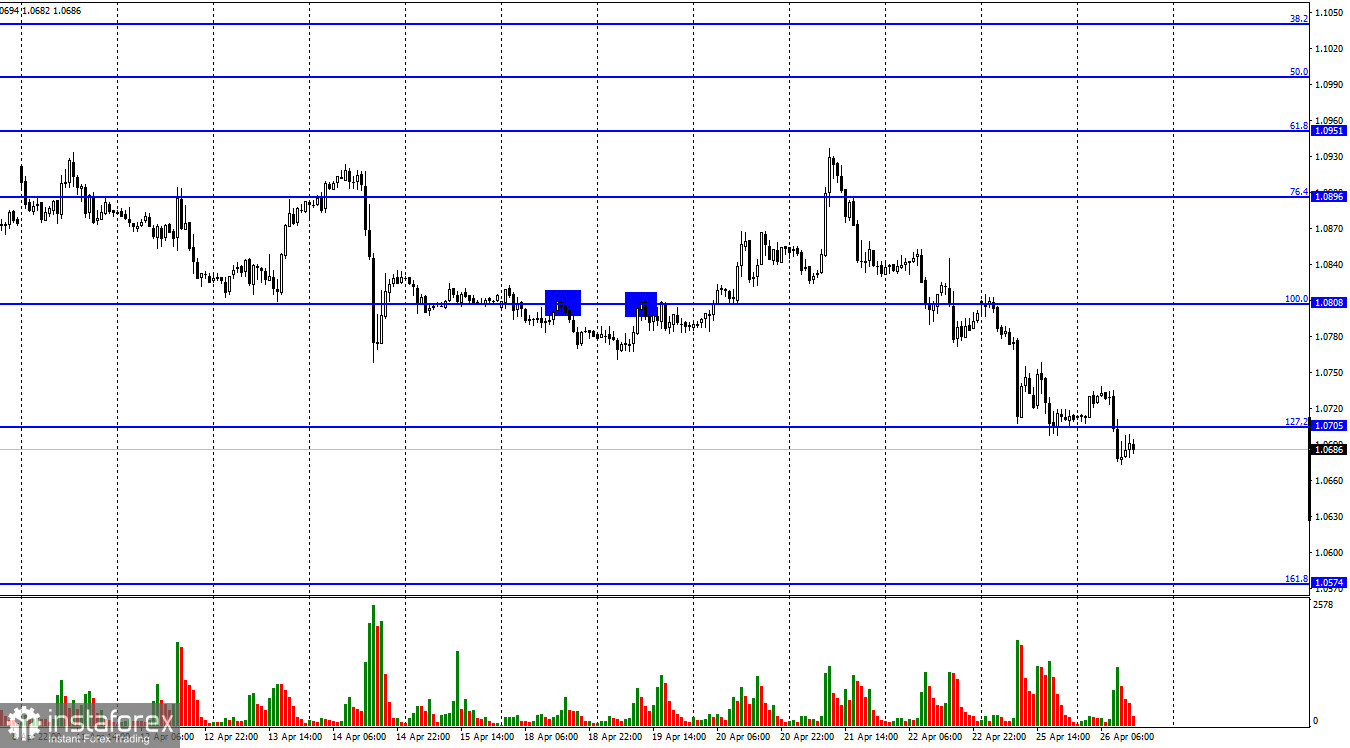

The EUR/USD pair continued the process of falling on Monday and closed under the corrective level of 127.2% (1.0705). Thus, the fall in quotes can be continued in the direction of the next Fibo level of 161.8% (1.0574). Traders' mood is characterized as "bearish". Last week, things started pretty well for the European currency. The pair has been showing growth for two and a half days in a row, but on Thursday afternoon it began a stronger decline, which continues to this day. I cannot say that the information background in the second half of last week was so disappointing for the European currency that it has already fallen by 260 points at the moment. I would say that traders continue to trade the pair in the same mode as a week earlier and two weeks earlier. The European currency is still not in demand among traders due to the Ukrainian-Russian military conflict, high threats of recession, stagflation for the European economy, high expectations regarding the tightening of the Fed's monetary policy, and weak expectations regarding the ECB's PEPP.

