If at the beginning of the armed conflict in Ukraine, the oil market was worried about supply problems due to the potential displacement of Russia, now prices are entirely dependent on demand. More precisely, from its slowdown in connection with the most serious outbreak of COVID-19 in China, the tightening of the Fed's monetary policy and increased recession risks in the eurozone. China, the United States, and the EU are the largest consumers of oil, so their difficulties allow the "bears" on Brent to actively counterattack.

Mizuho Securities estimates that oil demand in China has fallen by 1.2 million bpd since the start of the Shanghai lockdowns, and risks falling even more if the lockdowns extend to Beijing. The authorities intend to conduct mass testing in 11 of the 16 districts of the city, and the more infections are detected, the higher the chances of new lockdowns and a further slowdown in global demand.

The measures taken by the People's Bank of China look half-hearted. Along with lowering the reserve requirement for banks' foreign-currency assets from 9% to 8% and promising to do whatever it takes to support the economy, the PBOC has essentially done nothing. Investors were counting on large-scale incentives. It didn't work out. And this circumstance allows sellers of the North Sea variety to keep the situation under control.

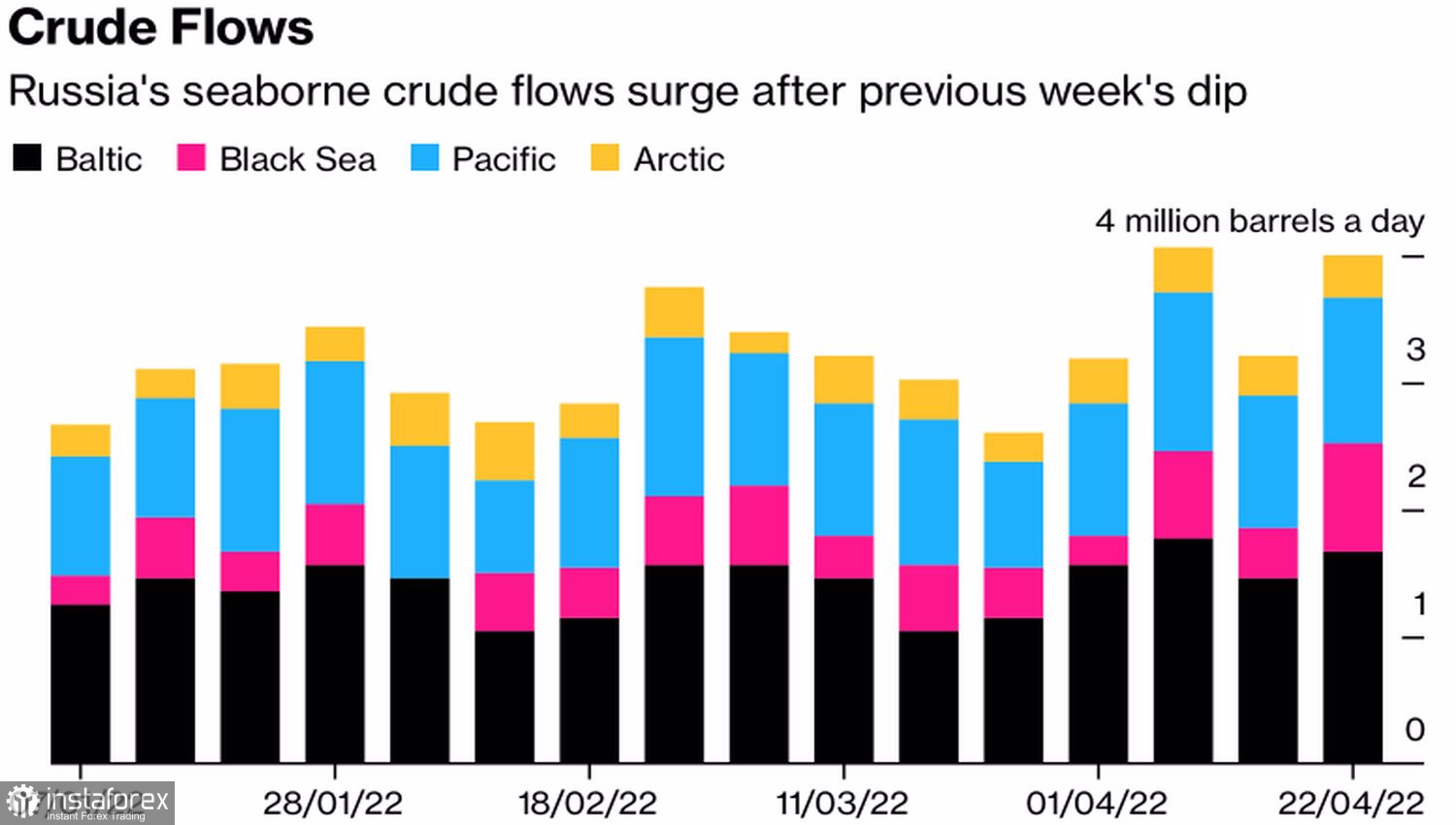

As for the ousting of Russian oil from the market, this has not yet happened. On the contrary, shipping in the week to April 22 jumped by 25%, to 4 million bpd, and a fifth of the tankers have no specific destination. It is assumed that most of them are heading to Asia.

Dynamics of sea transportation of Russian oil

The announcement by the Libyan government that previously closed fields could reopen within a few days further defused the situation. Since the beginning of political unrest in this country, daily production has fallen from 1.3 million bpd to 0.5 million bpd. Taking into account the increase in the export of oil by Russia, the supply situation is stabilizing, which leads to a reduction in the spread between futures with nearby execution dates to the lowest level since the beginning of 2022. This circumstance contributes to the fall in oil prices.

Brent was pressured by the decline in forecasts for the global economy by the World Bank and the IMF. In the latter case, it was about 0.8 percentage points with reference to the outbreak of COVID-19 in China and the armed conflict in Ukraine. The pandemic is having a negative impact on Asia, the fighting is having a negative impact on Europe. This is not to say that the US is not suffering. On the contrary, the Fed's aggressive monetary restriction will eventually come back to haunt the slowdown of the US economy.

Technically, there are Splash and Shelf and Triangle patterns on the Brent daily chart. The exit of quotes of the North Sea variety beyond the limits of the consolidation range of $98.2-113.6 per barrel is fraught with the development of a correction or restoration of the upward trend. At the same time, there is a high probability that the trade corridor will be preserved. Therefore, in my opinion, a test of support at $98.2, followed by a close above it, can be used for purchases.

Brent, Daily chart