Despite tougher rhetoric from the European Central Bank (ECB) leadership and the French election victory of Emmanuel Macron, the single European currency continues to be under a selling wave against the US dollar. This is very often the case. If the market has chosen a direction, it needs a very good reason to change it. In turn, the US dollar continues to receive support as a defensive asset from events in Ukraine and, of course, from the more than obvious hawkish intentions of the US Federal Reserve (Fed) to tighten its monetary policy at an active pace. In this context, macroeconomic statistics from the eurozone and the US are often simply overlooked by market participants. A typical example of this was yesterday when all three IFO indexes for Germany came out in the green, while the Chicago Fed economic activity index was weaker than forecast. However, this did not prevent the US dollar from strengthening considerably against the euro. No macroeconomic reports from the eurozone are scheduled for today. The United States will release a big statistic block today which will include durable goods orders, housing price index as well as consumer confidence indicator. More information on these and other events can be found in the economic calendar.

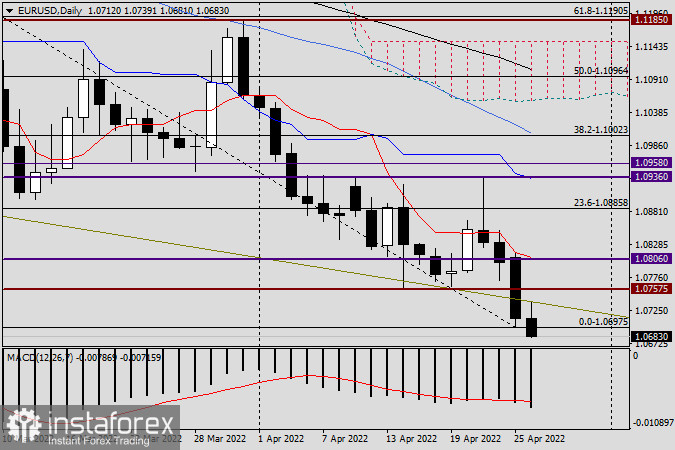

Daily

As mentioned above, yesterday the EUR/USD currency pair continued its downward trend and reached the indicated target area of 1.0745-1.0700. The EUR/USD bears even tested the 1.0700 level for a breakout, but the attempt was unsuccessful. After falling to 1.0697 the pair rebounded and closed Monday's session at 1.0711. Even if the decline will continue today and the day will be closed under 1.0700, it will not be reasonable to consider its true breakdown. Firstly, it is not at all correct to conclude from one closed candlestick that the breakdown has already taken place. Secondly, the level of 1.0700 is one of those which very rarely passes at the first attempt. In my opinion, there is still a fight for this level, which means that the pair will still be circling it. If so, we should expect the Euro bulls to try to return to 1.0750-1.0800, where a number of broken support levels are located. If so, from this area we might look to sell the pair.

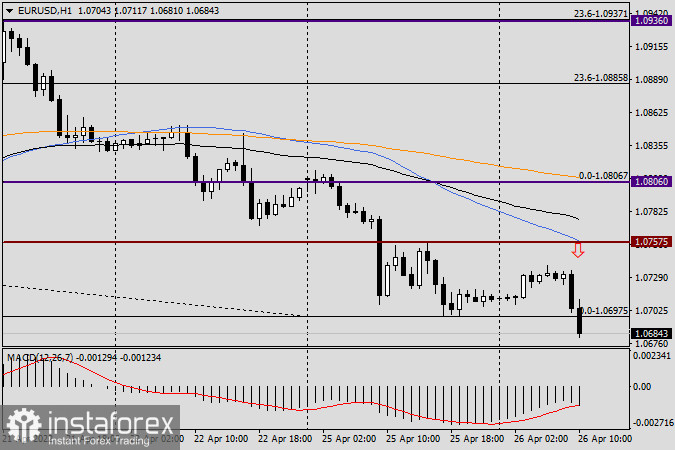

H1

On the hourly chart we see that since yesterday afternoon the EUR/USD has been trading in a rather narrow price range. This provides two scenarios for further developments. An upward move out of the current range would mark an attempt by the upside players to return the pair to higher prices. If the pair falls back down from current values, we will once again be convinced of the strength of the bearish trend and wait for a corrective pullback. Without it, it would be risky to open a sell trade near the current prices. A pullback of EUR/USD to 1.0745-1.0760 would be a good short entry point, because besides several strong technical levels, the blue 50-slide moving average is also located there.