All these factors, in my opinion, continue to put pressure on the euro. I would like to note that in the last few weeks the geopolitical situation in Ukraine has taken on a slightly different look. Active fighting and bombing of the main Ukrainian cities are happening less and less. Experts say that Russia is accumulating a grouping of troops and equipment for a new phase of the "special operation" in the Donbas, however, according to Kyiv's assurances, a grouping of 90,000 soldiers of the Russian army is already concentrated in the East of Ukraine. Independent experts from Bellingcat believe that Russia has already spent more than 70% of its missiles, and it takes time to create new ones. Also, Bellingcat does not believe that a 90-thousandth army will be able to conquer even the Luhansk and Donetsk regions of Ukraine. Thus, this conflict flows into a positional one, which can persist for years.

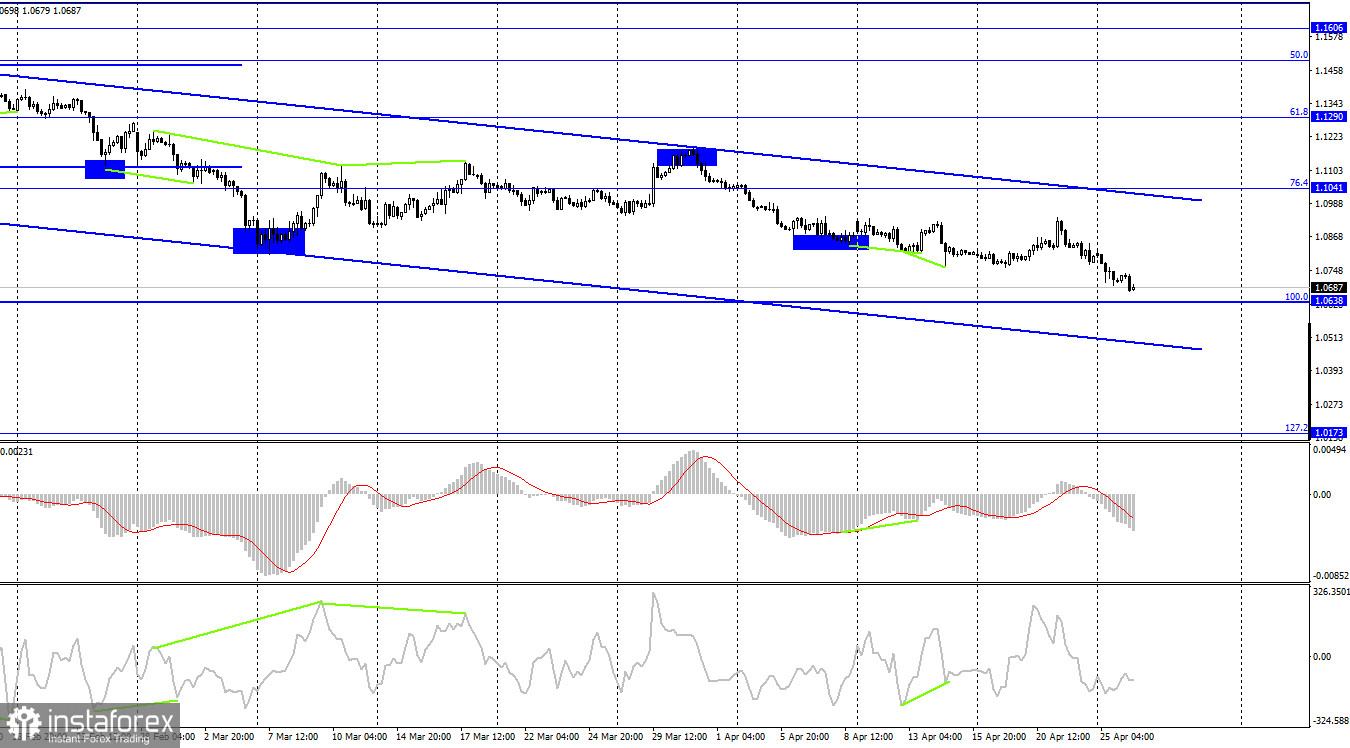

On the 4-hour chart, the pair performed a reversal in favor of the US currency and continues a new process of falling towards the corrective level of 100.0% (1.0638). The downward trend corridor still characterizes the mood of traders as "bearish". The rebound of quotes from the level of 1.0638 will work in favor of the EU currency and some growth of the pair. Consolidation below the level of 1.0638 will increase the probability of a further fall in the direction of the next Fibo level of 127.2% (1.0173).

