Hi, dear traders!

Yesterday, the pound sterling continued its fall against the US dollar, alongside the euro. Due to its more precarious position compared to EUR, GBP is dropping more sharply against USD. As a result, GBP/USD reached the lows of 2020 yesterday.

Today, UK public sector net borrowing data was released. Public sector borrowing has decreased by 18.1 billion pounds. During the American session, durable goods orders, house price index, and CB consumer confidence data will be released.

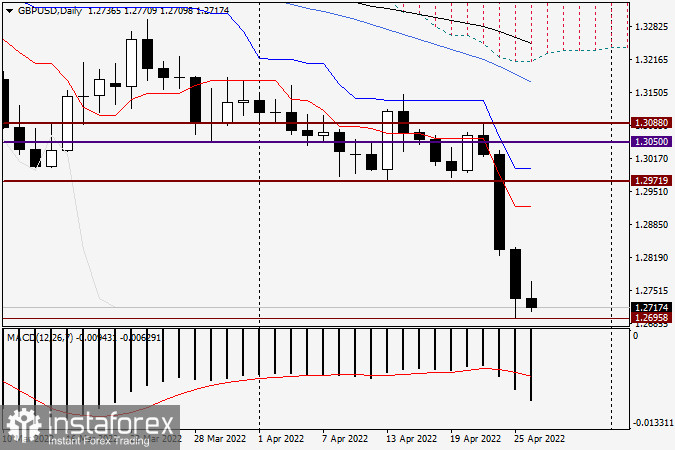

Daily

GBP/USD descended to 1.2696 yesterday and tested the strong technical area of 1.2700. However, the pair failed to break through it and finished the session at 1.2736. Bearish traders are likely to push the pair below 1.2700 today and at the following trading sessions. Opening short positions is quite risky at this point due to a possibility of an upward correction.

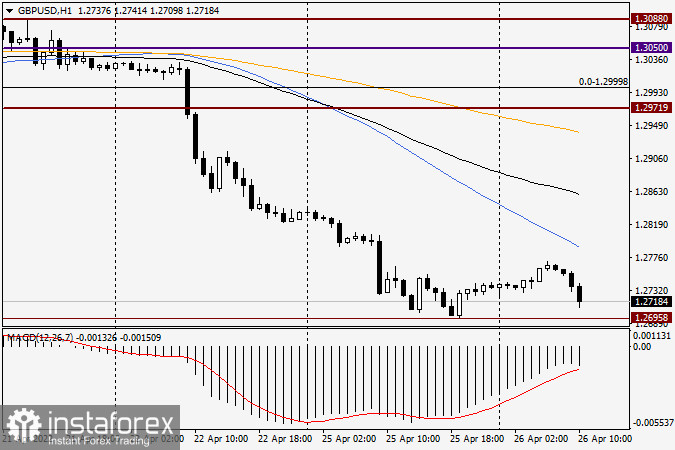

H1

According to the H1 chart, the pair is below all three MA lines, which could prevent GBP/USD from moving upwards. Furthermore, the pair could also perform an upward correction from 1.2700. Short positions could be opened if the pair rises towards the blue 50-day SMA line at 1.2790, as well as in the sell zone at 1.2785-1.2805. Above it lies the black 89-day EMA, which lies near the strong technical level of 1.2860. Any long position during upward corrections in this situation would be risky. The appearance of bullish reversal patterns at the end of today's trading session would serve as a buy signal. However, the recommended trading strategy is opening short positions in GBP/USD.

Good luck!