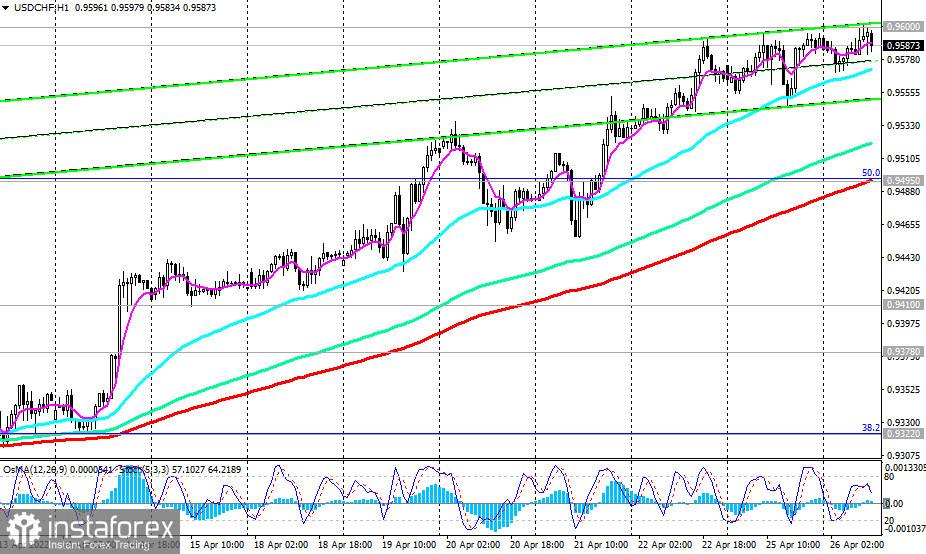

As of this writing, USD/CHF is trading near 0.9580, down from an intraday high of 0.9602 reached at the beginning of the European trading session.

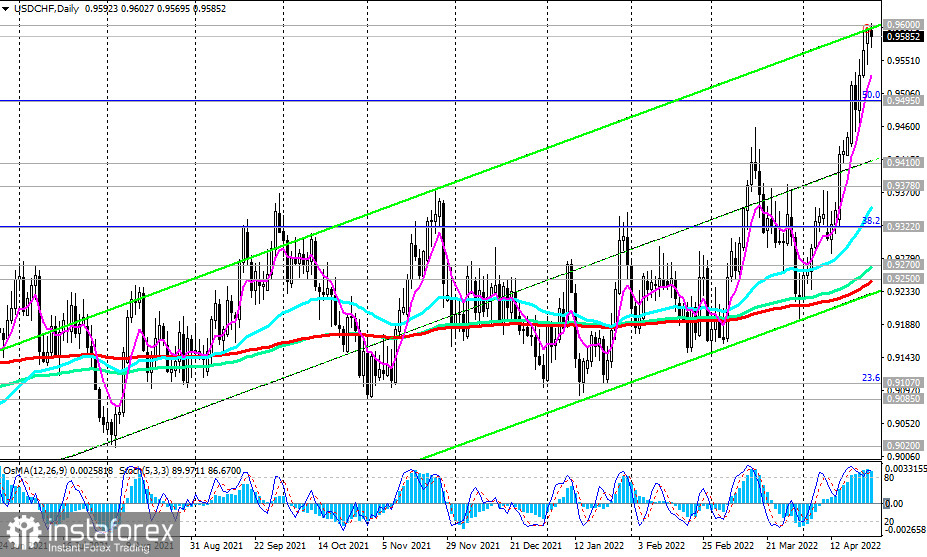

The USD/CHF pair has been rising since the beginning of 2021, supported by a strengthening dollar.

