As of today, Poland and Bulgaria have stopped receiving Russian gas after refusing to pay for supplies in roubles. There has been a significant escalation in the conflict between the EU and Russia, which has led to a sharp fall in the euro and pound. Previously, April was the first month to start filling European gas storage for the next season. This time is already missed, which dramatically increases the likelihood of a full-blown energy crisis in Europe over the next 3-6 months.

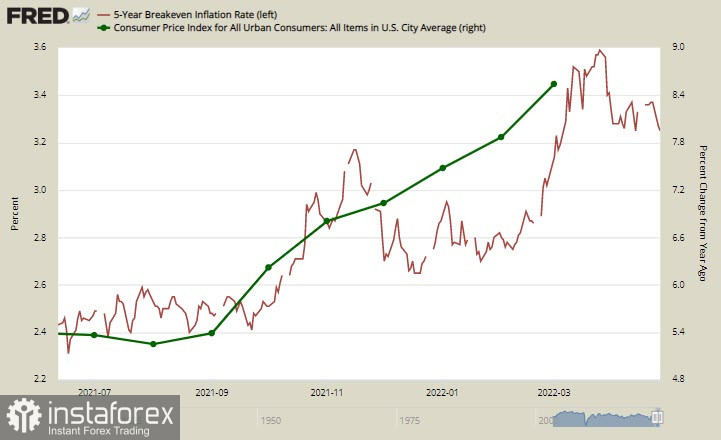

UST yields have fallen, reflecting growing fears of an approaching global economic crisis. Notably, yields on inflation-protected 5-year TIPS bonds are not rising, which could indirectly indicate that the issue of inflation now seems to be less important than the search for safe assets.

A possible Beijing lockdown, where a massive covid test started this morning, is noticeably less significant as the Australian and New Zealand dollars, are rising as part of the correction.

The US dollar looks like the most natural safe haven currency at the moment, especially against European currencies.

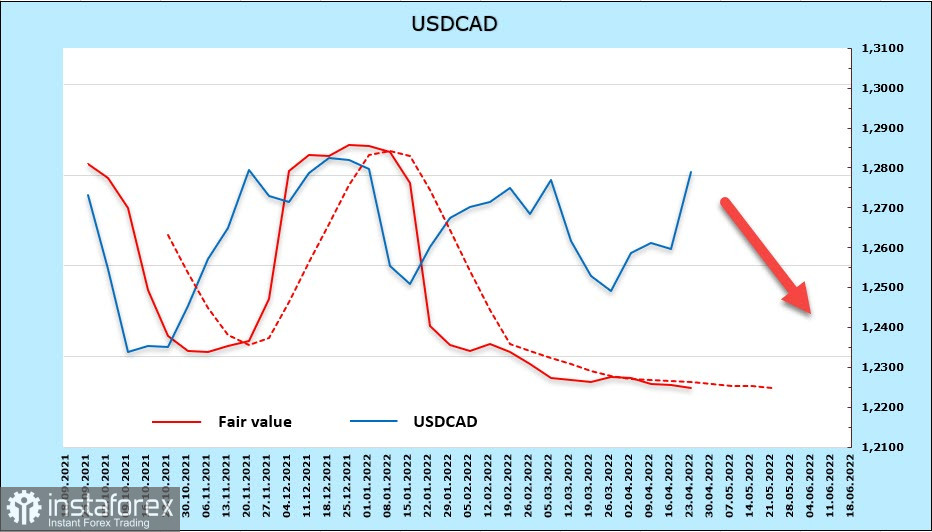

USDCAD

The inflation forecast for March has been markedly exceeded. Prices rose by 6.7% y/y against 5.7% a month earlier. The Bank of Canada is likely to raise the rate again by 0.5% at the next meeting. The BoC head has not ruled out a 0.75% hike, either. He announced this last week. Price rises are increasingly widespread, and this is also reflected in February's retail sales figures. Nominally sales rose by 0.1%, but adjusted for inflation in real terms, sales fell by 0.4%.

The next rate hike is expected in June. No threat to the Canadian economy yet, but the monetary policy shift has already begun.The positioning on the Canadian dollar, as indicated by the CFTC report, remains bullish. The long position rose by 721 million over the week to 1.682 billion. The settlement price is significantly below the spot. This indicates that the current USDCAD rally has political rather than economic reasons, caused by a sharp demand for the dollar.

We assume that USD/CAD will hold within the boundaries of the descending channel. The first key resistance is 1.2840/60, this is the channel boundary. The second key resistance is 1.2900. A move higher will mean a likely change in trend. In current conditions, if resistance is approached, we can sell with the aim of returning to the middle of the channel at 1.2550/80.

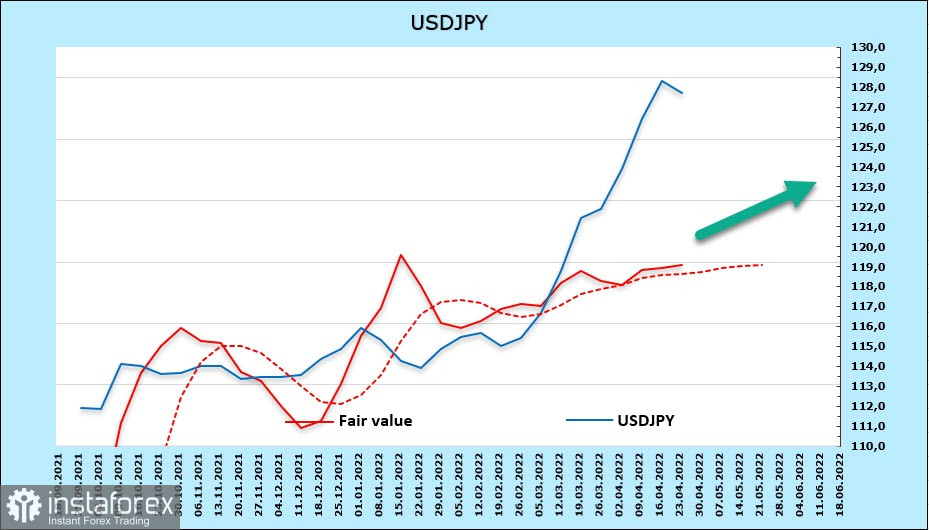

USDJPY

The governor of the Bank of Japan delivered a speech at Columbia University in New York. Noting that the state of Japan's economy was significantly different from that of the US, he said that, unlike other central banks, the BoJ had not faced a choice between prioritizing economic stability or price stability. He added that his role was to persevere with the current monetary policy easing, focusing on yield curve control.

Kuroda was supported by former Prime Minister Abe, who urged his supporters not to comment on the depreciation of the yen because there is no need to worry. It is clear that the gap between Bank of Japan and Fed policy will widen. Even if the bank raises its interest rate and stops the yen falling, it would not benefit as the inflation rate in Japan is well below the BoJ target of 2%, even though the cost of imports is rising.

Inflation in Japan is expected to rise sharply over the next few months. Only then can we expect an end to the weak yen policy. As yet, there is no reason for the USDJPY to fall.

Despite a weekly shorting of the short position in the yen (+755 million), positioning remains distinctly bearish. The margin was 10.4 billion. Speculators see a further weakening of the yen. The settlement price is noticeably lagging behind the spot because the yen's sharp weakening is due to the Bank of Japan's actions and not the supply-demand balance. However, it is still above the long-term average and is directed upwards.

The forecast is clear. If the BoJ refrains from buying fixed-income bonds in the coming days, the yen has a chance to correct. Support would be provided by the recent target of 125.90. However, rather than a correction, a continuation of the rise to a multi-year high of 135.19 looks more likely.