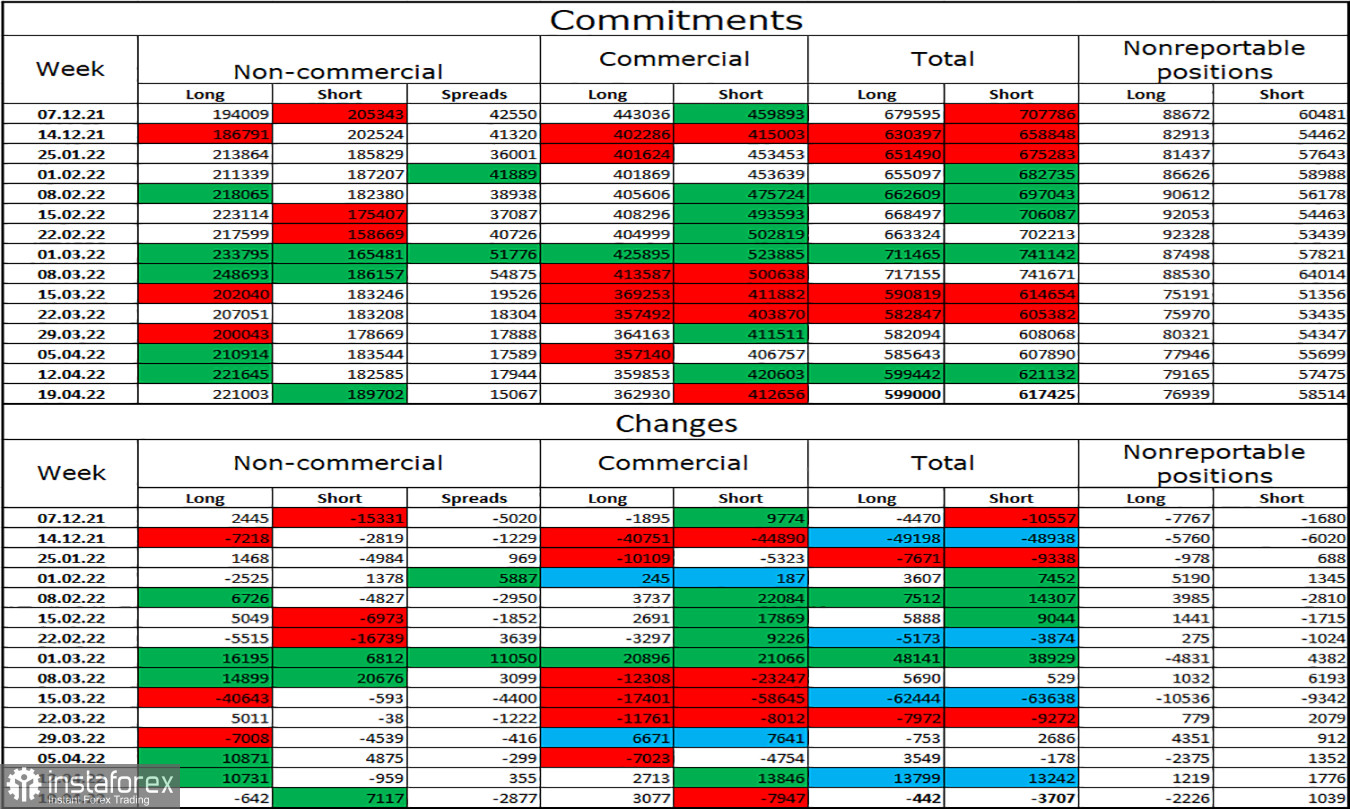

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 642 long contracts and opened 7,117 short contracts. This means that the bullish mood of the major players has weakened, but it has weakened a little. The total number of long contracts concentrated on their hands now amounts to 221 thousand, and short contracts - 189 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish". In this scenario, the European currency should show growth. But she has to show it for several weeks and even months and instead continues to fall into the abyss without any hope of salvation. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders is the possible continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position.

News calendar for the USA and the European Union:

US - change in the volume of orders for long-term goods (12:30 UTC).

US - an indicator of consumer confidence (14:00 UTC).

On April 26, the calendar of economic events in the European Union is empty. There are only two interesting records in America today, but they are not the most important. I believe that the information background will be extremely weak today.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if a close is made under the level of 1.0705 on the hourly chart with a target of 1.0574. I do not recommend buying a pair if there is a rebound from the 1.0638 level on a 4-hour chart with targets of 1.0705 and 1.0808.