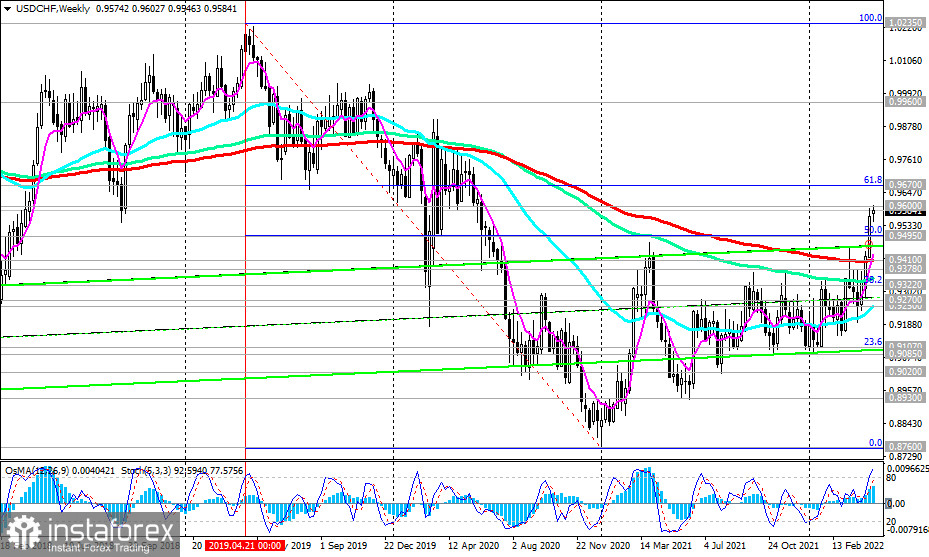

Last week, the pair confidently consolidated in the area above the long-term and important support level 0.9410 (200 EMA on the weekly chart), also breaking through the resistance level 0.9495 (50% Fibonacci retracement of the upward correction to the downward wave that began in April 2019 near 1.0235).

From the point of view of the analysis of Fibonacci levels, this is a confirming signal, indicating that the correction relative to the main trend is nearing completion. In case of a breakdown of the resistance level 0.9670 (61.8% Fibonacci retracement level), growth targets will be resistance levels 0.9960 (144 EMA on the monthly chart), 1.0235 (100% Fibonacci retracement), 1.0000 (psychologically significant level), and 1.0360 (local highs). The breakdown of the resistance level of 1.0480 will finally bring USD/CHF into the long-term bull market zone.

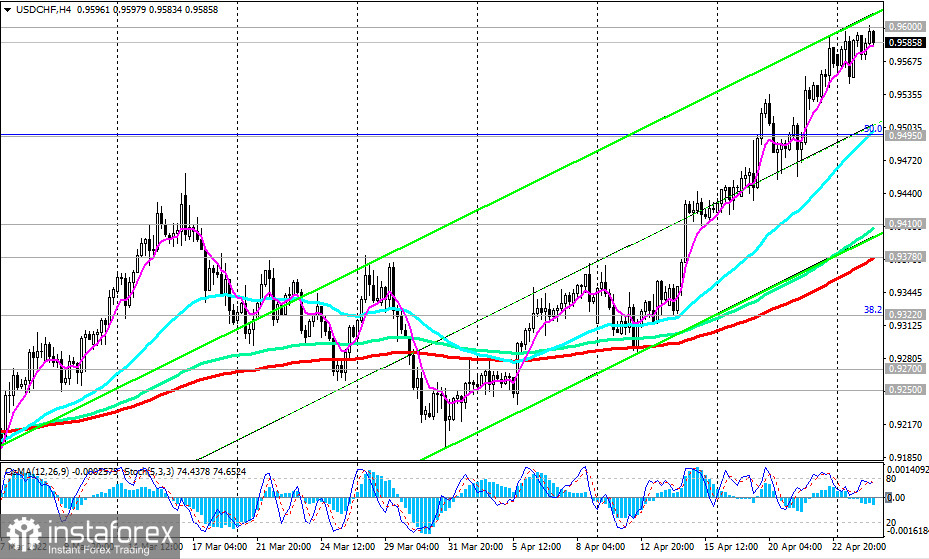

In an alternative scenario, the decline in USD/CHF will resume. The first sell signal will be a breakdown of the support level 0.9570 (200 EMA on the 15-minute chart and today's low), and the confirming one will be a breakdown of the important short-term support level 0.9495 (200 EMA on the 1-hour chart).

The targets of the downward correction will be the support levels 0.9410 and 0.9378 (200 EMA on the 4-hour chart). A deeper decline could bring USD/CHF back into the downward trend.

In the current situation, the main scenario for further growth of USD/CHF is preferable. The signal to open new long positions will be the update of today's high of 0.9600.

Support levels: 0.9570, 0.9495, 0.9410, 0.9378, 0.9300, 0.9270, 0.9250

Resistance levels: 0.9600, 0.9670, 0.9960, 1.0000, 1.0235, 1.0480

Trading tips

Sell Stop 0.9560. Stop-Loss 0.9610. Take-Profit 0.9495, 0.9410, 0.9378, 0.9300, 0.9270, 0.9250

Buy Stop 0.9610. Stop-Loss 0.9560. Take-Profit 0.9670, 0.9960, 1.0000, 1.0235, 1.0480