The US dollar index continues to rise, reaching a two-year high, stock indices are trying to contain the fall, but they are getting worse and worse. Bond yields eased slightly after a sharp rise last week.

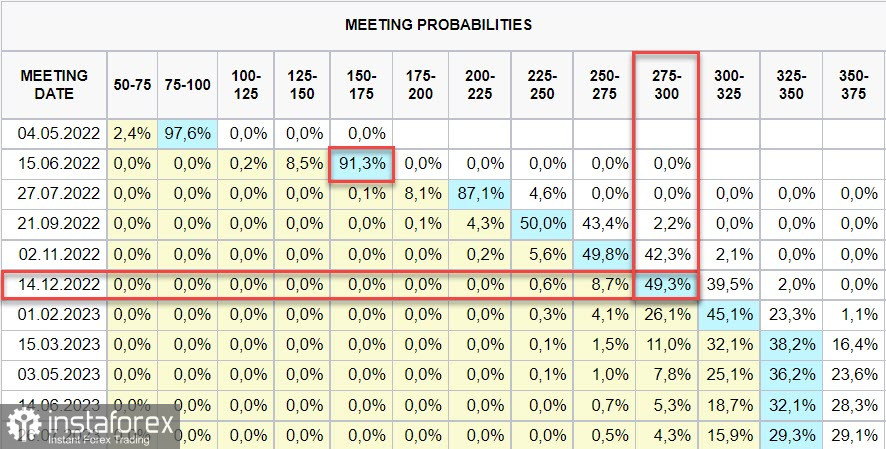

As historical experience shows, the strength of the US dollar usually decreases at the beginning of the Fed tightening cycle, but it seems not this time. Expectations for the rate have not yet reached the maximum, and futures for the rate, according to the CME, continue to grow. Two weeks ago, it was predicted to reach the range of 2.50/2.75% at the end of the year, now the forecast is 2.75/3.00%, while at the June meeting, the market sees the probability of a 0.75% rate hike.

It should also be noted that the pressure on the euro and the pound does not weaken. The most important factor here is the development of the Ukraine crisis and the actions of European countries related to it, plus the Bank of Japan, without a shadow of a doubt, continues to restrain the growth of Japanese bond yields, which leads to a weakening of the yen.

Meanwhile, there are more and more signs that Beijing is preparing to go into isolation. The yuan went above 6.60 for the first time since November 2020, and the People's Bank of China even reduced the currency reserve rate, which slightly added liquidity in dollars and allowed the yuan to hold the exchange rate.

We assume that these factors will be sufficient for the period of dollar dominance to continue.

NZDUSD

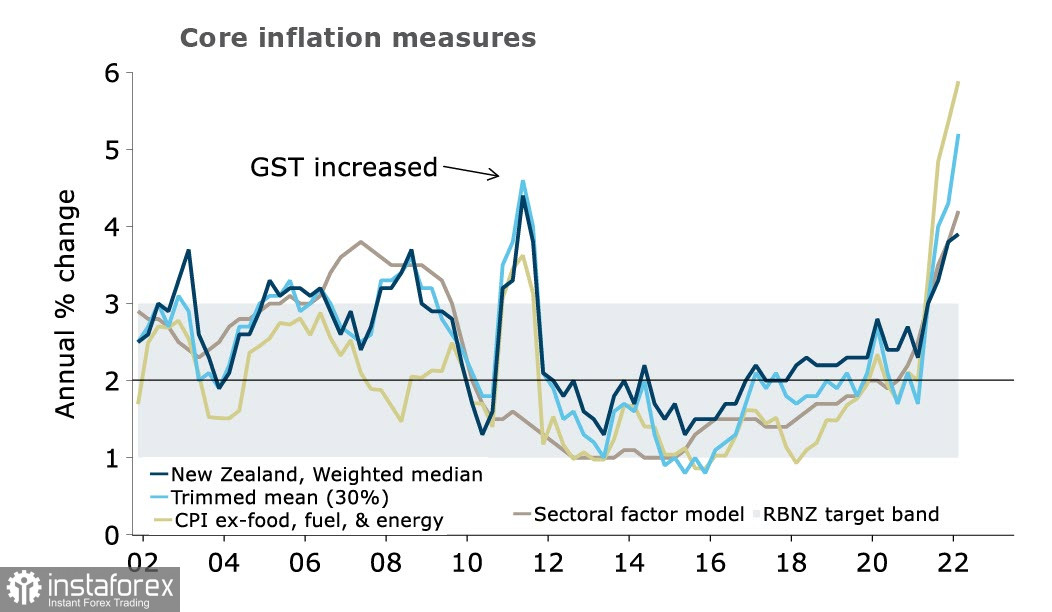

Stats NZ data showed that annual CPI inflation reached 6.9% in the first quarter, compared with 5.9% in the fourth quarter. This is less than the forecast of 7.1%, but still the highest level since 1990. The inflation data were in line with the expectations of the RBNZ that inflation would peak "about 7 percent" in the first half of 2022.

The release of data slightly below the forecast slightly reduces the pressure on the RBNZ, besides, it is expected that the recent actions of the government (primarily the reduction of excise taxes on fuel) will allow the CPI to decrease by 0.5% in the 2nd quarter, that is, in general, the pressure will weaken slightly.

