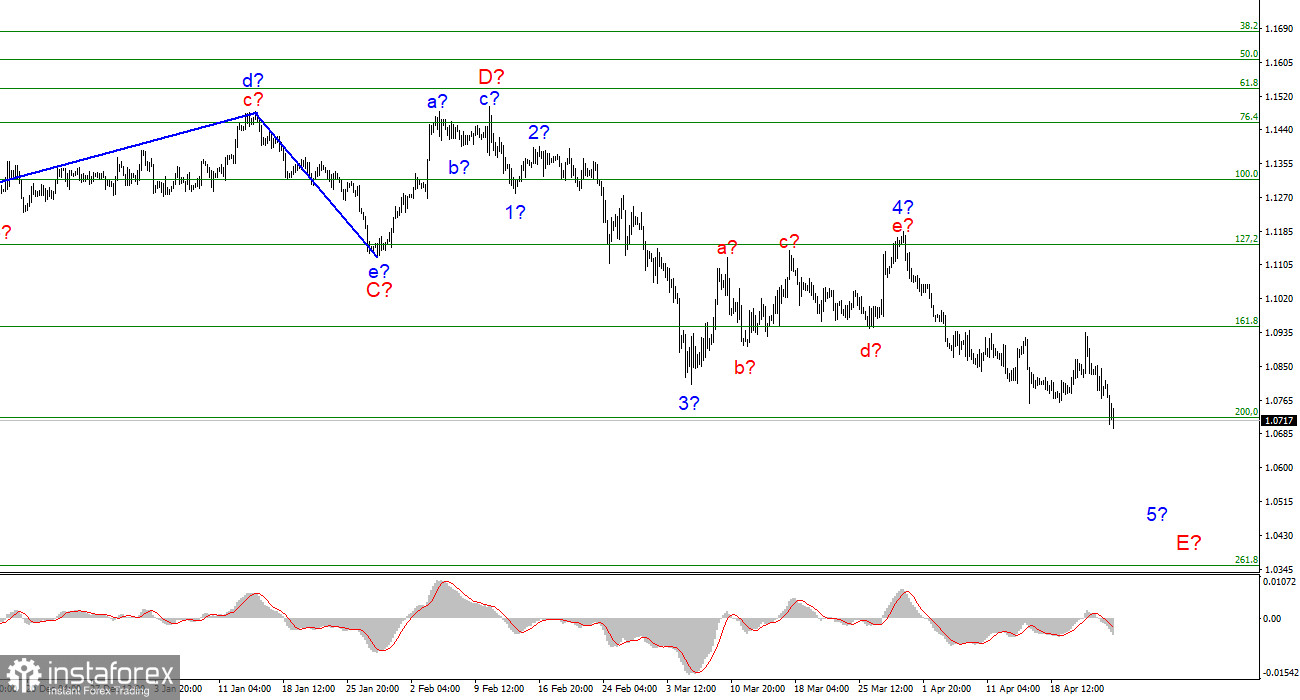

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing, despite several attempts to build a corrective upward wave. The instrument continues to build a descending wave 5-E, which may be the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since this wave may turn out to be a very long, five-wave in its internal structure. However, it may also turn out to be shortened and be already completed, since the instrument fell below the low of the previous wave 3-E. Thus, the euro still has the potential to decline, but it can still end at any moment. The target until today was 1.0721, which equates to 200.0% by Fibonacci, but today it was worked out. An unsuccessful attempt to break through the 200.0% Fibonacci level will indicate that the market is not ready for further sales of the instrument - it may begin building a new corrective wave. But I still think that the attempt will be successful and the decline will continue.

There was no news on Monday, but this did not save the euro currency.

The euro/dollar instrument fell by 100 basis points on Monday. There were no clear and understandable reasons for such a decline, but the market continued to sell the euro from the very beginning of the week. Even from the very beginning of the day, since the decline began at night. Thus, it is useless to look for the reasons for a new drop in demand for the euro. The current wave marking indicates movement in this direction, and the news background is not always present. Now we need to understand the internal structure of wave 5-E to understand how long it can get. It is unlikely to come out shortened. If you look at the news background as a whole, it turns out that the instrument may well lose several hundred more points before it completes the construction of a descending wave. And if the Ukrainian-Russian conflict persists for several more months or until the end of the year, then the entire downward wave E may turn out to be very long.

