The EUR/USD currency pair failed to start a correction again on Tuesday. Its fall has weakened slightly but remains stable overall. After a minimal pullback to the top, the European currency lost several dozen more points. As we said earlier, there is no one starting event, because of which the fall in the quotes of the European currency began at the end of last week. We believe that, in general, a new fall in the euro was brewing, and we have repeatedly talked about this in recent weeks. We did not expect only that the fall would resume so quickly and sharply, but in general, everything is going according to plan now. On Monday and Tuesday, there was not a single important event or macroeconomic publication in the European Union and the United States. Therefore, it is all the more impossible to say that the fall of the euro these days was somehow connected with the "foundation" or "macroeconomics". Therefore, our first conclusion about the "complex of reasons that caused the fall of the euro currency" is correct. And the complexity of these reasons has not changed in recent weeks and months. Everything remains as before.

However, the world does not standstill. Something is happening somewhere all the time and we can only track all these events and try to link them with the general fundamental background. For example, a series of terrorist attacks were committed yesterday in the unrecognized Republic of Transnistria, which is under the control of the Russian government (therefore it is unrecognized throughout the world). More precisely, a series of explosions, as a result of which radio towers, the Ministry of State Security, and several other objects were attacked. A state of emergency was immediately imposed in Transnistria, and the parade for May 9 was canceled. However, what do these explosions mean? It is unlikely that the blows were inflicted by Ukraine, which is now entirely focused on repelling the attacks of the Russian army in the East and it does not need another enemy already in the West. Then who? Moldova, is following the course of European integration and is dissatisfied with the fact that part of its territory is not under its control? Romania, which is rumored to enter Transnistria under the guise of the Moldovan military? One thing is clear - something is brewing already in Transnistria and it may well be another "special operation". Some top officials of the Russian Federation have already declared the "oppression of Russians in Moldova." As we said, the conflict in Ukraine may well spill out beyond its borders and several other countries may be involved in it at once.

The German Chancellor is suspected of having ties with the Kremlin.

Meanwhile, several opinion polls have been conducted in Germany, which clearly shows that Germans are dissatisfied with Olaf Scholz's policy regarding the Ukrainian-Russian military conflict. Recall that last week, it was reported that Scholz personally blocked the supply of heavy weapons to Ukraine. Previously, Germany was one of 4 countries that opposed the oil and gas embargo. Thus, for the most part, the people of Germany no longer support their chancellor. 52% of respondents opposed him, and only 35% believe that Scholz is coping well with foreign policy. At the same time, many political experts are beginning to suspect Olaf Scholz of having ties with the Russian government, since almost all EU countries (except Hungary) are currently helping Ukraine. Weapons, financial, humanitarian aid. Germany, which is the richest country in the EU, cannot take a passive position toward Ukraine. This is the opinion of both the European Union and the Germans themselves, who negatively assess Scholz's actions against Ukraine. It is also worth noting that the opposition parties of the Bundestag do not support Scholz's position and insist on supplying Ukraine with heavy weapons, as half the world is doing now. For Ukraine, the good news is precise that there is little that depends on Germany alone now. Heavy, armored vehicles are coming in a continuous stream from all over the world, as openly stated in Kyiv. Berlin wants to maintain a certain "neutrality" in relations with Moscow, but at the same time, this "neutrality" may cost Chancellor Olaf Scholz's chair. There is already talk of declaring a vote of no confidence in him.

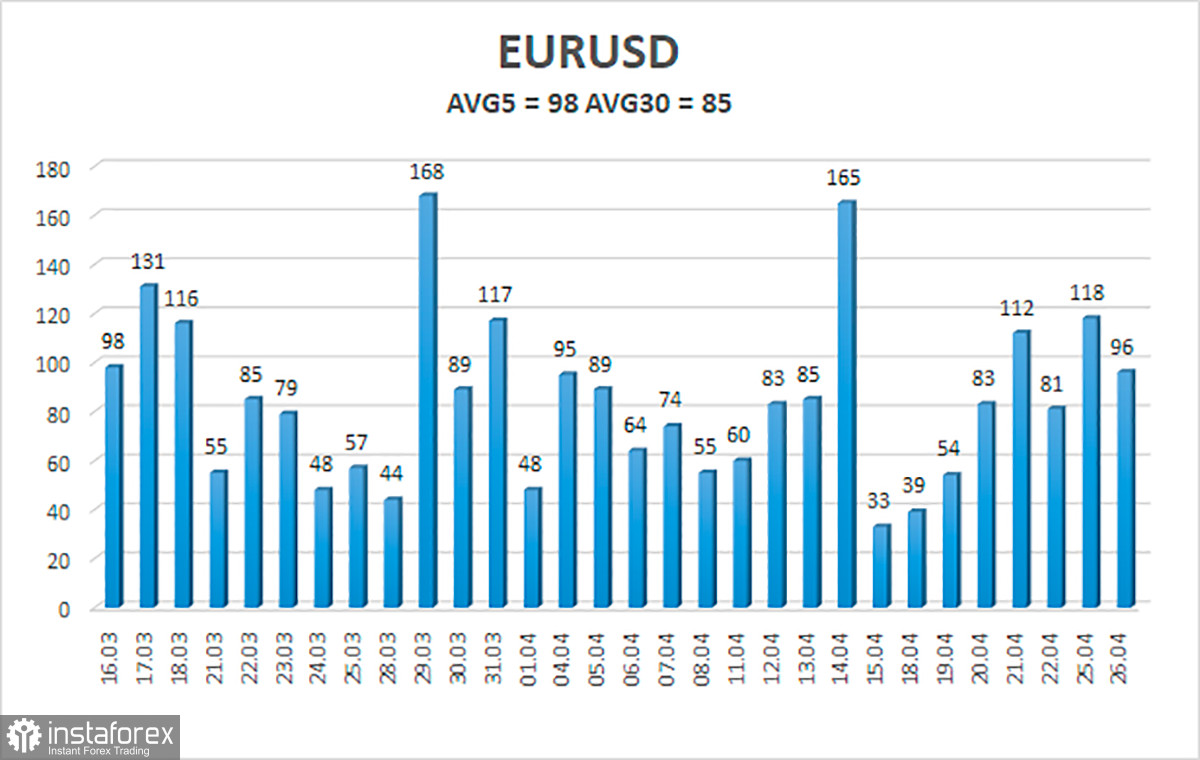

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 27 is 98 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0564 and 1.0761. The upward reversal of the Heiken Ashi indicator signals the beginning of an upward correction.

Nearest support levels:

S1 – 1.0620

Nearest resistance levels:

R1 – 1.0681

R2 – 1.0742

R3 – 1.0803

Trading recommendations:

The EUR/USD pair continues to move down. Thus, now we should stay in short positions with targets of 1.0620 and 1.0564 until the Heiken Ashi indicator turns up. Long positions should be opened with targets of 1.0864 and 1.0925 if the price is fixed above the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.