Lower inflation will pull up real yields if the RBNZ does not abandon its plans, in which case the kiwi will have chances to resume growth.

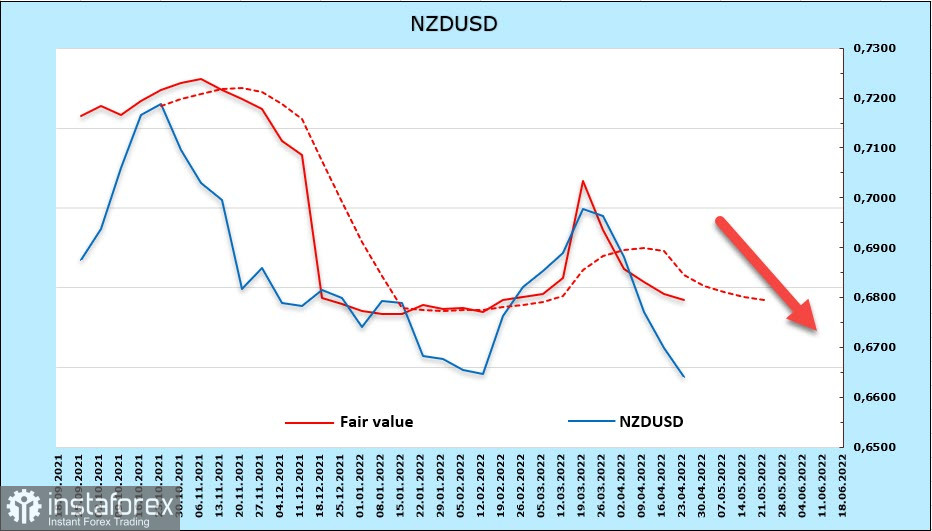

In the futures market, the position on NZD has remained neutral for a long time, the latest CFTC report showed an increase of 44 million up to 25 million, and the estimated price is lower than the long-term average and is directed downward.

A week ago, we saw the target at approximately 0.6660/70, the kiwi went even a little lower, and taking into account the fact that the momentum has not yet been fully worked out, the target is shifting lower. Corrective growth is possible to the resistance zone of 0.6680/6700, where sales are justified with an eye to support 0.6510/30.

AUDUSD

The Australian PMI rose in April in both the manufacturing and services sectors. Economic growth continues, which is due both to the exit from covid restrictions and to the growth of exports. The overall positive growth was also facilitated by higher-than-predicted employment data.

The threat of a slowdown in China's economy and a decrease in demand for raw materials from its side is the main negative factor for AUD, which led to a sharp drop in quotes after the first reports of cases of covid in Beijing.

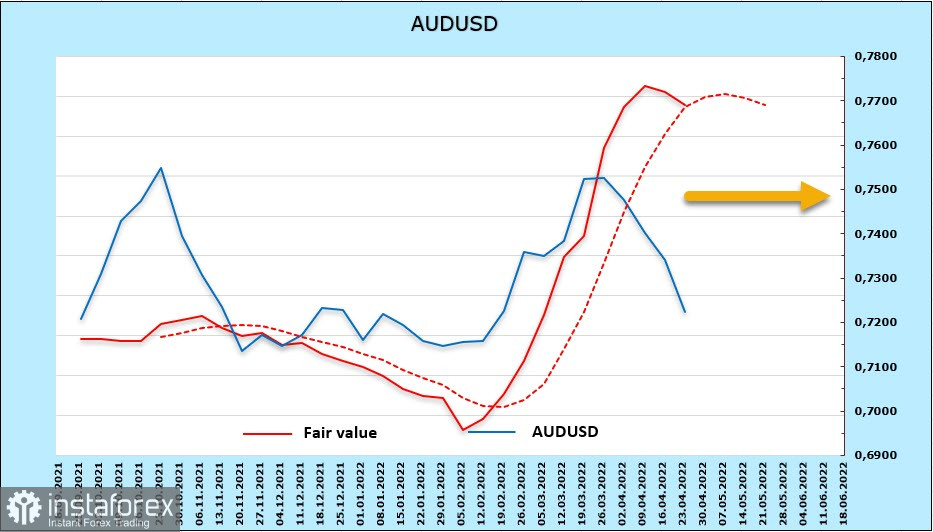

The active reduction of the net short position on AUD that has been observed for several weeks in a row has stopped, the weekly change is only +15 million, the bearish preponderance is -2.126 billion, and the estimated price is trying to turn down.

The forecast for the resumption of growth, supported by both good internal statistics and an increase in commodity prices, did not materialize. The support of 0.7320/40 did not resist, and the trend line was broken, which led to the triggering of stops and a deep update of the lows.

Nevertheless, we do not believe that the aussie has formed a bearish trend, a slight upward pullback is highly likely (the first target is 0.7260/80, the second is 0.7335/45), and after which the trade will go into a sideways range. If Beijing goes into isolation, this will also put pressure on commodity prices, which will lead to a further fall in AUD, in which case we can expect a move to 0.70.