What can be highlighted from the latest news? In my opinion, there is nothing to highlight. Everything remains the same as it has been in the last few months. Emmanuel Macron won the French presidential race, but few believed in a different result. The Ukrainian-Russian conflict persists, but no one expected it to end in the near future. The peace talks failed, but there were no prerequisites for a different result. The Fed is going to raise the rate in May by 50 basis points at once, but several FOMC members, including Jerome Powell, have already openly stated this. Only the statement of Luis de Guindos last week could slightly increase the demand for the euro currency, as he unexpectedly announced that in July the ECB could raise the rate for the first time in a long time and end the APP program. However, on this news, the euro rose a little and then resumed its decline. So this news was worked out, and then the market began to act again following the rest of the news background.

General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The supposed internal correction wave of 5-E has quickly ended but may take on a more extended form.

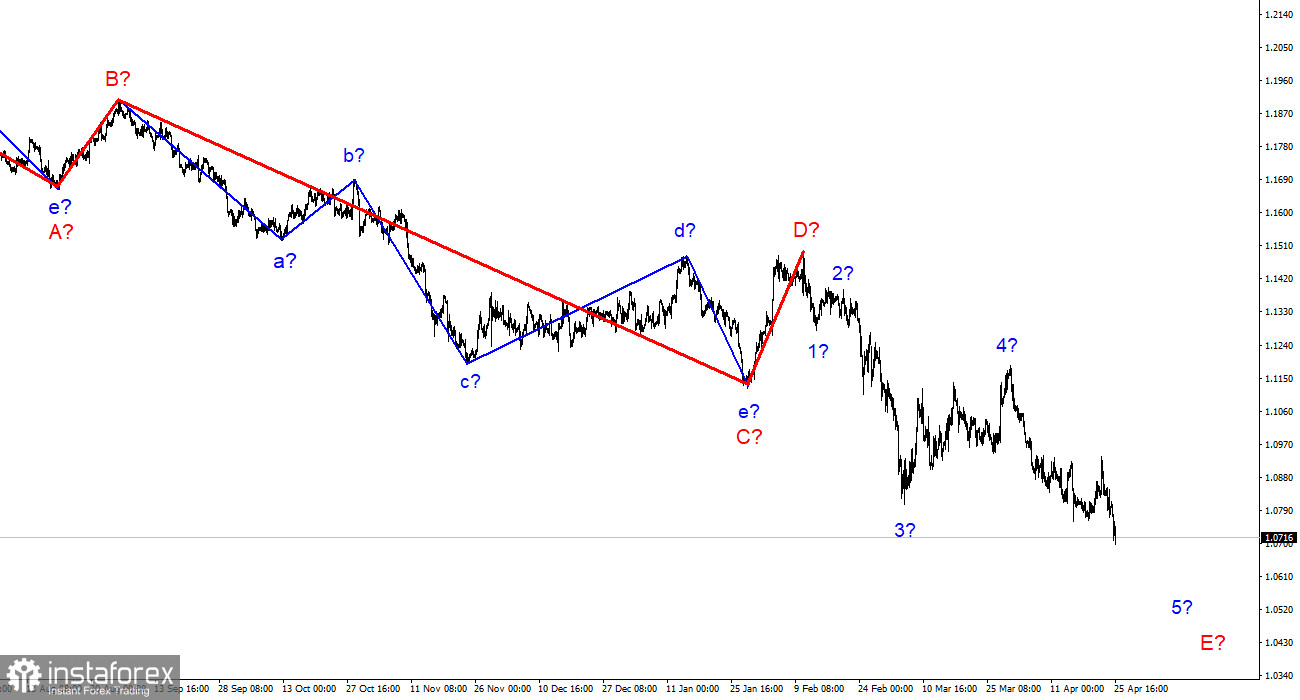

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.